Risk management

Credit - Energising credit

Traditional credit instruments can be used to mitigate credit risk in the energy sector, despite the unique risk management challenges, says Chris Coovrey

A comeback for coal

With gas prices soaring, it seems inevitable that coal - the Cinderella of energy resources - is bound to return to the forefront. But how long will it last? asks Eric Fishnaut

Icecap completes first closing of its carbon portfolio

Icecap, the carbon emissions group, has today reached first closing of its carbon portfolio having raised aggregate commitments to buy 15 million tonnes of carbon credits from the Clean Development Mechanism and Joint Implementation markets.

Duke Energy to adopt Cinergy trading approach

Following the transfer of its energy derivatives portfolio to Barclays Capital, Duke Energy is targeting a lower-risk trading strategy pioneered by Cinergy, the company it is buying

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

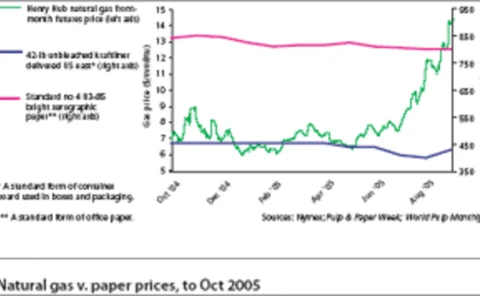

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

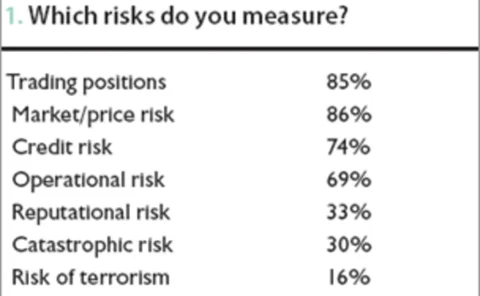

Top of the agenda

Energy Risk's inaugural risk management survey reveals what you consider the biggest challenges, greatest fears and chief problems facing risk managers today, and what changes you would like to see in the future

Nymex plans to sell 10% stake to private equity firm

The New York Mercantile Exchange (Nymex) has signalled its intention to sell a 10% equity stake to General Atlantic, a US-based private equity firm, for $135 million.

Indian exchange to list IPE Brent crude futures

Oil traders in India will from September 15 be able to trade rupee-denominated Brent crude futures, settled monthly by reference to the benchmark IPE Brent crude futures contract.

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

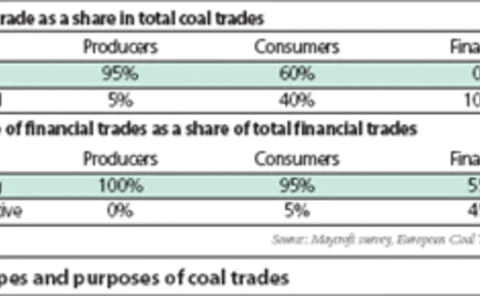

Coal facing changes

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Evolution expands US west coast emissions brokerage ops

Energy broker Evolution Markets has expanded its environmental market operations for the western US with the hire of Laura Meadors, an expert in environmental market design and analysis. She is based in the San Francisco office, which opened in February…

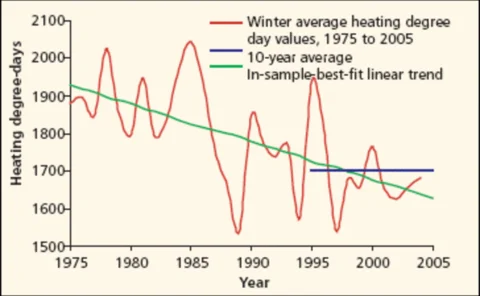

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

Keep it simple, stupid

Do you prefer sophistication or simplicity? Neil Palmer takes a look at optimisation methods in energy modelling and asks if energy quants aren’t sometimes being a little too heavy-handed

Struggling for growth

All three Canadian energy exchanges – NGX, Watt-Ex and NetThruPut – are finding it slow-going with their expansion plans. Meanwhile the rivalry between NGX and Watt-Ex is growing. Joe Marsh reports

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

Checking outside the box

Companies often use checklists to evaluate their IT buying requirements. But these rarely address what the firm actually needs. Brett Humphreys discusses how over-reliance on checklists may lead to poor software buying decisions

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh