Feature

Struggling for integration

Political issues are stalling Mexico’s energy sector reform just as the country is poised to become a major natural gas importer, reports Maria Kielmas

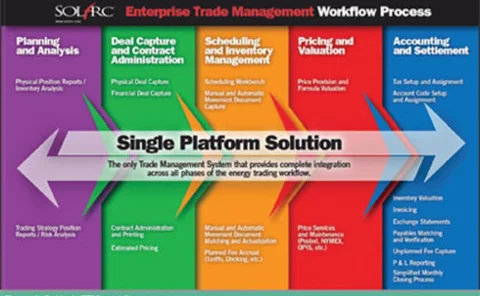

Capturing value from energy supply and trading

Companies that plan to engage in energy trading need to invest in the right personnel, processes and information management tools if they intend to be successful, says David Dunkin, SolArc’s Chief Strategic Executive

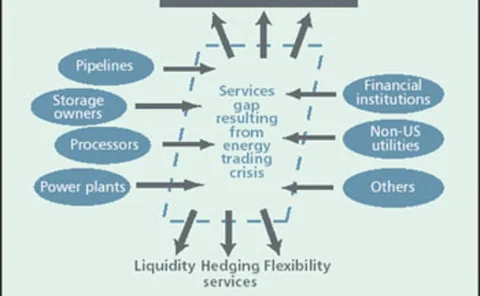

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report

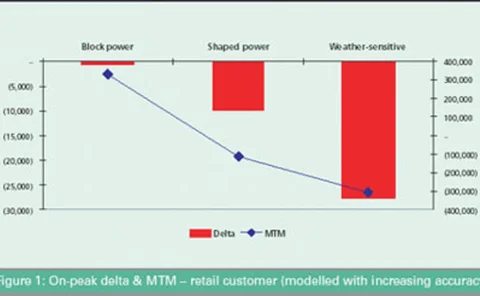

The Power Sector Model

David Soronow, Mike Pierce and King Wang, of Financial Engineering Associates, introduce the firm’s Power Sector Model as the next step in derivatives pricing

New Energy Associates, a Siemens Company, presents the future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

Making sense of the new power market

Bank of America’s Rogers Herndon and David Mooney examine expectations in the energy and power markets before and after the collapse of Enron and outline their predictions for the future

Trading natural gas futures with weatherfutures at the CME

Craig Jimenez and Mirant’s Vishu Kulkarni discuss how the burgeoning relationship between the natural gas futures market and the weather futures market is providing opportunities for traders, hedgers and speculators alike

Quality data and solutions for a challenging market

FAME provides today’s uncertain energy market with transparent information and the tools to analyse it

A safety net for energy traders

Will the Edison Electric Institute’s master netting agreement help reduce credit risk for energy traders? Kevin Foster takes a look at this new initiative

End of an era for GdF

Gaz de France is certain to lose its monopoly position – without it, what strategy can the gas giant adopt in a liberalised European market? Mickael Laurans reports

How much can you take?

Given recent events, energy firms need to fundamentally re-think how they estimate their risk tolerance. Maria Kielmas asks what has prompted this soul-searching

A mark-to-market u-turn

A reversion to the old, non-mark-to-market regime for accounting for energy trading contracts is changing the energy supply business, reports Catherine Lacoursière

Weighing up the options

The Brazilian energy market is set for more upheaval as the incoming president seeks a compromise between his campaign promises of greater state control over energy and the goal of attracting foreign investors into the sector. Maria Kielmas reports

El Paso helps RiskMetrics adapt

RiskMetrics Group, a company more often associated with the financial sector, is implementing its risk solution software at energy firm El Paso Corp. How is it adapting the software to the specifics of the energy sector? Kevin Foster reports

A long road to deregulation

Prospex Research’s Ben Tait reports on Spain and Portugal’s progress in integrating their power markets. High ambitions for deregulation are proving difficult to achieve

All clear for energy

Several organisations have brought over-the-counter clearing to the US energy markets over the past six months. Kevin Foster assesses their progress and asks whether they can all survive

Clearer waters for ratings

Despite a credit ratings crisis in the energy markets, the prognosis for natural gas companies looks stable, finds Shifa Rahman

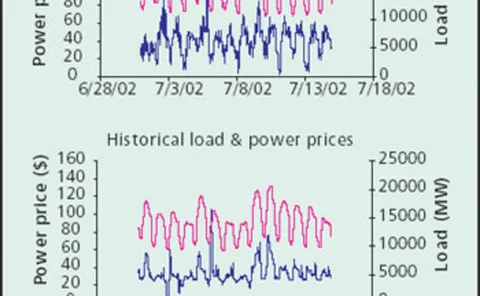

Gas storage and power prices: inextricably linked

While much has been made of the effect of natural gas storage on gas prices, very little thought has been given to its impact on the price of electricity. John Hopper, president of Falcon Gas Storage Company, analyses the situation

Looking to the long term

After years of public debate, the European Commission, energy companies and governments of gas-producing countries all seem to agree that long-term gas contracts are here to stay. So why is it still such a big issue, asks Maria Kielmas

LNG: handling flexibility risk

Even though the euphoria about the global liquefied natural gas market has dissipated, experts still forecast significant long-term growth. But in a buyer’s market the supplier has to understand the new risks. Maria Kielmas reports

Getting protected

Insurance premiums may have rocketed for power companies over the past year but new ‘dual-trigger’ insurance products could still be an efficient way of transferring price risk. James Ockenden reports

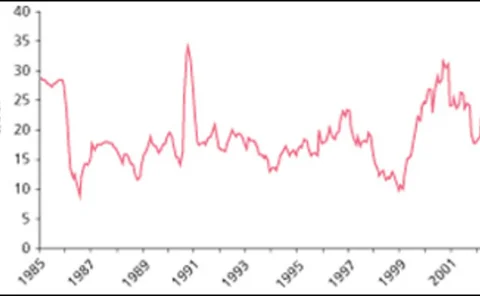

Fighting oil volatility

Oil cartel Opec froze its production output level at its last meeting in September. With war in Iraq on the cards, Shifa Rahman reports on the future of oil volatility