Credit risk

Bankrupt Mirant seeks more time to file restructuring plan

Bankrupt US energy marketer Mirant has sought a further 90 days in which to file its plan of reorganisation for emerging from Chapter 11 protection from creditors. It filed the request with the US Bankruptcy Court on Monday, and this would be the third…

CMS Energy to sell $200m of convertible senior notes

CMS Energy intends to offer for sale $200 million of convertible senior notes due on December 1, 2024, but would not reveal the rate of interest they will pay.

BarCap launches commodity-linked credit product

Fixed-income investors can now make use of a credit instrument that provides access to commodities as an asset class, says Barclays Capital. The investment bank has launched Apollo, a collateralised commodity obligation (CCO), which uses derivatives…

Changing of the guard

Changes to the European gas market may further attract financial players, and tighten the rules in case of physical supply disruptions. Meanwhile changes in the UK gas market may lead to clearing at the hub. By James Ockenden

Dynegy to buy Sithe Energies from Exelon

Dynegy is set to reduce the effect of some of its loss-making tolling and financial swap contracts, buy power plants in the northeast US and acquire a supply agreement to increase stable cashflow and service debt.

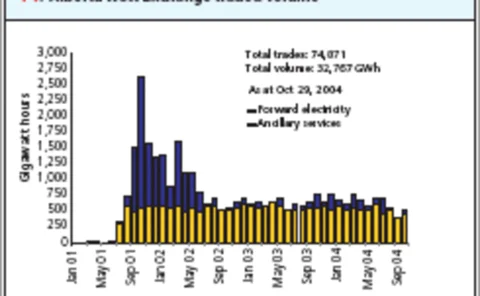

Clear intentions

The Alberta Watt Exchange in Calgary is already clearing over-the-counter electricity contracts and from next year will be able to clear natural gas as well. But how much liquidity will it attract? Joe Marsh reports

A popular punt

Experts remain bullish about the flow of new money into catastrophe cover. But an influx of hedge funds backed increasingly by institutional capital has led to worries of a “domino effect”. By Maria Kielmas

OGE Energy gets $550m credit line

OGE Energy Corp has arranged two new revolving credit facilities totaling $550 million with a 16-bank group led by Wachovia Securities and JP Morgan Securities. The facilities replace $400 million of existing credit lines due to expire this year.

Edison Mission Energy sells stake in NZ utility

California-based Edison Mission Energy has completed the sale of its 51.2% stake in New Zealand-based Contact Energy to Origin Energy New Zealand. Origin paid NZ$1.1 billion ($739 million) in cash and assumed NZ$535 million ($359 million) in debt to take…

Allegheny Energy makes $152m from share sale

Pennsylvania-based Allegheny Energy has sold 10 million shares for $151.5 million to four institutional investors. The company intends to use the proceeds to reduce debt as part of its plan to repay $1.5 billion in debt by the end of 2005.

Pemex signs up to OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

RBS offers freight derivatives

Royal Bank of Scotland (RBS) has started offering shipping derivatives, in the form of forward freight agreements (FFAs) linked to the transport costs of bulk commodities to its client base.

Oneok gets new $1bn financing and agrees to buy US gas co

Oklahoma-based energy company Oneok has obtained a five-year, $1 billion credit line from a group of banks to fund asset purchases. The company has also agreed to buy pipeline operator Northern Plains Natural Gas Company from asset acquisition company…

Aquila completes $330m refinancing and pays off $430m loan

Kansas City-based energy company Aquila has made further moves to reduce its debt with two new 364-day unsecured financings: a $110 million revolving credit facility and a $220 million term loan facility. The company borrowed the full amount under the…

NRG Energy to sell another power plant

Minnesota-based NRG Energy has agreed the sale of its 1,160 megawatt (MW) generating plant in Minooka, Illinois to an affiliate of asset acquisition company LS Power. NRG has the right to buy back a 40% interest in the project within a 10-year period,…

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

A history lesson

Abstract: The size of bid/ask spreads in electricity options has both valuationand credit implications. Here, Ted Kury of The Energy Authority shows how toderive theoretical spreads using historical option price data so they can beused as liquidity…

A fresh landscape

Prebon Energy’s Kevin McDermott says that much has changed in the electricitybroking world post-Enron. And it’s all for the better. By Paul Lyon

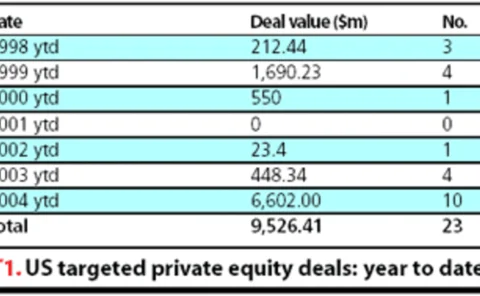

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

SG sets up $100m credit facility for Kazakh energy company

SG Corporate & Investment Banking (SGCIB) said earlier this week that it has arranged an unsecured 66-month $100 million loan and hedging facility for Canada-based PetroKazakhstan Kumkol Resources (PKKR). PKKR is a subsidiary of PetroKazakhstan Inc, an…

Alliant sells assets of gas marketing business

Wisconsin-based Alliant Energy Corp said yesterday that it has sold most of the assets of NG Energy Trading to BP Canada Energy Marketing Corp, but would not disclose the terms of the deal. The sale continues the trend for US energy companies to distance…

Mirant CFO Burns handed extra role of chief restructuring officer

Bankrupt Atlanta-based energy company Mirant has given chief financial officer Michele Burns the additional role of chief restructuring officer.

IPE relaunches UK power futures, while LCH clears first OTC UK power trade

The International Petroleum Exchange (IPE), the London-based energy futures and options exchange, will relaunch UK baseload and peakload electricity futures contracts on September 14. Meanwhile, London-based clearing house LCH Clearnet yesterday cleared…

S&P raises Aquila rating

Standard & Poor's Ratings Services (S&P) has raised its corporate credit rating on energy provider Aquila to 'B-' from 'CCC+' and removed the rating from CreditWatch, where it was placed with developing implications on July 21, 2004. The outlook is…