Risk management

How much can you take?

Given recent events, energy firms need to fundamentally re-think how they estimate their risk tolerance. Maria Kielmas asks what has prompted this soul-searching

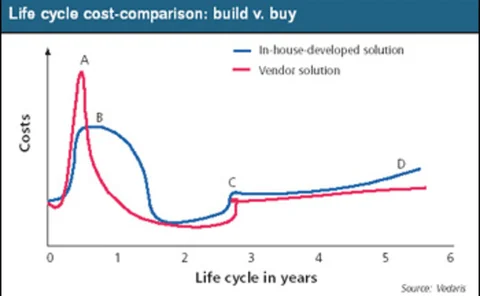

Build in or buy out?

Is it more cost-effective for companies to buy available systems from vendors or to develop and deploy their own energy trading and risk management solutions? Bob Bridger of Vedaris looks into the dilemma faced by many companies

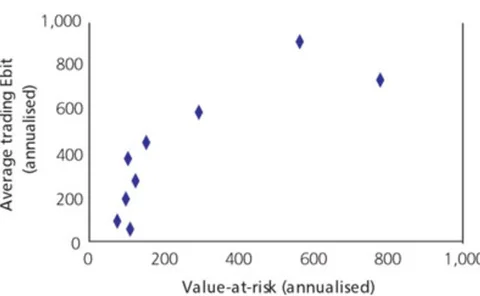

Doing the maths: physical value-at-risk

ABB’s William Rutz and Bob Fesmire investigate new tools that calculate physical value-at-risk based on simulations of generating resources and power transactions

Know your trade types

An accurate and clearly communicated classification of the types of trade a company carries out brings a better understanding of risk methodologies and where they are best used across the enterprise, says Greg Keers

The CRO road

A company-wide understanding of risk has never been more important for energy firms. Kevin Foster talks to three chief risk officers about their role and how it is changing

The three-way knock-on effect

Peter Nance and Lin Franks look at the interplay between market, credit, and operational risks and consider how firms might approach implementing an integrated company-wide system to tackle them

Untangling the web

Ruling out the need for a major software infrastructure project, web-based concepts make perfect sense for enterprise-wide risk management systems, says Martin Chavez

Keeping EAR simple

Brett Humphreys discusses how trading groups can be captured within earnings-at-risk and cashflow-at-risk models. He suggests taking a top-down approach instead of a bottom-up approach based on actual positions

Managing risk under SMD

Scott Greene, Mark Niehaus and Pankaj Sahay examine the impact of Ferc’s proposed standard market design on power risk management

Clear in present danger

Energy companies are crying out for clearing solutions to reduce their counterparty credit risk. James Ockenden looks at new initiatives from London-based power exchange UKPX and German firm Clearing Bank Hannover

Keeping an eye on the long-term

Brett Humphreys discusses the problems with standard credit risk limits and proposes limits that may work better

Var too far

The energy industry has shown tremendous commitment to value-at-risk (Var) methodologies. But use of Var has been misguided, as James Ockenden discovers

What’s the worst that could happen?

Brett Humphreys discusses how using a standard credit value-at-risk measure may be misleading for credit risk decisions

The value of volatility

Brett Humphreys and Tim Essaye seek out the best method for calculating volatility by comparing different measures, and find that complex approaches aren’t necessarily the best ones to use

Tools for the trade

Ken Nichols examines the mechanisms available for incorporating credit risk management into an energy company’s portfolio

Avoiding over-exposure

Eurof Thomas finds the European energy market is increasing its focus on credit risk mitigation in the wake of Enron’s demise

Higher or lower?

Kevin Foster looks at how credit rating agencies assign a rating to companies in the energy sector and what kind of factors are taken into account

A whole new ball game

Enron’s bankruptcy has changed the playing field for credit risk in the energy sector. Kevin Foster reports on the renewed significance of assessing credit quality

Proper procedures

Rajiv Arora examines the processes necessary for effectively measuring, managing and hedging credit risks

A cure for Enron flu

Brett Humphreys discusses recent events in the energy sector and the role risk managers can play in improving the industry

Keeping score

This month Brett Humphreys and Zach Jonasson show how energy trading firms can compare performance using publicly available corporate information

Covering the threat

Since September 11, energy companies have had to re-assess the threat of terrorist attack. Despite the insurance industry introducing new terms and products, some companies remain unprotected, as Joel Hanley discovers

Building blocks for complex probability distributions

Brett Humphreys demonstrates how to construct more accurate return distributions and use them to price options