Credit watch

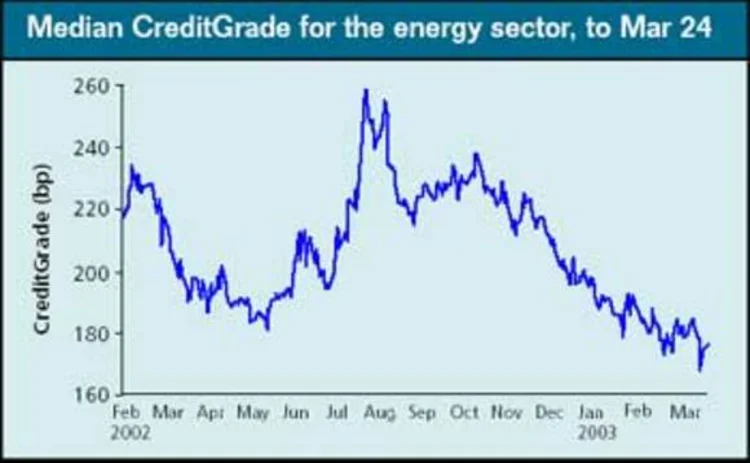

In terms of specific names, this month’s top-two tighteners – El Paso Corp and Williams – were last month's top wideners.

El Paso tightened by 115bp, as it replaced its chairman and chief executive, William Wise, closed on a $1.2 billion two-year loan, sold certain non-core assets – bringing it to 45% of its targeted amount of asset sales for the year of $1.35 billion – and, most recently, reached a settlement with California over claims that the company conspired to drive up power prices during the state’s energy crisis.

Williams tightened by 106bp, as it announced it had swung to an unexpected profit in the fourth quarter of 2002, and said it expects to generate $2.8 billion of cash at year-end through asset sales and financings and to have sufficient liquidity to meet debt obligations and operate its businesses.

The bullish tone of the energy sector was underscored by the relatively minor widening of this month’s top wideners. Leading the list was Hanover Compressor, a provider of natural gas compression services, which widened by 38bp as it posted a fourth-quarter loss as it took charges on the sale of its California power generation assets and some used equipment business lines.

* ‘Energy’ for CreditGrades purposes refers to companies defined as being in the energy sector by Bloomberg. Bloomberg has 10 sectors, and there are 167 companies in the energy sector. For the ‘top movers’, we restrict this universe to companies with market capitalisations greater than $400 million. In addition, the firms we analyse here are listed either on the New York Stock Exchange or Nasdaq.

More on Financing

Why commodity finance is ripe for stablecoin

Digital currency brings cost efficiencies to financing, but its real benefit to commodity firms lies in making huge pools of new capital available, write Jean-Marc Bonnefous and Ronan Julien

Uncertainty causes rethink on clean energy investment

Waning enthusiasm for net-zero pledges, environmental policy shifts, funding cuts and US tariffs are causing clean energy investors to retreat

Deal of the year: Intersect Power

Energy Risk Awards 2025: Clean energy company secures significant BESS financing amid market volatility

Innovation of the year – Project: Tramontana

Energy Risk Awards 2025: Finance specialist develops transformational agroforestry project

Sustainable finance house of the year: Bank of America

Energy Risk Awards 2025: Bank furthers commitment to sustainability with large-scale transactions that showcase innovation, ingenuity and vision

Supply chain decoupling fires up alpha focus at BofA

Talking Heads: Stock dispersion sees funds gross up on long/short baskets, while US structured notes come of age

Sustainable bond markets miss an options trick

A derivatives mindset could boost lagging sustainability-linked market, argues climate think-tank

UBS precious metals team shines amid market turmoil

Global uncertainty always adds allure to precious metals, putting a premium on the long-standing relationships and cutting-edge technology of the UBS precious metals team