Feature

Competing at the highest level

BP is fast becoming as well known for its risk management services as it is as a global energy company.

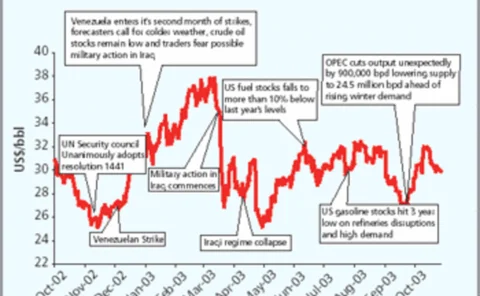

Lands of confusion

Oil production uncertainties in Iraq and political doubts in Russia and Venezuelaare keeping crude prices well above historical averages. MariaKielmas reports

Opec keeps a tight grip

The latest production quota cut by the Organisation of Petroleum Exporting Countries has forced prices up, but will crude oil producers in Europe and elsewhere co-operate to help them stay up? EricFishhaut examines the situation

Upstream sector gets flexible

The oil exploration and production sector is transforming its thinking and trying to become more flexible by using portfolio management models, finds Maria Kielmas

Trading crude blows

Banks and oil majors alike are building up their oil derivatives operations, vying to attract the same corporate client base. But the oil companies do notseem unduly concerned about the competition, finds Paul Lyon

Refining systems for oil trading

The increasing complexity of the crude oil business – on both the physical and financial side – means companies in the sector need fast-changingand flexible software to manage their operations. CliveDavidson reports

Profiting from gas prices

Rachel Jacobson of energy information and software provider Fame looks at how natural gas prices are likely to rise and what firms can do to protect against them

Eyeing the pricing

US energy regulators are keeping an ever-more-watchful eye on gas and power price reporting – but are they finally flexing their muscles appropriately? Paul Lyon reports

The great gas price divide

US natural gas prices may be volatile, but is there a real need to worry? Some participants blame the New York Mercantile Exchange for price spikes and worry about the future, while others see no problem with the market’s health. By Paul Lyon

The politics of betting

Using markets to forecast political events may not be as strange an idea as it seemed in July, when a terrorism futures scheme collapsed. But there is still scepticism as to whether such an approach would be ethical or effective. By Maria Kielmas

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

To store or not to store

Here we describe the optimal operation and valuation of gas storage based on a real option methodology. Using Zeebrugge gas prices as a practical example, Cyriel de Jong and Kasper Walet clarify the optionality in gas storage, analyse its valuation and…

Gas supply problems persist

Natural gas prices are likely to remain high, as the Bush administration’s efforts to open up new sources of supply continue to face opposition. Kevin Foster reports

US gas squeeze hits power

Tight natural gas supplies in the US are adding to worries over reliability of electricity supplies, says Richard McMahon of the Edison Electric Institute

Power to the European gas markets

Interesting developments in theEuropean gas markets mean that 2003proving to be a good year.Luca Baccarini, managing director ofGaselys and market expert, looksforward to profitable times

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals

Pieter Verberne

Pieter Verberne, Amsterdam PowerExchange’s (APX) chief operatingofficer, is a busy man. The Dutchexchange is finalising the technologyupgrading of its recent acquisitions, naturalgas exchange Enmo and Automated PowerExchange, both based in the UK. It is…

Switching off to save cash

High electricity price volatility over the European summer has raised awareness of interruptible power contracts, finds James Ockenden

Farms weather power shortages

Farmers in both hemispheres are struggling to cope with heat waves and droughts while pondering the prospect of future power supply disruptions, finds Maria Kielmas

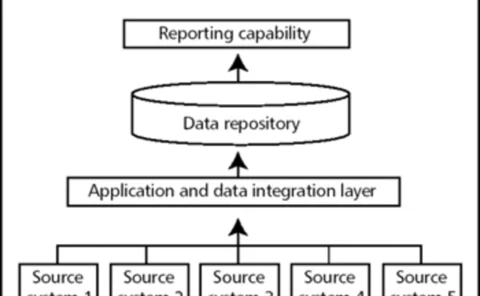

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Watching the home front

The growing international controversy about Iran’s nuclear ambitions as well as internal unrest may stall foreign investment in the country’s energy sector in a way that US sanctions have failed to do. Maria Kielmas reports

Taiwan’s growing risk appetite

Relying on imports for most of its energy requirements and constrained by the government’s view that risk management is gambling, how can Taiwan tackle the challenge of price risk in its growing energy sector? By David Hayes

A hard Act to follow

The final piece of the Sarbanes-Oxley Act – section 404 – falls into place this month, requiring internal control reports. While the Act may go some way to restoring investor confidence, it is costing energy companies dear, finds Kevin Foster

System-ready for Sarbanes-Oxley

Energy companies are not alone in having to review their operations to comply with the Sarbanes-Oxley Act. Energy software suppliers, too, are looking at their systems, although most are confident they are already well prepared, finds Clive Davidson