Risk management

A good time to build

US utilities may need to spend more than $100 billion in the next 25 years on new power plants and transmission capacity. Richard McMahon looks at how utilities are assessing long-term risks and attracting potential investors

The best of all worlds

Thanks to their varying scale, structure and diversity, European organisations often have very different solutions to risk management. But which system is the most effective? In an exclusive to Energy Risk, the European Energy Risk Forum offers a route…

ECX and Powernext team up on carbon trading

French electricity exchange Powernext and the Amsterdam-based European Climate Exchange (ECX) have agreed to jointly offer carbon futures and spot contracts. The partnership is complimentary, because ECX lists a futures contract and Powernext offers a CO…

European Commission to examine energy-sector competition

The European Commission (EC) today launched an inquiry into competition in natural gas and electricity markets, in response to concerns from consumers and new market entrants about the development of wholesale markets and limited consumer choice.

Powernext to launch spot carbon contract in late June

French electricity exchange Powernext will launch its delayed CO 2 emissions spot market on June 24, barring any technical or administrative difficulties among market members.

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Getting it together

The US Committee of Chief Risk Officers is proposing an energy data hub to improve price transparency in the natural gas market, but index publisher Platts is concerned over some aspects of the initiative. Joe Marsh reports

Staying one step ahead

Picking the right investment opportunities will never be a precise science, but a combination of global forecasting and risk management has enabled US Global Investors to become one of the most successful US mutual funds in the energy space. Its chief…

Strategies for success

To succeed in the fast-changing US gas market requires an effective hedging and risk-management strategy. Accenture’s Alexander Landia , Paul Equale and Julie Adams look at what firms need to do to win in this key market

The dragon’s revenge

In the second article on the pitfalls of hedging, Neil Palmer considers one of the risks of managing options: dynamic hedging. He shows there is an awful lot that can go wrong in the quest for perfect risk elimination

Valuing interruptus

Managing wholesale spot power price volatility by turning off supply offers a way of reducing price spikes, but measuring the value of such interruptibility involves costly modelling techniques. JK Winsen suggests a simpler alternative

The ABC of PCA

Often, the costs associated with implementing advanced statistical models can outweigh the potential benefits. Brett Humphreys shows how to smooth and speed up choppy simulations using principal components analysis

Commodity kickers

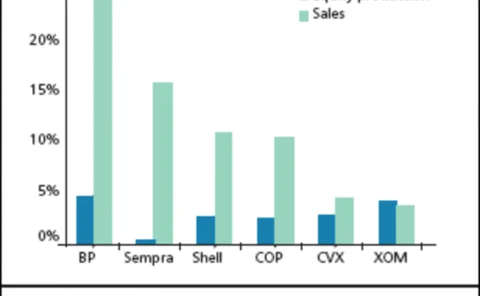

Retail investors are showing greater interest in commodity-linked products. but most of the structures launched in Europe so far have been based on small, tailor-made baskets. By Patrick Fletcher

UK business paying £1bn/year too much for energy

UK businesses are failing to manage energy buying efficiently and as a result are exposed to volatile prices, losing up to £1 billion ($1.81 billion) a year, a new survey has found.

DrKW launches retail carbon product

Dresdner Kleinwort Wasserstein has paved the way for private investors to gain exposure to the carbon emissions market with a new securitised product.

Barclays Capital in first Leba carbon index trade

Barclays Capital has completed the first financial carbon trade using the new Leba Carbon Index for "a significant volume" of EU emissions allowances.

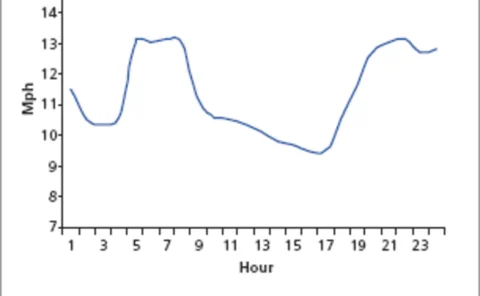

Peaking patterns

Weather is increasingly affecting power market dynamics, with prices as variableas the temperatures. But the volatility has spawned a growing variety of methodsofmanaging peak load demand. By Catherine Lacoursiere

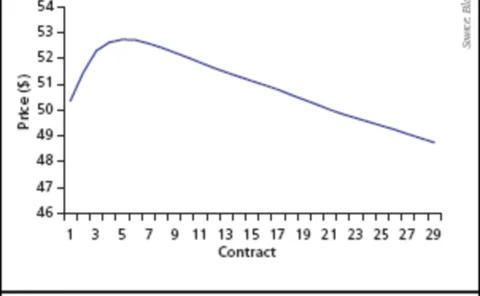

Contract killers

Hidden risks can lurk in unexpected areas – such as the contracting process. Brett Humphreys and Brett Friedman discuss how risk managers must look beyondsimple value-at-risk measures and find other potentially hidden exposures

Slaying the dragon

In the first of a two-part series on hedging risk, NeilPalmer looks at the effectsof imperfect correlation on basis risk, and finds that unless you have a perfecthedge, you may just have to learn to live with risk

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

Tentative steps

Algeria’s state-owned oil company Sonatrach is about to become the first oil and gas company within Opec to roll out an independent risk management programme to cover its crude oil and gas sales. Stella Farrington reports

Battle for Brent rages on as open outcry closes at IPE

Open outcry at London’s IPE had its last day on Thursday, yet the debate over whether the screen can adequately replicate an oil market rages on, with IPE and Nymex both taking a punt on opposing beliefs.

Answers in the wind

Project valuation means making calculated assumptions that aren’t always accurate. Brett Humphreys discusses the assumptions that may be embedded within a valuation and how these assumptions can affect the final value

IPE-ECX carbon futures contract faces fierce competition

London’s International Petroleum Exchange (IPE) and the Amsterdam-based European Climate Exchange (ECX) are set to offer CO 2 futures contracts under the EU Emissions Trading Scheme (ETS).