Risk management

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

Static emissions price “does not reflect fundamentals”

The European emissions trading market, with its static price over the last four to five weeks, “is not a good market,” and does not reflect fundamentals, said Chris Rowland, managing director of utilities research at Dresdner Kleinwort Wasserstein.

Energy users demand trading oversight

The debate continues over whether speculative traders are distorting energy prices, following a letter sent by the Industrial Energy Consumers of America (IECA) to Congress last week. “Energy markets have changed drastically, and regulatory oversight,…

EEX to launch spot carbon contract

German-based electronic exchange European Energy Exchange (EEX) is to launch a spot contract to trade EU carbon emissions allowances in January 2005.

European emissions trading on track

The EU emissions trading scheme is on track to start in January 2005, with the European Commission having approved 16 out of 25 of the EU member National Allocation Plans that lie at the heart of the scheme, said Peter Vis, acting head of the Industrial…

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way

Taking cover

US energy companies are increasingly taking out terrorism cover, even though none has yet made a claim. This is partly because the cost of policy premiums is falling. But this trend may be under threat. Joe Marsh reports

Agree to disagree

Volatility in the dry freight market has led to the use of derivatives such as forward freight agreements and the development of other innovative products. But will they have a lasting impact on the energy markets? By Hann Ho

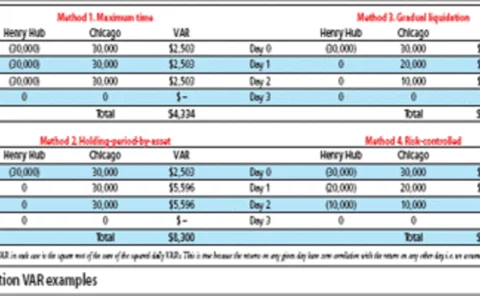

Risky liquidations

It is all too easy to go for the simplest solution when liquidating an energy portfolio of different positions. Brett Humphreys discusses some of the problems with appropriately calculating the VAR associated with liquidating a portfolio

A popular punt

Experts remain bullish about the flow of new money into catastrophe cover. But an influx of hedge funds backed increasingly by institutional capital has led to worries of a “domino effect”. By Maria Kielmas

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Pressure on Puhca

The US General Accounting Office is to investigate whether the SEC has been lax in its oversight of the Public Utility Holding Company Act. How will this affect firms subject to Puhca requirements? By Paul Lyon

Bilateral collateral

Until recently, there was little legal protection from foreign investment risk.But the past few years have seen the rise of the bilateral investment treaty(BIT). Matthew Saunders shows how BITs can benefit the energy sector

Found in translation

While risk managers have become focused on value-at-risk and similar risk metrics,these may not be the best way of communicating risk to stakeholders. BrettHumphreys discusses how to improve communications

The windy city rules

The Chicago Climate Exchange is going from strength to strength if its new initiatives,new members and volumes are anything to go by. Here PaulLyon talks to CCX founderRichard Sandor about the exchange’s future

Oneok gets new $1bn financing and agrees to buy US gas co

Oklahoma-based energy company Oneok has obtained a five-year, $1 billion credit line from a group of banks to fund asset purchases. The company has also agreed to buy pipeline operator Northern Plains Natural Gas Company from asset acquisition company…

Dominion forward-sells shares to obtain equity on demand

Virginia-based energy company Dominion has forward-sold 10 million shares of its common stock in a block trade to JP Morgan Securities. The deal was done in connection with a forward-sale agreement between Dominion and investment bank Merrill Lynch. It…

Shaping the curve

A shaped forward curve is important for both trading and risk management. Here, Giorgio Cabibbo and Stefano Fiorenzani provide a model for shaping electricityforward curves that is consistent with both financial theory and market practice.Here, they…

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

Covering all the bases

Abstract: Many articles have discussed constructing models for either spot orforward prices. Yet none cover the whole process of constructing a joint modelfor both. Here, Andreas Huber and MonikaKrca develop a multi-factor model thatcaptures both the…

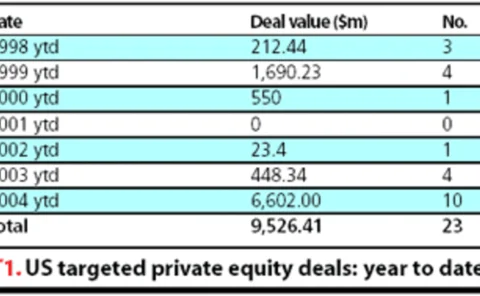

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

SunGard acquires ASP pioneer Kiodex

SunGard has acquired New York based Kiodex, a supplier of web-based risk management, financial reporting, FAS 133 compliance and market data solutions for companies exposed to commodity price risk.

Tractebel opts for PowerCosts

Tractebel Energy Marketing, a subsidiary of energy company Tractebel, has signed up to use risk trading technology provided by PowerCosts Inc (PCI).