Risk management

Nord Pool’s back-up

Nord Pool Clearing is the first pure electricity clearing house to obtain capitalsupport through insurance to cover defaults by its trading counterparties. Areenergy companies set to follow suit? Joe Marsh reports

Simulating spots

Abstract: The use of Monte Carlo simulation is becoming increasingly importantin energy trading and risk management. Here, Les Clewlow and ChrisStrickland present the first in a series of articles looking at the implementation of simulationtechniques and…

Heroes or cowboys?

Banks and energy companies alike are sceptical about the role that hedge fundsplay in energy markets. Are they really an aid to market stability, or is theirpresence compounding market volatility? Paul Lyon reports

The right charge

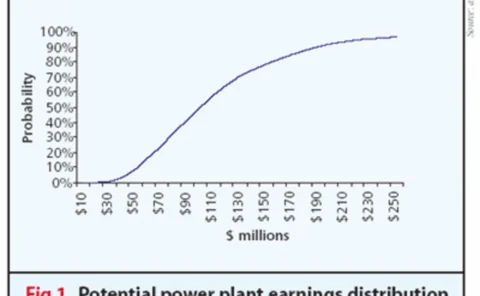

Savvy firms now accept risk is inevitable. Those that use their risk capitalefficiently outperform those that don’t. Brett Humphreys looks at alternativeinvestments to find out what the right risk-adjusted return on capital chargesmight be

Using a square peg

Hedging load exposures is a complex issue, and plumping for hedging the expectedvolume is unlikely to be the best solution. Brett Humphreys and RahulGill showthat sometimes, the best hedge of a shaped position is an over-hedge

European companies outline concerns over emissions trading

Corporates are expressing concern at the ramifications of the European UnionEmissions Trading Scheme – just as EU member states finalise their nationalallocation plans. By Paul Lyon

Norway's Statoil sets up emissions trading unit

Norwegian energy company Statoil has formed a unit for trading carbon dioxide emissions. The Oslo-based firm said: “The Norwegian emissions trading regime will govern Statoil’s involvement in the purchase and sale of carbon quotas.”

Skating on thin Ice

Profits at the Intercontinental Exchange fell by more than half last year thanksto a contraction in over-the-counter revenues. Yet the exchange reports recordvolumes for its IPE business. Paul Lyon analyses the results

A fertile future

The CME is hoping its introduction of fertiliser futures will protect the industryfrom fluctuations in the price of natural gas – a vital ingredient in mostnitrogen fertilisers. But is it a case of too little too late? By Paul Lyon

RMS releases updated Climetrix weather trading system

Risk Management Solutions (RMS), a California-based provider of products and services for the management of natural hazard risk, today released version 4.0 of its Climetrix weather derivatives trading and risk management system.

The big picture

Focusing only on measuring VAR and stress tests limits the role of the risk manager.And there are great benefits from a wider view of what risk management can achievefor a company. By Brett Humphreys

Repeal repercussions

Opinions are divided over the possible repeal of the Public Utility Holding CompanyAct. All agree that the environment for investor-owned electric utilities woulddramatically change if the repeal were to go ahead. By Paul Lyon

Taking the slow road

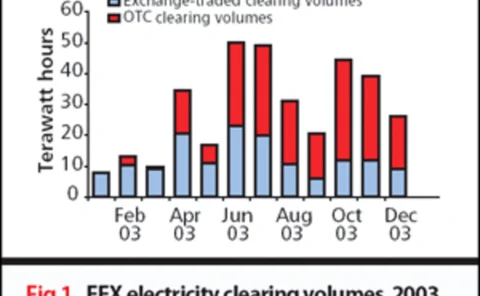

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

Risk at the margin

Competition and deregulation has led to new ways of running utilities, and the commodity-trading model has emerged as the leading approach. But the challenge lies in how it is applied, argues Lawrence Haar

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

Protection treaty

Matthew Saunders , of law firm DLA, introduces the bilateral investment treaty which, though often overlooked, can be an effective method of affording legal protection for energy investments and minimising energy project risk

Capital calculations

The latest Committee of Chief Risk Officers white paper offers capital adequacy guidelines for energy merchants. But why should energy firms perform these calculations? Glyn Holton asks whether the CCRO has missed the point

FirstEnergy to blame for US blackout, say reports

Utilities in Ohio – chiefly FirstEnergy – were at fault for the US blackout in August, conclude separate reports from a US-Canadian task force and Michigan regulators. But the midwest system operator does not escape blame. By Joe Marsh

Degreasing palms

The United Nations is likely to ratify extensive anti-corruption legislation in December. But recent scandals at energy giants Elf and Statoil highlight the difficulties in stamping out bribery and corruption. By Joe Marsh

Back to basics

Correlation and volatility methods are accepted ways of measuring risk. But areview of the underlying assumptions underlying the statistics used for risk management can identify areas where errors can occur, says Brett Humphreys

Bound by the rules

In his last day in office, Governor Gray Davis announced the Californian energy crisis was over. Revelations from indicted traders, and the punishments doled out to them, will have a profound effect on how the market moves forward. By Catherine…