Feature

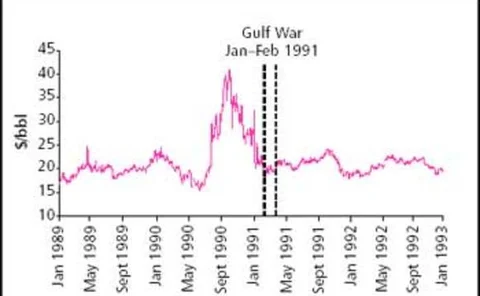

Speculate away

A new report argues that speculative trading in the crude oil markets contributes far less to volatility than its critics suggest. Kevin Foster looks at the arguments

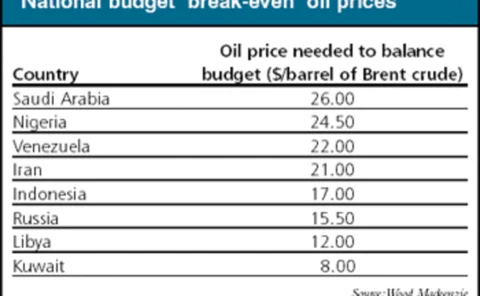

A formula for high prices

The US chemical industry is crying foul over spiralling natural gas prices, but there are measures they can take to protect themselves, as Kevin Foster discovers

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done

Seeking a boost for crude

Venezuela’s internal conflict and the intended removal of Saddam Hussein from Iraq have meant both countries are seeking deals with international investors to boost oil production. But are the potential legal problems worth the trouble? By Maria Kielmas

Trading with a small ‘t’

What made headlines before is now becoming everyday news: energy companies are scaling back or leaving energy trading. Some industry observers are emphasising the shift to ‘trading around assets’. Anne Ku investigates just what this means

The return of Russian crude

Russia has reclaimed its position as the world’s biggest oil producer for the first time in a decade – but uncertainty is still preventing some foreign oil firms from making the investments the country needs to fulfil its potential. Kevin Foster reports

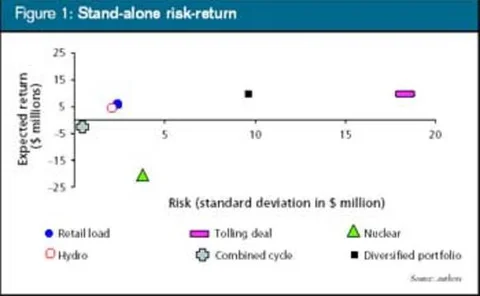

Optimise this

One of the reactions to recent energy trading difficulties has been a shift away from speculative activities towards portfolio optimisation, but what does the term really mean, ask Tim Essaye and Brett Humphreys

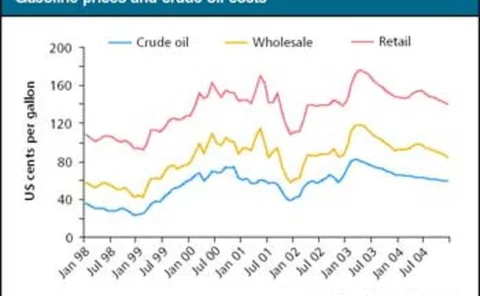

Pumping up prices

Gasoline prices in the US hit all-time highs in March, and the price is expected to remain high throughout the summer. Kevin Foster looks at the contributing factors

Models of good behaviour

The development of new models that describe the real dynamics of energy prices have to take into account the behavioural aspects of market players. The problem is how to quantify these aspects. Maria Kielmas reports

Greening the markets

Environmental risks are increasingly being recognised as important financial issues, but the markets are still some way from rewarding companies for good environmental performance, as Kevin Foster discovers

Pointing the index finger

Concerns over manipulative energy price reporting has led to a call for price index reform. But many market participants are apprehensive about disclosing detailed confidential data to a third party. James Ockenden looks at developments

Seam shifts in central Europe

Gordon Feller looks at the changing coal economies of Bulgaria, the Czech Republic and Slovenia and the effect of electricity sector moves in the region

Climbing the competition Pole

The Polish government hopes to boost competition in the electricity market through a controversial securitisation plan that it will use to buy out long-term contracts between generators and the transmission grid operator. Maria Kielmas reports

US retreat hits European trading

The retreat of US energy firms from energy trading has reportedly hit European volumes hard. But volumes aside, James Ockenden finds that the withdrawal may bring a fundamental change in the market. With additional reporting by Eurof Thomas

Opportunity knocks for smelters

Aluminium manufacturers have long used sophisticated hedging and risk management techniques to protect against fluctuating metal prices, yet they have only recently looked at transferring these skills to power risk management. David Wilson reports

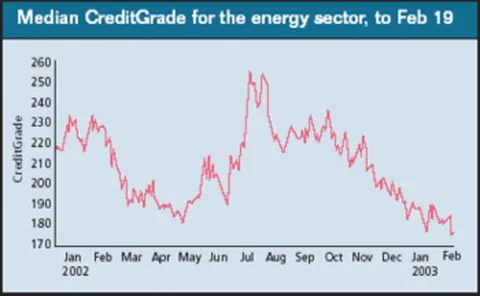

Credit watch

Risk management and analytics firm RiskMetrics gives this month’s analysis of energy companies’ credit quality using its CreditGrades tool

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure

Playing a waiting game

With energy – and particularly natural gas – costs on the rise, are end-users finally coming to terms with the importance of hedging or are they still waiting to get burned before they enter the hedging market? Kevin Foster reports

Exchanges gradually gain pace

After much talk of new trading solutions for German power, only one platform – EEX – has made significant progress, although the new clearing solution from Clearing Bank Hannover seems to be picking up steam. James Ockenden reports

Ahead of the green game

Given the efforts they have already made to reduce emissions, many German firms do not share their environment minister’s enthusiasm for the EU’s new, obligatory cross-border greenhouse gas emissions trading market. Jessica McCallin reports

The bigger they come…

The German market is at the heart of the European power business, but it has stuttered since its early promise, and has yet to set the pace for the region as a whole. From a new entrant’s point of view, this is only to be welcomed, argues Ben Tait

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas

Energy clearing – solutions for a changing trading environment

E. Michael Jesch, head of business development at Clearing Bank Hannover, examines the effect of energy market liberalisation, globalisation and recent technological advancement on short- and long-term trading