Feature

House of the year – electricity

Winner: EDF Trading

Energy risk manager of the year

Winner: BP

Broker of the year

Winner: Spectron

Risk manager of the year – retail

Winner: Reliant Energy Solutions

Risk manager of the year – consumer

Winner: Bayer

House of the year – oil products

Winner: Koch Supply & Trading

Software house of the year

Winner: KWI

House of the year – natural gas, US

Winner: Bank of America

Energy finance house of the year

Winner: ABN Amro

House of the year – crude oil

Winner: Société Générale

Storms ahead

Weather traders in Europe are celebrating the issuance of an innovative catastrophe bond by EDF. Meanwhile, US traders are concerned over attempts to regulate weather risk contracts as insurance, rather than derivatives. By Paul Lyon

Taking the slow road

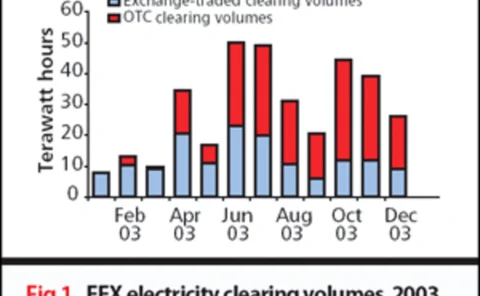

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

Nybot in Nymex sights

Nymex aims to buy Nybot as part of its expansion and acquisition drive, according to Nymex president Robert Collins.

Flying high

The US airline industry is struggling due to high jet fuel prices. Accordingly, one trade association is urging the Bush administration to change its oil purchasing strategy. By Paul Lyon

The deal deluge

Last year was certainly an interesting time for energy company financing, and some of the most important deals were completed just before year-end. Paul Lyon looks back at some of the major trends and asks what 2004 will hold

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

Risk at the margin

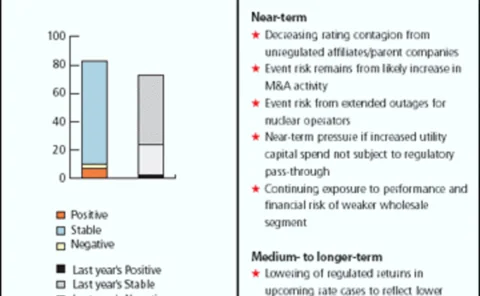

Competition and deregulation has led to new ways of running utilities, and the commodity-trading model has emerged as the leading approach. But the challenge lies in how it is applied, argues Lawrence Haar

Nuclear stockpile

The US Nuclear Regulatory Commission has come under fire for not adequately monitoring the decommissioning funds of nuclear power plants. But the NRC says the criticism is unwarranted. By Paul Lyon

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

Brokers look toshow their worth

Brokers are increasingly looking to provide energy price data. The choice may be wider, but are energy firms getting the credible data and analysis they need for intelligent price forecasts? Joe Marsh reports

Modernisingprice reporting

Recent investigations have seriously affected the voluntary reporting of energy price data. Now, the market is ready to move on. Edison Electric Institute’s Richard McMahon gives his organisation’s views on the future operation of indexes

Protection treaty

Matthew Saunders , of law firm DLA, introduces the bilateral investment treaty which, though often overlooked, can be an effective method of affording legal protection for energy investments and minimising energy project risk

Capital calculations

The latest Committee of Chief Risk Officers white paper offers capital adequacy guidelines for energy merchants. But why should energy firms perform these calculations? Glyn Holton asks whether the CCRO has missed the point