Feature

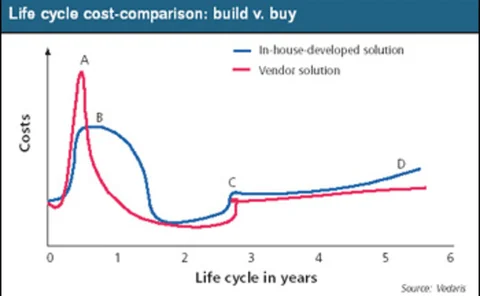

Build in or buy out?

Is it more cost-effective for companies to buy available systems from vendors or to develop and deploy their own energy trading and risk management solutions? Bob Bridger of Vedaris looks into the dilemma faced by many companies

Doing the maths: physical value-at-risk

ABB’s William Rutz and Bob Fesmire investigate new tools that calculate physical value-at-risk based on simulations of generating resources and power transactions

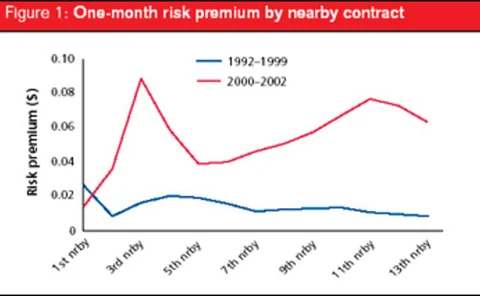

How to gain from risk premia

Brett Humphreys examines historic data for the natural gas market and finds smart traders could make money from hidden risk premia

Know your trade types

An accurate and clearly communicated classification of the types of trade a company carries out brings a better understanding of risk methodologies and where they are best used across the enterprise, says Greg Keers

The CRO road

A company-wide understanding of risk has never been more important for energy firms. Kevin Foster talks to three chief risk officers about their role and how it is changing

The three-way knock-on effect

Peter Nance and Lin Franks look at the interplay between market, credit, and operational risks and consider how firms might approach implementing an integrated company-wide system to tackle them

Untangling the web

Ruling out the need for a major software infrastructure project, web-based concepts make perfect sense for enterprise-wide risk management systems, says Martin Chavez

Keeping EAR simple

Brett Humphreys discusses how trading groups can be captured within earnings-at-risk and cashflow-at-risk models. He suggests taking a top-down approach instead of a bottom-up approach based on actual positions

Managing risk under SMD

Scott Greene, Mark Niehaus and Pankaj Sahay examine the impact of Ferc’s proposed standard market design on power risk management

Balancing the books

Regulators are taking advantage of a lull in power project development in the US to close loopholes in financing rules, reports Catherine Lacoursière

Out of the zone: nodal pricing takes hold

Congestion-constrained US electricity markets are likely to find relief with the arrival of a new pricing regime, reports Catherine Lacoursière

Clear in present danger

Energy companies are crying out for clearing solutions to reduce their counterparty credit risk. James Ockenden looks at new initiatives from London-based power exchange UKPX and German firm Clearing Bank Hannover

Confusion over a barrel

The latest efforts to stem price manipulation have left crude oil market participants wondering which contracts they should be trading and who will lead the pricing? Joel Hanley reports

A towering success

There is more to the Malaysian oil and natural gas giant Petronas than its impressive headquarters. One of Asia’s biggest energy players is finding new ways of branching out, as Joel Hanley discovers

Green risks for the black stuff

The impact of environmental risk on oil companies may be substantial, says a new report by the World Resources Institute. What will the effect be on the oil majors’ stock prices? James Ockenden reviews the report

Brent changes promise stability

The recent change in Platts’ definition of Brent crude oil follows much debate about the price assessment of North Sea Brent crude. Software vendor Logical Information Machines takes a historic view in a search for the reasons behind the move

After the swashbucklers

Oil exploration today is about taking as few risks as possible, meaning the smaller independent firms are losing out to the energy majors, as Maria Kielmas discovers

Market mind games

The year has seen surprisingly high oil prices, which has caught many forecasters unaware given widespread predictions of slow growth. Maria Kielmas reports

High oil and gas prices enhancing credit quality

The ‘war premium’ is propping up oil and gas prices and oil firms’ balance sheets. But debt levels and quality of assets are still king. Catherine Lacoursière reports

A credit boost for traders

Clearing houses are emerging as a crucial function of energy trading exchanges. John Kennedy explains their importance in terms of a firm’s credit rating

Keeping an eye on the long-term

Brett Humphreys discusses the problems with standard credit risk limits and proposes limits that may work better

Var too far

The energy industry has shown tremendous commitment to value-at-risk (Var) methodologies. But use of Var has been misguided, as James Ockenden discovers

Online trading moves forward

Online energy trading seems to have a bright future, despite the two biggest players – Dynegy Direct and EnronOnline – leaving the market, finds Catherine Lacoursière