Risk management

Both sides of the fence

Ernst Eberlein and Gerhard Stahl analyse price series of 25 energy spotrates simultaneously using Lévy models. This model class allows thecapture of stochastic behaviour of these financial instruments.Theimplications of this analysis will form the…

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Powernext selects Trayport for emissions trading, awaits CO 2 allocation

French electricity exchange Powernext will use software supplier Trayport’s Global Vision platform for CO 2 emissions trading, but is still waiting to start the spot emissions market it first announced in January.

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

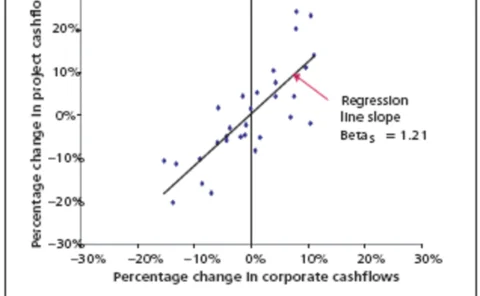

The sum of its parts

One can view a corporation’s individual projects as a portfolio of options – useful risk management tools to be used if their risk/return ratios are better than that of the firm as a whole. But how to work out the equity cost of capital at this…

A complicated option

Why does the New York Mercantile Exchange not list average-price WTI crude options as a contract on its ClearPort electronic platform? Internal politics could be the main obstacle. Joe Marsh reports

Spectron to launch LPG web-trading platform

UK energy broker Spectron will launch an online trading platform for liquefied petroleum gas (LPG) on Tuesday (February 22). Spectron said the screen will be the first to allow the trading of LPG in both the east and west, as outrights or spreads, and…

OpenLink may launch web-based version of Endur

OpenLink may launch a web-based version of Endur, its energy trading and risk management system, according to Matt Frye, Houston-based managing director of the software company.

Exceptions to the rule

With commodity markets set to fall within the scope of more EU regulation, trade associations are concerned that this extra burden on market participants could stifle trade. By Stella Farrington

Correlation: the horror!

The murky world of correlation, with its many pitfalls, represents a black hole in the minds of some energy market professionals. But, says Neil Palmer , you needn’t be afraid of the dark

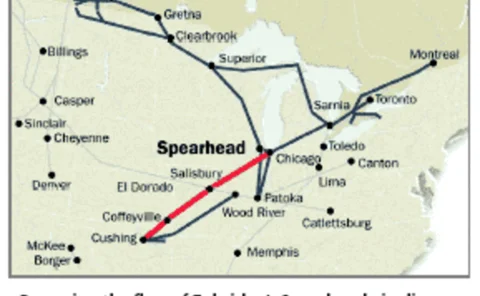

Crude imitation

Hedging Canadian heavy crude oil is difficult: unlike Canadian light crude, ithas no closely matching price benchmarks. Trading basis differentials is onesolution, but help may be at hand from another quarter. By JoeMarsh

TriOptima trims six companies' oil swap portfolios

TriOptima, a Swedish company dedicated to reducing over-the-counter swap portfolios, has expanded its service into energy. The company has terminated its first group of multilateral OTC oil derivative swaps, with six companies eliminating unnecessary…

European Commission sues over emissions-trading legislation

The European Commission is taking legal action against Greece, Italy, Belgium and Finland for not fully transposing the emissions-trading directive into national law by December 31, 2003. Separately, Italy will receive a final written warning because it…

Amerex gains sulpur dioxide trading privileges on CCX

Houston-based broker Amerex Energy has obtained SO 2 trading privileges on the Chicago Climate Exchange (CCX), an emissions-trading marketplace. Amerex can now broker futures contracts in trading increments of 25-tonne SO2 allowances. The standard over…

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

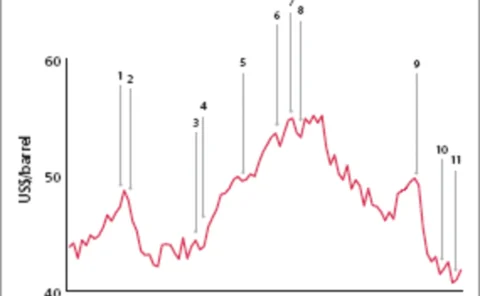

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

A new breed of bond

Issuance of rate reduction bonds by utilities may be down, but the market is preparing for a surge in new asset-backed securities derived from the stranded cost model. By Catherine Lacoursiere

Pay as you go

It is going to be a hard day at the office for Joe Risk Manager. The risk management committee might welcome his new risk charge system, but how would the traders take it? By Brett Humphreys and David Shimko

China Aviation Oil ceases oil derivatives trading

China Aviation Oil (Singapore) Corp has ceased all oil derivative trading activities after announcing a $550 million trading loss and seeking court protection from creditors last week, the company said late Wednesday.

Satya Capital sues China Aviation Oil

Indonesian firm Satya Capital Limited is suing China Aviation Oil (Singapore) Corp and it parent company China Aviation Oil Holding Company for over $28 million for an alleged breach of a share purchase agreement, CAO (Singapore) Corp said late Wednesday.

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

BarCap launches commodity-linked credit product

Fixed-income investors can now make use of a credit instrument that provides access to commodities as an asset class, says Barclays Capital. The investment bank has launched Apollo, a collateralised commodity obligation (CCO), which uses derivatives…

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…