Risk management

A whole new ball game

Enron’s bankruptcy has changed the playing field for credit risk in the energy sector. Kevin Foster reports on the renewed significance of assessing credit quality

Proper procedures

Rajiv Arora examines the processes necessary for effectively measuring, managing and hedging credit risks

A cure for Enron flu

Brett Humphreys discusses recent events in the energy sector and the role risk managers can play in improving the industry

Keeping score

This month Brett Humphreys and Zach Jonasson show how energy trading firms can compare performance using publicly available corporate information

Covering the threat

Since September 11, energy companies have had to re-assess the threat of terrorist attack. Despite the insurance industry introducing new terms and products, some companies remain unprotected, as Joel Hanley discovers

Building blocks for complex probability distributions

Brett Humphreys demonstrates how to construct more accurate return distributions and use them to price options

Counterparty concerns

Following the California crisis and the fall of Enron, energy firms are finally paying more attention to credit risk. Here Fred Cohen, Satyan Malhotra and Rafael Cavestany present some overarching issues senior management must address in implementing an…

Clearing the way?

The German over-the-counter market has been growing quickly in recent years, but a series of shocks has sparked fears of credit risk exposure. Can trading regain recent highs and save the OTC market from credit-wary traders, asks Joel Hanley

Controlling power

Maggi Shippy-Ksionsk and Stefan Ulreich explain how portfolio risk management gives a company control over its energy procurement

Two hubs or one?

Independent traders are desperate for a hub that will provide real liquidity and help force the Ruhrgas-dominated German natural gas market to open to competition. Peter Joy reports

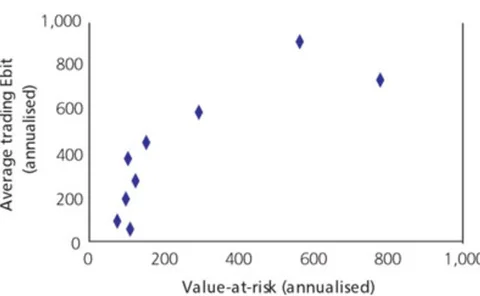

Knowing your limits

Value-at-risk limits are widely used risk management instruments. But issues over the allocation of Var limits remain, says Brett Humphreys

A hedge by any other name

It is one of the most commonly used phrases in risk management parlance, but what exactly is meant by the term ‘hedge’? Here we propose a new definition. By Brett Humphreys

Poor relations

Here EPRM outlines an approach for sorting out common problems relating to calculating correlation measures in value-at-risk. By Brett Humphreys

Deutsches data duel

Statistical analysis of competing meteorological data from two different sources in Germany might lead to disparate views of weather risk management. By Bob Dischel