Credit risk

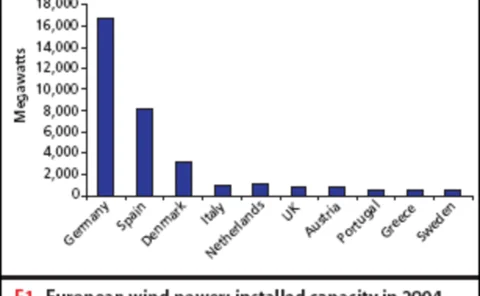

Blowing hot and cold

Across Europe, government enthusiasm and support for wind energy will dictate the ability for wind project sponsors to refinance project loans via the bond market. Jan Willem Plantagie of Standard & Poor’s explains

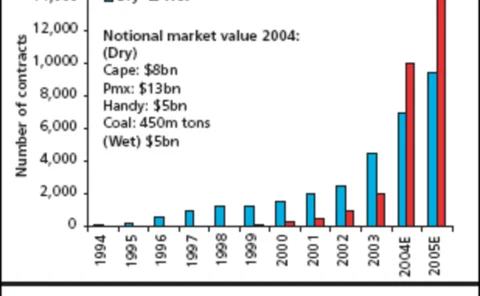

Delivering the goods

There’s huge scope for growth in the freight derivatives market, but to attract more players, existing participants need to adopt more innovative and sophisticated trading practices, participants say. Stella Farrington reports

Emissions education

As the European carbon market continues to grow, so too do some unique challenges: not least the gap between retail and wholesale players and the problem of counterparty credit risk. Oliver Holtaway reports

Clearing service launches for physical power in US

North American Energy Credit and Clearing (NECC), the Clearing Corporation (CCorp) and Atlanta-based commodity-trading platform IntercontinentalExchange (Ice) have launched a physical clearing service for the US energy markets.

The clearing challenge

Growing over-the-counter trade in the energy markets, much of it from hedge funds, coupled with exceptional price volatility, could test the current clearing system to the limit, warns independent consultant Chris Cook

North AmericanEnergy Forum

Leading energy market players discuss market trends, credit risk management and the future of the energy sector market, with a special focus on Canada

Stateside summit

Adding to the success of Energy Risk Europe in March, last month’s Energy Risk USA conference raised some lively debate. ERM, credit risk and the problems facing quant analysts were among the hot topics. Oliver Holtaway reports

Awards

Welcome to the annual Energy Risk awards, celebratingthe talent,innovation and enthusiasm that forms thebackbone of this industry.

Broken promises

Asian countries are now a power in the world’s energy markets, but governmentinterference in tariff structures and shaky sovereign guarantees mean regulatoryrisks forinvestors remain. By Maria Kielmas

Counterparty risk

Eduardo Canabarro, Evan Picoult and TomWilde present a new approach to derivativescounterparty credit risk that can affect utilities using a onefactor conditionalindependence framework, deriving a formula for theratio of ‘expected positive exposure’ to…

Tentative steps

Algeria’s state-owned oil company Sonatrach is about to become the first oil and gas company within Opec to roll out an independent risk management programme to cover its crude oil and gas sales. Stella Farrington reports

Polish power exchange chooses OMX software for trading and clearing

In a move to develop its electricity spot and derivatives market, the Polish Power Exchange (PolPX) will use the Condico system from Stockholm-based OMX, the owner and operator of the Swedish stock exchange.

The swap terminator

Multilateral swap cancellations look set to become commonplace in the energy sector, thanks to a service from TriOptima, which has just terminated its first round of oil swaps for six firms. Joe Marsh reports

Layers of intrigue

The Yukos saga – up to now largely confined to the political and legal arenas – recently took a step closer to the physical oil markets with a $6 billion oil deal between China and Russia. By Stella Farrington

TriOptima trims six companies' oil swap portfolios

TriOptima, a Swedish company dedicated to reducing over-the-counter swap portfolios, has expanded its service into energy. The company has terminated its first group of multilateral OTC oil derivative swaps, with six companies eliminating unnecessary…

Mirant to pay $460m to settle California energy crisis claims

Bankrupt Atlanta-based energy marketer Mirant will pay $460 million to California power utilities and public agencies to resolve claims related to the state’s energy crisis in 2000 and 2001. The California utilities and agencies in the settlement were…

Double exposure

Continuing our series on applications of Monte Carlo simulation to applied problems in energy risk management, Les Clewlow , Chris Strickland , Oleg Zakharov, and Scott Browne look at potential future exposure and the analogous measure of expected credit…

A new breed of bond

Issuance of rate reduction bonds by utilities may be down, but the market is preparing for a surge in new asset-backed securities derived from the stranded cost model. By Catherine Lacoursiere

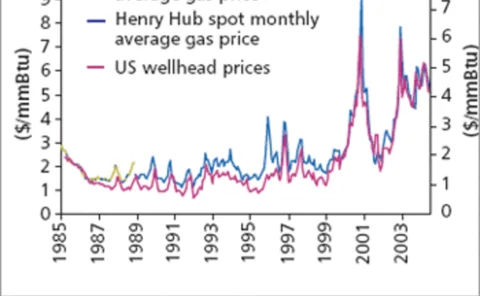

Bridging the gas gap

Volatility in the natural gas markets shows no sign of any let-up, which means that managing basis risk at Henry Hub continues to spur demand for increasingly innovative derivatives products. Catherine Lacoursiere reports

Fitch to buy Algorithmics

Fitch Group, parent of credit rating agency Fitch Ratings, is to acquire New York-based risk management software provider Algorithmics. The purchase, valued at $175 million, is expected to close in January, said Fitch today.

GE Commercial Finance Energy Financial Services to arrange and underwrite debt

Energy companies now have another option when it comes to choosing who will help finance a project or arrange a debt placement for them. GE Commercial Finance Energy Financial Services is to broaden its role as an equity and debt investor to include…

China Aviation gets six week breather

China Aviation Oil (CAOSCO) has been granted a six week extension by the High Court of Singapore to its deadline to submit its scheme of arrangement restructuring plan, due today. The new deadline is January 21, 2005.

China Aviation Oil ceases oil derivatives trading

China Aviation Oil (Singapore) Corp has ceased all oil derivative trading activities after announcing a $550 million trading loss and seeking court protection from creditors last week, the company said late Wednesday.