Risk management

US puts trust in Canadian finance

Canadian income trusts have been trading at all-time highs. Now that the Canadiangovernment is allowing bigger players onto the market, interest from US energyfirms in such vehicles is growing. By Catherine Lacoursiere

CGE Power falls as banks demand cash

CGE Power, the bank consortium formed to acquire distressed UK power assets, has withdrawn offers totalling around £3 billion on 12 plants and ceased trading after proposals to acquire two key power plants were rejected by lenders, according to a…

Liquidity, not regulation, is key to avoid manipulation, says CFTC

Regulators should avoid the temptation to implement over zealous regulation of the energy derivatives market, and instead encourage the development of liquidity, if market manipulation is to be avoided. That was the message delivered by Sharon Brown…

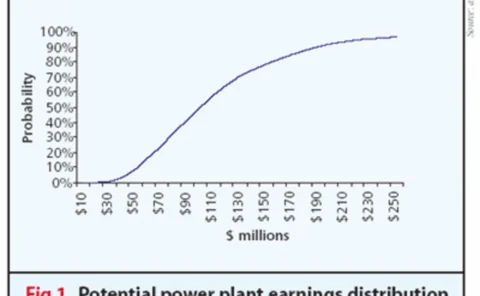

FEA unveils updated power exposure solution

Financial Engineering Associates (FEA), the Berkeley-based subsidiary of technology company Barra, today unveiled its @Energy/Power Generation 2.0 solution for power plant optimisation, risk exposure assessment and valuation

S&P places focus on energy merchant liquidity risk

Rating agency Standard & Poor’s is to issue new liquidity adequacy guidelines for US energy merchants, which are particularly vulnerable to large and sudden liquidity demands related to collateral calls.

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports

Nord Pool’s back-up

Nord Pool Clearing is the first pure electricity clearing house to obtain capitalsupport through insurance to cover defaults by its trading counterparties. Areenergy companies set to follow suit? Joe Marsh reports

Simulating spots

Abstract: The use of Monte Carlo simulation is becoming increasingly importantin energy trading and risk management. Here, Les Clewlow and ChrisStrickland present the first in a series of articles looking at the implementation of simulationtechniques and…

Heroes or cowboys?

Banks and energy companies alike are sceptical about the role that hedge fundsplay in energy markets. Are they really an aid to market stability, or is theirpresence compounding market volatility? Paul Lyon reports

The right charge

Savvy firms now accept risk is inevitable. Those that use their risk capitalefficiently outperform those that don’t. Brett Humphreys looks at alternativeinvestments to find out what the right risk-adjusted return on capital chargesmight be

Using a square peg

Hedging load exposures is a complex issue, and plumping for hedging the expectedvolume is unlikely to be the best solution. Brett Humphreys and RahulGill showthat sometimes, the best hedge of a shaped position is an over-hedge

European companies outline concerns over emissions trading

Corporates are expressing concern at the ramifications of the European UnionEmissions Trading Scheme – just as EU member states finalise their nationalallocation plans. By Paul Lyon

Norway's Statoil sets up emissions trading unit

Norwegian energy company Statoil has formed a unit for trading carbon dioxide emissions. The Oslo-based firm said: “The Norwegian emissions trading regime will govern Statoil’s involvement in the purchase and sale of carbon quotas.”

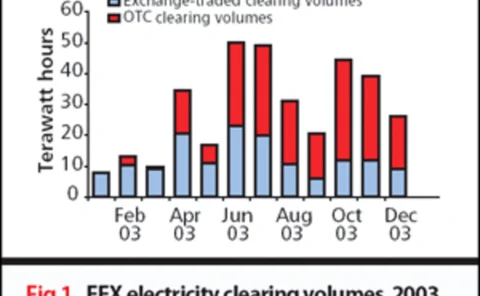

Skating on thin Ice

Profits at the Intercontinental Exchange fell by more than half last year thanksto a contraction in over-the-counter revenues. Yet the exchange reports recordvolumes for its IPE business. Paul Lyon analyses the results

A fertile future

The CME is hoping its introduction of fertiliser futures will protect the industryfrom fluctuations in the price of natural gas – a vital ingredient in mostnitrogen fertilisers. But is it a case of too little too late? By Paul Lyon

RMS releases updated Climetrix weather trading system

Risk Management Solutions (RMS), a California-based provider of products and services for the management of natural hazard risk, today released version 4.0 of its Climetrix weather derivatives trading and risk management system.

The big picture

Focusing only on measuring VAR and stress tests limits the role of the risk manager.And there are great benefits from a wider view of what risk management can achievefor a company. By Brett Humphreys

Repeal repercussions

Opinions are divided over the possible repeal of the Public Utility Holding CompanyAct. All agree that the environment for investor-owned electric utilities woulddramatically change if the repeal were to go ahead. By Paul Lyon

Taking the slow road

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

Risk at the margin

Competition and deregulation has led to new ways of running utilities, and the commodity-trading model has emerged as the leading approach. But the challenge lies in how it is applied, argues Lawrence Haar

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

Protection treaty

Matthew Saunders , of law firm DLA, introduces the bilateral investment treaty which, though often overlooked, can be an effective method of affording legal protection for energy investments and minimising energy project risk