Risk management

Allegheny sells West Virginia gas ops for $228m

Monongahela Power Company, a subsidiary of Pennsylvania-based Allegheny Energy, is to sell its natural gas operations in West Virginia for $141 million in cash and $87 million in assumed long-term debt to a private investment partnership.

Looking to the east

Can power market operators in the new EU member states in eastern Europe gainthe liquidity they need to challenge either bilateral electricity contracts orthe established exchanges? Joe Marsh reports

Viva lost vegas

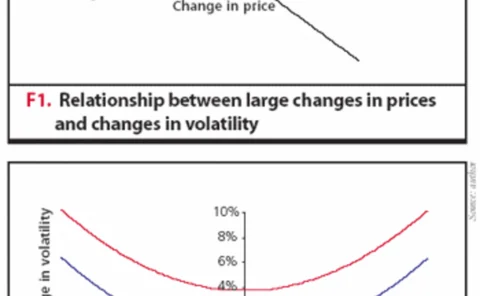

Brett Humphreys discusses the problems of calculating true value-at-risk on aconcentrated options portfolio – in particular, the various pitfalls thatcan befall a risk manager in ignoring vega risk – and considers ways ofhandling these issues

Vertical take-off

As UK supplier Centrica narrows its focus to fund an asset acquisition spree, James Ockenden finds the ‘asset-light’ utility model has finallybeen buried and a move towards ‘vertical integration’ is now thestrategy of choice

Building load links

In the third article in this series, Les Clewlow , ChrisStrickland and MichaelBooth show how the Monte Carlo techniques used in previous articles can accuratelyhighlight the crucial relationship between price and load – a complex correlationaffecting the…

Technology upload

There has been a recent upswing in the fortunes of energy risk software industry. And that is reflected in this year’s expanded technology vendor guide, making it the definitive guide to energy software and technology available

The troubleshooter

After struggling for a year with a difficult Triple Point installation, US energycompany Cinergy brought in energy IT veteran Joel McKnight. Nine months on, implementationand integration is complete. By Joe Marsh

King of convenience

The need for Sarbanes-Oxley certification has boosted sales of internet servicerisk systems, says web pioneer Martin Chavez of Kiodex. By James Ockenden

Nordic volumes heading south

Nordic region electricity trading volumes are falling fast, which is damagingprofits at Oslo-based power exchange Nord Pool. The company may face postinga loss for 2004 if it cannot reverse this trend. Joe Marsh reports

Energising Houston

Bear Stearns created its Houston-based energy group to acquire and optimise powergeneration assets in North America. And the business is going from strength tostrength, says its managing director Pamela Baden. PaulLyon reports

Energising Houston

Bear Stearns created its Houston-based energy group to acquire and optimise powergeneration assets in North America. And the business is going from strength-to-strength,says its managing director Pamela Baden. Paul Lyon report

Weather patterns

OTC weather derivatives volumes are down around 20% on last year, but exchange-tradedweather futures are on the up. Paul Lyon looks at WRMA’s annual survey,and reviews the past year’s trends in the weather risk market

Banking on energy

Banks keen to establish an energy trading presence are finding that partneringwith energy companies, or even acquiring trading businesses outright, could bethe way forward. Paul Lyon reports

Bank of America settles Enron case

Bank of America (BoA) has agreed to pay $69 million as part of an agreement to settle a class action lawsuit brought on behalf of purchasers of Enron securities and led by the Regents of the University of California (UC).

RWE signs up to Raft

RWE, the German utility company, has signed up to use Raft’s credit risk management technology, Raft Credit. Raft International, the London-based risk technology company, did not disclose the size of the contract.

Tepco hedges weather

The Tokyo Electric Power Company (Tepko) has entered into weather derivatives contracts with both Tokyo Gas Company and Osaka Gas Company. The deals have been finalised in a bid to limit the effect on Tepco’s earnings from summer temperature conditions,…

Munich Re launches weather desk

Munich Re, the world’s largest reinsurer, has established a New York-based weather derivatives desk in its Munich American Capital Markets division.

Spring loading

Abstract: In May’s Expert Series, LesClewlow and Chris Strickland discussedthe use of Monte Carlo simulation in energy risk management and introduced aseries of models that they argued were suitable for the simulation of energy-and weather-dependent…

US puts trust in Canadian finance

Canadian income trusts have been trading at all-time highs. Now that the Canadiangovernment is allowing bigger players onto the market, interest from US energyfirms in such vehicles is growing. By Catherine Lacoursiere

CGE Power falls as banks demand cash

CGE Power, the bank consortium formed to acquire distressed UK power assets, has withdrawn offers totalling around £3 billion on 12 plants and ceased trading after proposals to acquire two key power plants were rejected by lenders, according to a…

Liquidity, not regulation, is key to avoid manipulation, says CFTC

Regulators should avoid the temptation to implement over zealous regulation of the energy derivatives market, and instead encourage the development of liquidity, if market manipulation is to be avoided. That was the message delivered by Sharon Brown…

FEA unveils updated power exposure solution

Financial Engineering Associates (FEA), the Berkeley-based subsidiary of technology company Barra, today unveiled its @Energy/Power Generation 2.0 solution for power plant optimisation, risk exposure assessment and valuation

S&P places focus on energy merchant liquidity risk

Rating agency Standard & Poor’s is to issue new liquidity adequacy guidelines for US energy merchants, which are particularly vulnerable to large and sudden liquidity demands related to collateral calls.

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports