Credit risk

Scaling the credit cliff

How are designers of credit risk software reacting to the new credit realities of the energy trading sector? Kevin Foster talks to some leading companies to find out

A clear answer to credit problems

US firm PA Consulting is working with a number of major US energy companies to set up a one-off trade netting scheme. Kevin Foster investigates the proposals

Standing out from the crowd

Credit risk management groups can differentiate themselves from their competitors through their different capabilities. Randy Baker and Brett Humphreys explain how

Post-delivery problems

The credit exposures that arise from trading physical and financial energy are inherently more complicated and volatile than those encountered in trading purely financial products. Richard Sage looks at the different elements to be considered

Trying to model reality

Quantitative credit risk models are a must-have in today’s energy industry. But human judgement is still needed, as Maria Kielmas discovers

Enron will not centralise risk management

Failed energy trader Enron plans to package together the majority of its internationalassets into a company known as InternationalCo, the shares of which will be distributedto its creditors.

Energy firms turn to overlay

Energy companies face a tough future over pension provisions – a problem that could well exacerbate credit deterioration. Paul Lyon finds that innovative use of currency overlay could provide some form of refuge

Energy firms find succour

US energy company debt has reached critical levels, with nervous investors and banks working hard to keep these companies afloat. But Paul Lyon finds the secretive hedge fund industry could also lend a helping hand

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

Own, sell or restructure

UK and US utilities are presently saddled with a lot of debt, thanks to overcapacity and low power prices. But what’s the best way for these firms to deal with the power plants they don’t need? By Jessica McCallin

Delaying the inevitable?

As Reliant Resources celebrates a $6.2 billion refinancing deal, some in the industry say such deals are merely postponing problems that are bound to resurface. James Ockenden reports

Bearing the brunt

Building contractor bankruptcies of have recently stressed the credit profiles of several power projects in the US. Standard & Poor’s Scott Taylor and Tobias Hsieh look at how sponsors and lenders responded and the effects on the various parties

The case for financially settled contracts

Banks and hedge funds have shied away from trading electricity due to fear and ignorance of the physical nature of the market. But, as Todd Bessemer of Accenture points out, financially settled contracts can avoid the complexity of physical delivery and…

Tough talk on derivatives

The Commodity Futures Trading Commission and Ferc are getting tough in throwing fines around. Is this a ploy to avoid being lumbered with further over-the-counter regulatory responsibilities? Some market participants certainly think so. By Paul Lyon

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done

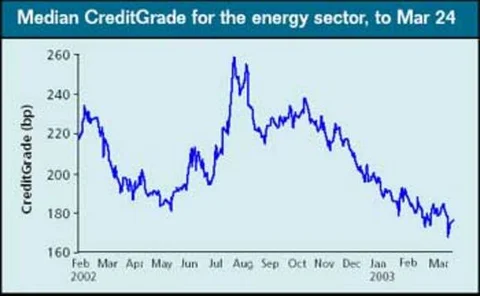

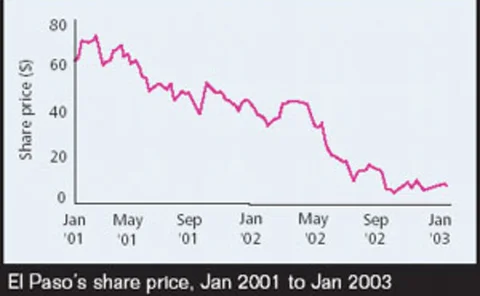

Credit watch

In this month’s analysis of energy firms’ credit quality via Riskmetrics’ CreditGrades tool, Williams and El Paso are among those with tighter spreads

Online clearing: the shape of energy markets to come

The energy trading market is moving towards a structure in which participants achieve market presence through a dedicated market network, rather than having to use local or regional exchanges, says strategic consultant Chris Cook

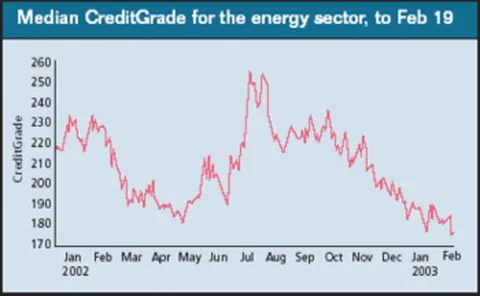

Credit watch

Risk management and analytics firm RiskMetrics gives this month’s analysis of energy companies’ credit quality using its CreditGrades tool

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure

Exchanges gradually gain pace

After much talk of new trading solutions for German power, only one platform – EEX – has made significant progress, although the new clearing solution from Clearing Bank Hannover seems to be picking up steam. James Ockenden reports

Energy clearing – solutions for a changing trading environment

E. Michael Jesch, head of business development at Clearing Bank Hannover, examines the effect of energy market liberalisation, globalisation and recent technological advancement on short- and long-term trading

Making the grade

As credit risk is now a major concern in the energy industry, EPRM takes a look at CreditGrades, a risk measurement tool from risk analytics firm RiskMetrics