Credit risk

Structured finance caught off-balance

Efforts by energy and finance professionals to stress the difference between legitimate off-balance-sheet entities and Enron’s opaque devices have had little impact, as US regulators rush to clean up structured finance. Maria Kielmas reports

A new look at credit risk capital

In the second of two articles on Standard & Poor’s refinement of analytical methodology, John Kennedy discusses an updated approach to evaluating credit risk capital

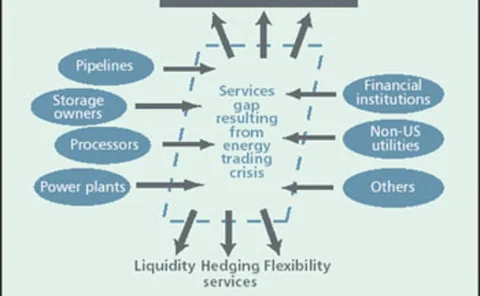

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report

New Energy Associates, a Siemens Company, presents the future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

A safety net for energy traders

Will the Edison Electric Institute’s master netting agreement help reduce credit risk for energy traders? Kevin Foster takes a look at this new initiative

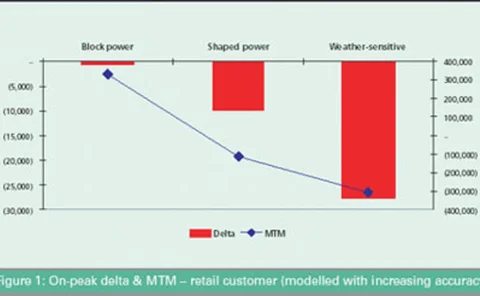

FAS 133: increasing transparency

Standard & Poor’s Jack Kennedy and Neri Bukspan believe new Financial Accounting Standards Board rules for US energy traders will make it easier to measure a firm’s risk management ability, liquidity position and equity capital

Clearer waters for ratings

Despite a credit ratings crisis in the energy markets, the prognosis for natural gas companies looks stable, finds Shifa Rahman

Tripping around credit quality

Jack Kennedy of Standard & Poor’s looks at the effect of round-trip trades on a firm’s credit quality and how they should be treated

The three-way knock-on effect

Peter Nance and Lin Franks look at the interplay between market, credit, and operational risks and consider how firms might approach implementing an integrated company-wide system to tackle them

Close-up on market risk capital

Jack Kennedy outlines rating agency Standard & Poor’s new approach for analysing the credit quality of US energy trading firms

Balancing the books

Regulators are taking advantage of a lull in power project development in the US to close loopholes in financing rules, reports Catherine Lacoursière

Clear in present danger

Energy companies are crying out for clearing solutions to reduce their counterparty credit risk. James Ockenden looks at new initiatives from London-based power exchange UKPX and German firm Clearing Bank Hannover

The rise of the money men

Wanted: company to trade power in the US. Strong credit, trading expertise and appetite for risk required. Only banks need apply? By Kevin Foster

High oil and gas prices enhancing credit quality

The ‘war premium’ is propping up oil and gas prices and oil firms’ balance sheets. But debt levels and quality of assets are still king. Catherine Lacoursière reports

A credit boost for traders

Clearing houses are emerging as a crucial function of energy trading exchanges. John Kennedy explains their importance in terms of a firm’s credit rating

Keeping an eye on the long-term

Brett Humphreys discusses the problems with standard credit risk limits and proposes limits that may work better

What’s the worst that could happen?

Brett Humphreys discusses how using a standard credit value-at-risk measure may be misleading for credit risk decisions

The software needs of the credit-wary

After a difficult year that shows few signs of getting any easier, it looks like every energy company needs an effective risk system. The software vendors hold the key, but what do energy players need, asks Joel Hanley