Credit risk

Cash upfront

Memphis Light, Gas & Water is readying a landmark bond sale to fund a prepay electricity contract with the Tennessee Valley Authority. But some fear the deal could set a dangerous precedent. By Paul Lyon

Flexible bonds

A depressed power market means major firms face an uphill struggle to refinancetheir debt. But a commodity hedge has given US energy giant Calpine Corp considerableflexibility in its $800 million bond issue. By James Ockenden

TVA will go bust, say academics

US academics say that the Tennessee Valley Authority would be close to bankruptcy if it were not for the promise of a government bailout, reports Paul Lyon

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon

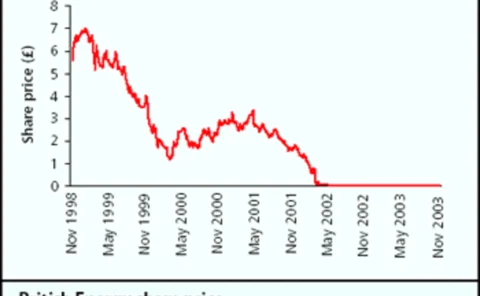

Radioactiveliabilities

Creditors have agreed nuclear generator British Energy’s restructuring package. But without European Union agreement over the UK government’s £4 billion in subsidy, these creditor agreements could be meaningless. James Ockenden reports

The credit charge

Brett Humphreys describes a simple method for charging traders for the credit risk embedded in a contract, using an example based on an oil purchase agreement. Such a charge creates proper incentives for traders with regard to credit risk

A slow recovery

Recent research carried out by Fitch Ratings says the energy merchant sector has made great strides towards solving its near-term liquidity woes. But there is much work still to be done, finds Paul Lyon

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

Calpine completes project financing in Wisconsin

California power company Calpine Corp has completed a $230 million non-recourse project financing for its 600-megawatt (MW) gas-fuelled electricity-generating Riverside Energy Center in Beloit, Wisconsin.

Enron files complaint against six of its former banks

Houston-based Enron last month filed a court complaint against six of its former banks, claiming they gave bad financial advice that contributed to its demise in late 2001. As a bankrupt company, Enron is required to try to recover as much as it can for…

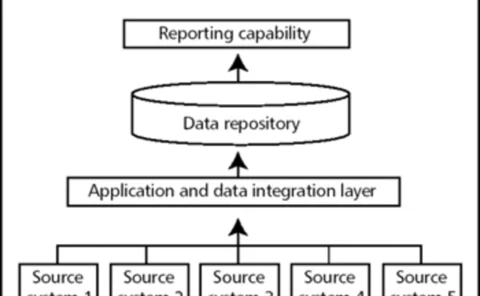

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

Isda and EEI collaborate on Power Annex

The New York-based International Swaps and Derivatives Association (Isda) and US trade body the Edison Electric Institute (EEI) published a North American Power Annex to the Isda Master Agreement in August.

UK energy brokers form association

Nine brokers operating in the over-the-counter energy markets in the UK formed the London Energy Brokers’ Association (LEBA) in July.

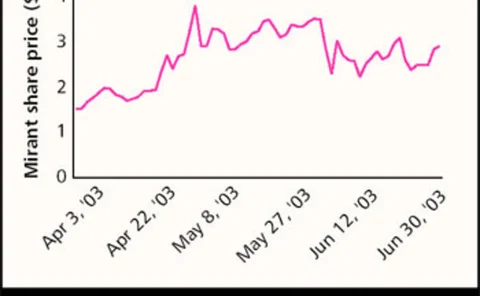

Mirant bankruptcy is not terminal

US energy firm Mirant’s July bankruptcy filing bucks the recent trend of last-minute restructuring deals that have saved many of its rivals from a similar fate. But analysts say the company is likely to emerge from its filing with at least some of its…

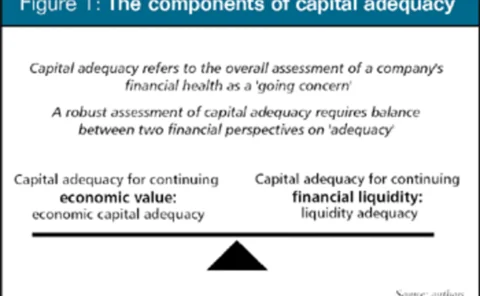

A capital adequacy primer

A summary of the Committee of Chief Risk Officers’ (CCRO) emerging guidelines on capital adequacy, by Cinergy’s Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith

Management buys out SG’s weather and cat bond funds

Société Générale’s (SG) weather derivatives team completed an amicable management buyout of the weather division at the French bank. The buyout creates what is believed to be the largest range of dedicated weather derivative and catastrophe bond funds,…

S&P to apply stress test to power firms

Standard & Poor’s (S&P) is to apply a stress test designed to measure how well power companies can stand price swings in volatile electricity markets. The move is part of the credit rating agency’s effort to combat criticism of rating agency failure to…

Mirant raises prospect of bankruptcy

Energy company Mirant asked its bank lenders to approve a pre-packaged bankruptcy plan in June, suggesting the Atlanta-based company could be forced to file for Chapter 11 bankruptcy.

More power to the banks

Banks now have greater freedom to participate in derivatives markets based on physical commodities thanks to two recent ruling by US regulators. As a result, the balance of power looks set to shift from Houston to New York. By Paul Lyon

Lessons in loaning

Lenders and borrowers alike are becoming ever more innovative at a worrying time for energy company financing. But will the new ideas catch on? Paul Lyon reports