Credit risk

A poor standard

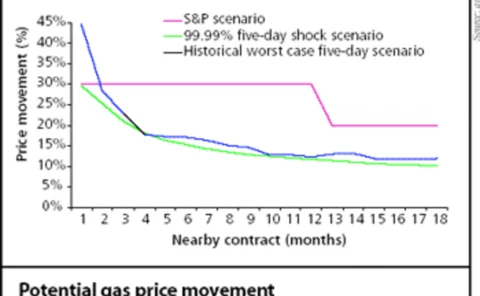

Rating agency Standard & Poor’s has recently released guidelines totest liquidity that could be an efficient probe into company finances. BrettHumphreys looks at how S&P has arrived at its calculations, asks if the liquiditymeasures are too conservative…

A natural standard

In the first part of a two-part series, Agnes Bizet and KevinWulwik highlightthe main issues to consider when trading under Isda’s European Gas Annex,including a close look at default events

CGE Power falls as banks demand cash

CGE Power, the bank consortium formed to acquire distressed UK power assets, has withdrawn offers totalling around £3 billion on 12 plants and ceased trading after proposals to acquire two key power plants were rejected by lenders, according to a…

FOA close to releasing UK power trading guidelines

The UK Futures and Options Association (FOA) says it is close to releasing final drafts of guidelines on various areas of the UK power market. The problem areas identified by the FOA's Power Trading Forum (PTF) are reference pricing, credit risk…

Nymex to clear contracts on OTC oil and gas options

The New York Mercantile Exchange (Nymex) and broker Icap are set to launch an electronic market in options on oil and gas inventory statistics. The over-the-counter options will be offered through an auction process and cleared by Nymex.

Energy clearing in Catch 22 situation, says Fitch

Denise Furey, New York-based senior director of global power at rating agency Fitch believes that the clearing of OTC energy derivative contracts is in something of a ‘Catch 22’ predicament. “We need standardization of contract documentation to get to…

LCH Clearnet set to clear US trades

LCH Clearnet, Europe's largest derivatives clearing house, has won approval from the US Commodity Futures Trading Commission to clear financial futures and options contracts on US exchanges.

A history lesson

Abstract: The size of bid/ask spreads in electricity options has both valuationand credit implications. Here, Ted Kury of The Energy Authority shows how toderive theoretical spreads using historical option price data so they can beused as liquidity…

Nord Pool’s back-up

Nord Pool Clearing is the first pure electricity clearing house to obtain capitalsupport through insurance to cover defaults by its trading counterparties. Areenergy companies set to follow suit? Joe Marsh reports

Isda raises Basel-linked concerns

Bankers have been preparing for the implementation of the Basel II Capital Accordfor a number of years. But Isda says that it is still concerned about the effectthe Accord may have on the commodities markets. By Paul Lyon

Energia selects SunGard’s Entegrate ZaiNet

Energia, part of the Viridian Group, has selected SunGard’s Entegrate ZaiNet for the straight-through processing and risk management of its physical and financial power and gas contracts.

US refinancings suggest recovery

Do several big debt refinancings at US utilities mean energy companies are finally starting to emerge from their post-Enron and post-California crisis problems? Joe Marsh reports

New clearing system for Nordic market

Nord Pool Clearing, the clearing organization for the Nordic power exchange Nord Pool, has launched a new clearing system for the electricity derivative market. OM Technology is the system provider.

De Vitry elected to Isda board

Benoit de Vitry, London-based global head of commodities and emerging markets rates at Barclays Capital, has been elected to the board of the International Swaps and Derivatives Association (Isda).

Erasing Enron

Enron’s story may finally be drawing to a close. Jeffrey Skilling has finally been indicted and the company’s creditors have begun receiving ballots to vote on a plan of reorganisation. By Paul Lyon

Calpine scraps $2.3 billion loan and junk bond sale

San Jose-based Calpine last month cancelled a $2.3 billion secured term loan and secured notes offering. Its wholly owned subsidiary, Calpine Generating (CalGen) Company (formerly Calpine Construction Finance Company II ) cancelled its offerings due to…

Bush urges TVA to modify debt estimates

The Bush administration last month said it intends to propose legislation that will require the Tennessee Valley Authority (TVA), the largest public power producer in the US, to count its lease-leaseback deals as debt.

Taking the slow road

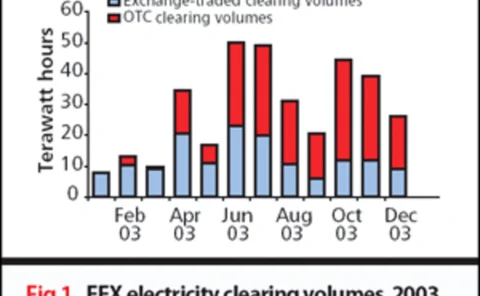

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

The deal deluge

Last year was certainly an interesting time for energy company financing, and some of the most important deals were completed just before year-end. Paul Lyon looks back at some of the major trends and asks what 2004 will hold

Winning players

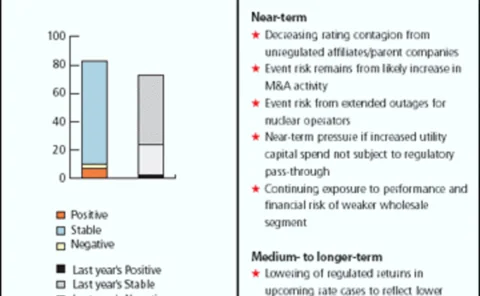

A turbulent year in energy markets showed there was more competition between banks and oil majors, and further highlighted the need for a solution to the credit issues dogging energy companies and airlines. By James Ockenden

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

El Paso to cut debt by a third, while gas trader pleads guilty

US natural gas company El Paso – which has recently survived a bid toreplace its board and seen one of its tradersindicted – has unveiled aplan to significantly reduce its debt. By Joe Marsh

Capital calculations

The latest Committee of Chief Risk Officers white paper offers capital adequacy guidelines for energy merchants. But why should energy firms perform these calculations? Glyn Holton asks whether the CCRO has missed the point