Feature

In pursuit of the eurobarrel

The markets say they do not want oil prices in euros. But denominating internationalcrude prices in euros is a political ambition the European Union seems determinedto pursue – starting with Russia. MariaKielmas reports

Cash upfront

Memphis Light, Gas & Water is readying a landmark bond sale to fund a prepay electricity contract with the Tennessee Valley Authority. But some fear the deal could set a dangerous precedent. By Paul Lyon

Flexible bonds

A depressed power market means major firms face an uphill struggle to refinancetheir debt. But a commodity hedge has given US energy giant Calpine Corp considerableflexibility in its $800 million bond issue. By James Ockenden

Bouncing back

Business may be sluggish in the energy sector, but energy risk technology companiesare adapting to the tough market environment and proving their resilience, evenif that means partnering with rivals. By Paul Lyon

Open for business

The Russian government has taken the first steps toward the deregulation of its gas and power markets, and despite recent the high-profile Yukos scandal, investors are eyeing up some interesting opportunities. By Paul Lyon

Contract killing

The California Public Utilities Commission wants to renegotiate long-term contractsthe Department of Water Resources entered into during the state’s energycrisis. So far, Ferc has been less than receptive to the request. By Paul Lyon

Nuclear renaissance

Both Canadian and US governments want to bring more nuclear power capacity online, but will the private investors come? By Catherine Lacoursière

Degreasing palms

The United Nations is likely to ratify extensive anti-corruption legislation in December. But recent scandals at energy giants Elf and Statoil highlight the difficulties in stamping out bribery and corruption. By Joe Marsh

Back to basics

Correlation and volatility methods are accepted ways of measuring risk. But areview of the underlying assumptions underlying the statistics used for risk management can identify areas where errors can occur, says Brett Humphreys

Winter of content

Some forecasters are warning of a volatile winter in Europe and the US, whichmeans fluctuating demand for fuel over the coming months. Weather derivativestraders are hopeful of an upturn in business. By Paul Lyon

Bound by the rules

In his last day in office, Governor Gray Davis announced the Californian energy crisis was over. Revelations from indicted traders, and the punishments doled out to them, will have a profound effect on how the market moves forward. By Catherine…

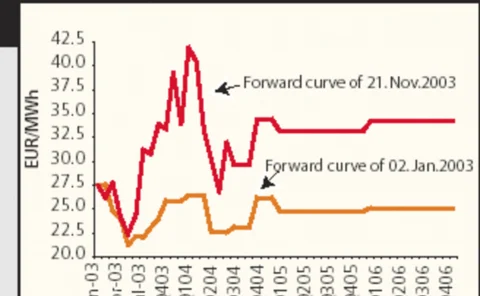

Searching for sellers in 2003

High volatility and rising prices in 2003 clearly above fundamental levels signal the need for improved guidelines from legislative institutions andeasily accessible information

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

Creative challenges in customer-driven risk management

Shell Trading’s Ken Gustafson and Jemmina Gualy shed light on the environment in North America for customers and dealers in risk management, and look at the opportunities ahead for the business

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

Koch smooths volatile waters

Koch has marketed the first energy volatility swap in a deal with hedge fund Centaurus, a move the oil trader hopes will increase its share in options marketsand attract more hedge funds to the energy business. JamesOckenden reports

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon

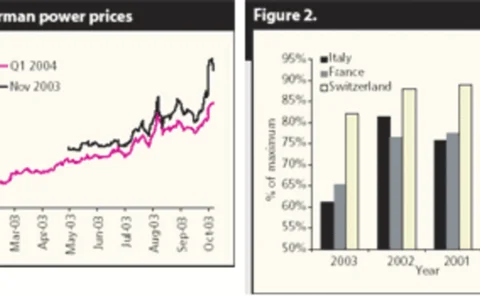

Blackouts spark supply debate

The world’s energy regulators met in Rome last month, days after the Italian blackout on September 28. Perfect timing, it would seem – but what are the regulators going to do about Europe’s bottlenecked grid? Paul Lyon reports

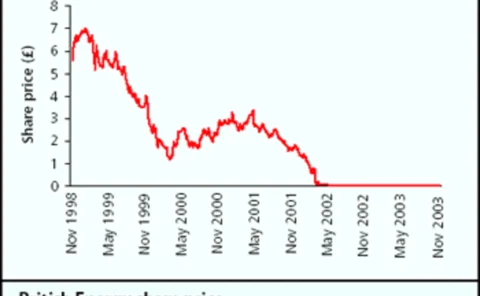

Radioactiveliabilities

Creditors have agreed nuclear generator British Energy’s restructuring package. But without European Union agreement over the UK government’s £4 billion in subsidy, these creditor agreements could be meaningless. James Ockenden reports

The credit charge

Brett Humphreys describes a simple method for charging traders for the credit risk embedded in a contract, using an example based on an oil purchase agreement. Such a charge creates proper incentives for traders with regard to credit risk

A slow recovery

Recent research carried out by Fitch Ratings says the energy merchant sector has made great strides towards solving its near-term liquidity woes. But there is much work still to be done, finds Paul Lyon

Running late

Compliance with the new International Financial Reporting Standards is likely to have a big effect on the volatility of oil, natural gas and utility companies’ reported earnings. Yet the sector has been slow to implement the IASB standards, finds James…

Gas prices hit fertiliser industry

North American fertiliser producers are struggling for survival, thanks to the high cost of natural gas. Some have turned to hedging and pre-purchasing their gas, but such measures may not be sufficient. Paul Lyon reports

Russian roulette

European and US oil companies are tipped to be big investors in Russia’s oil market. But while rewards could be great, any decision to invest in thecountry will be fraught with difficulties. Paul Lyon reports