Feature

End of the road for California?

A bill aiming to re-regulate the California energy sector is progressing through the state’s legislature. Does this spell the end for California’s troubled experiment with deregulation? Kevin Foster finds market participants split over the issue

California’s master plan

California’s energy regulators have an action plan to upgrade the electricity system. But if they don’t add generation, shortages could again hit. Kevin Foster reports

More power to the banks

Banks now have greater freedom to participate in derivatives markets based on physical commodities thanks to two recent ruling by US regulators. As a result, the balance of power looks set to shift from Houston to New York. By Paul Lyon

Lessons in loaning

Lenders and borrowers alike are becoming ever more innovative at a worrying time for energy company financing. But will the new ideas catch on? Paul Lyon reports

Scaling the credit cliff

How are designers of credit risk software reacting to the new credit realities of the energy trading sector? Kevin Foster talks to some leading companies to find out

A clear answer to credit problems

US firm PA Consulting is working with a number of major US energy companies to set up a one-off trade netting scheme. Kevin Foster investigates the proposals

Standing out from the crowd

Credit risk management groups can differentiate themselves from their competitors through their different capabilities. Randy Baker and Brett Humphreys explain how

Post-delivery problems

The credit exposures that arise from trading physical and financial energy are inherently more complicated and volatile than those encountered in trading purely financial products. Richard Sage looks at the different elements to be considered

Trying to model reality

Quantitative credit risk models are a must-have in today’s energy industry. But human judgement is still needed, as Maria Kielmas discovers

ABN Amro makes global OTC oil and gas drive...

Dutch bank ABN Amro last month started to offer its clients oil and gas hedgingservices, as part of its financial markets business which incorporates debt capitalmarkets, structured lending and risk management activities.

Energy firms turn to overlay

Energy companies face a tough future over pension provisions – a problem that could well exacerbate credit deterioration. Paul Lyon finds that innovative use of currency overlay could provide some form of refuge

Seeking an end to manipulation

Renewed allegations of manipulation of natural gas pipeline capacity in the US have been partly blamed on regulatory complacency. How can regulators put an end to the problems dogging the gas markets? Catherine Lacoursière reports

Energy firms find succour

US energy company debt has reached critical levels, with nervous investors and banks working hard to keep these companies afloat. But Paul Lyon finds the secretive hedge fund industry could also lend a helping hand

Buying your way out of trouble

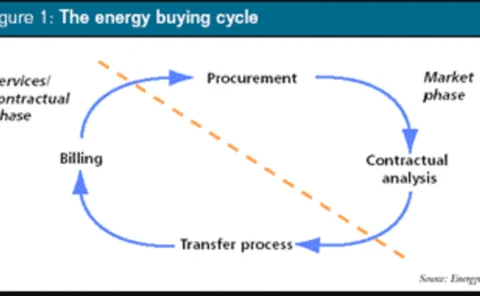

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

Power asset prices plummet

The energy price boom may be over, but bargain hunters beware: the predicted sale of US generation assets is yet to occur. Kevin Foster reports

Own, sell or restructure

UK and US utilities are presently saddled with a lot of debt, thanks to overcapacity and low power prices. But what’s the best way for these firms to deal with the power plants they don’t need? By Jessica McCallin

Delaying the inevitable?

As Reliant Resources celebrates a $6.2 billion refinancing deal, some in the industry say such deals are merely postponing problems that are bound to resurface. James Ockenden reports

Bearing the brunt

Building contractor bankruptcies of have recently stressed the credit profiles of several power projects in the US. Standard & Poor’s Scott Taylor and Tobias Hsieh look at how sponsors and lenders responded and the effects on the various parties

The case for financially settled contracts

Banks and hedge funds have shied away from trading electricity due to fear and ignorance of the physical nature of the market. But, as Todd Bessemer of Accenture points out, financially settled contracts can avoid the complexity of physical delivery and…

A Spanish power struggle

A takeover bid by gas distributor Gas Natural for power utility Iberdrola may provide the impetus for much-needed competition in the Spanish energy market. But the bid has upset many traditional links in politics, finance and business. By Maria Kielmas

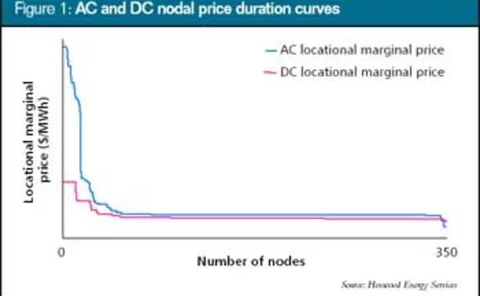

The LMP supermodel

With Ferc’s standard market design (SMD) seeking a shift from zonal power pricing to nodal pricing, the concept of locational marginal pricing (LMP) has become a key policy issue. Henwood Energy’s Vikram Janardhan proposes 10 key modelling features to…

Carbon across Europe

Pan-European emissions trading is a step closer after agreement of an EU directive. Atle Christiansen and Kristian Tangen of Point Carbon look at the consequences

Tough talk on derivatives

The Commodity Futures Trading Commission and Ferc are getting tough in throwing fines around. Is this a ploy to avoid being lumbered with further over-the-counter regulatory responsibilities? Some market participants certainly think so. By Paul Lyon