Risk management

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done

Trading with a small ‘t’

What made headlines before is now becoming everyday news: energy companies are scaling back or leaving energy trading. Some industry observers are emphasising the shift to ‘trading around assets’. Anne Ku investigates just what this means

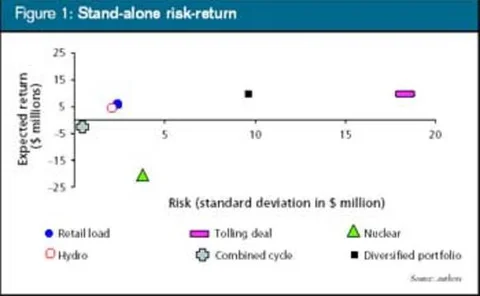

Optimise this

One of the reactions to recent energy trading difficulties has been a shift away from speculative activities towards portfolio optimisation, but what does the term really mean, ask Tim Essaye and Brett Humphreys

Models of good behaviour

The development of new models that describe the real dynamics of energy prices have to take into account the behavioural aspects of market players. The problem is how to quantify these aspects. Maria Kielmas reports

Greening the markets

Environmental risks are increasingly being recognised as important financial issues, but the markets are still some way from rewarding companies for good environmental performance, as Kevin Foster discovers

Opportunity knocks for smelters

Aluminium manufacturers have long used sophisticated hedging and risk management techniques to protect against fluctuating metal prices, yet they have only recently looked at transferring these skills to power risk management. David Wilson reports

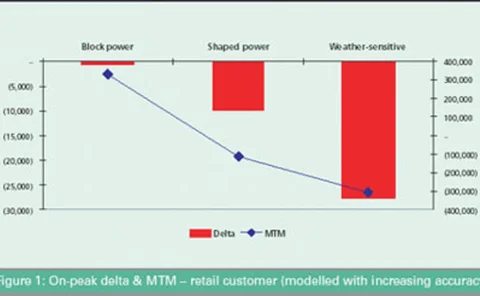

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure

Ahead of the green game

Given the efforts they have already made to reduce emissions, many German firms do not share their environment minister’s enthusiasm for the EU’s new, obligatory cross-border greenhouse gas emissions trading market. Jessica McCallin reports

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas

Option pricing for power prices with spikes

European power prices are very volatile and subject to spikes, particularly in German and Dutch markets. Ronald Huisman and Cyriel de Jong examine the impact of spikes on option prices by comparing prices from a standard mean-reverting model and a regime…

Blurring the lines

A turf war between Atlanta’s IntercontinentalExchange and the New York Mercantile Exchange reveals a shift in the traditional role of over-the-counter brokers and exchanges, finds Catherine Lacoursière

Enough’s enough

Brett Humphreys takes the guesswork out of determining how many simulations are needed to calculate value-at-risk

Exchanging blows

Conflict in the US and growth in Europe marked another turbulent year for energy exchanges. Kevin Foster casts an eye back over 2002

Getting stressed

To understand how much value can be lost from a position in the energy markets, we need to use measures other than value-at-risk. Brett Humphreys discusses methods for creating effective stress tests

Standardising electricity contracts

Electricity contracts have come and gone, but a new trio of financially settled futures contracts aims to widen the electricity market, reports James Ockenden

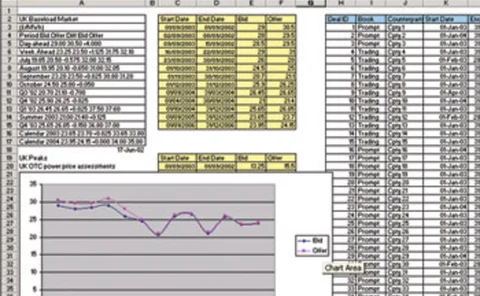

Cell mates

Traders love spreadsheets. But complex deals can quickly outgrow a sheet developed on the fly. Since traders won’t abandon their favourite tools, Stuart Cook and Tony Hughes of The Structure Group look at how firms can control their use

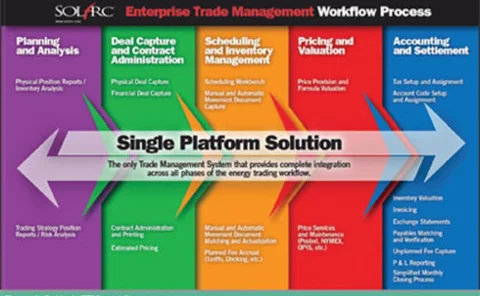

Capturing value from energy supply and trading

Companies that plan to engage in energy trading need to invest in the right personnel, processes and information management tools if they intend to be successful, says David Dunkin, SolArc’s Chief Strategic Executive

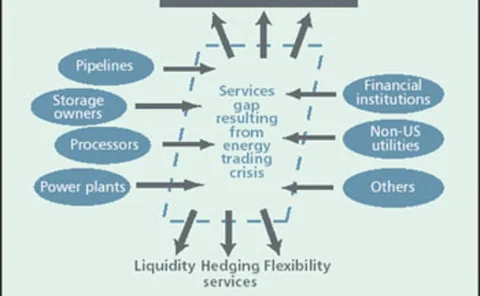

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report

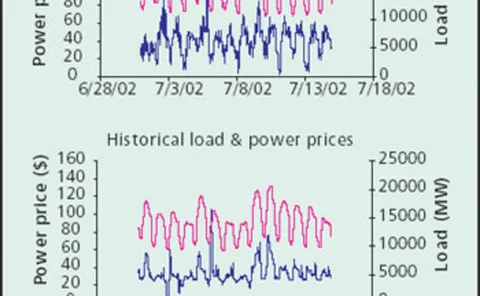

The Power Sector Model

David Soronow, Mike Pierce and King Wang, of Financial Engineering Associates, introduce the firm’s Power Sector Model as the next step in derivatives pricing

New Energy Associates, a Siemens Company, presents the future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

Making sense of the new power market

Bank of America’s Rogers Herndon and David Mooney examine expectations in the energy and power markets before and after the collapse of Enron and outline their predictions for the future

Trading natural gas futures with weatherfutures at the CME

Craig Jimenez and Mirant’s Vishu Kulkarni discuss how the burgeoning relationship between the natural gas futures market and the weather futures market is providing opportunities for traders, hedgers and speculators alike

Quality data and solutions for a challenging market

FAME provides today’s uncertain energy market with transparent information and the tools to analyse it