Feature

Deregulation versus re-regulation

While the US authorities are still ironing kinks out of a major electricity market redesign and looking to repeal the utility industry’s most influential Act, US regulators and self regulators are moving to fill the vacuum. Catherine Lacoursière reports

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

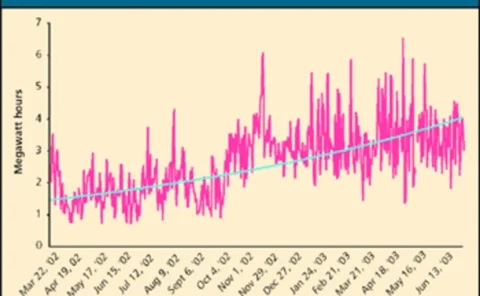

Warming to the exchanges

Weather derivatives may not be the most widely traded product on exchanges, but new initiatives and strong trading volume at the Chicago Mercantile Exchange bode well for the development of a mature exchange-traded market. Paul Lyon reports

Joining up the markets

The Amsterdam Power Exchange has recently developed a market-coupling system. This spot market system supports international trading – linking two independent markets based on area-based elasticity curves, it also allows flexible block orders

Gas hubs jockey for position

The Bunde-Oude natural gas hub on the German-Dutch border is the most likely candidate to become the Henry Hub of Europe, according to a survey of European natural gas experts conducted by Maycroft Consultancy Services

The derivatives burden

Former International Petroleum Exchange official Chris Cook looks at the issues raised at a debate on the future of the European energy markets at the end of London’s Derivatives Week event. The regulatory burden on firms took centre stage

How to be top of the class

Brett Humphreys discusses the attributes that combine to create a best-in-class market risk management division within an energy company

The search for spot

Strong demand for US liquefied natural gas is accelerating the development of an active global spot market and pricing benchmarks, as Catherine Lacoursière discovers

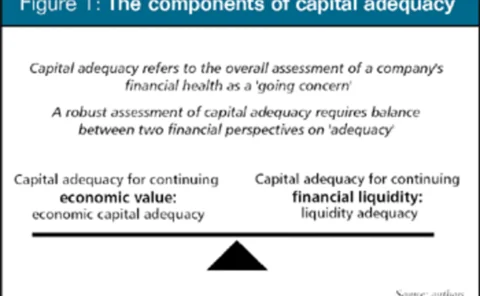

A capital adequacy primer

A summary of the Committee of Chief Risk Officers’ (CCRO) emerging guidelines on capital adequacy, by Cinergy’s Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith

Austrian rail firm on the risk management fast track

Austria’s largest electricity consumer, rail firm Österreichische Bundesbahnen, talks to EPRM about its energy risk management strategy. And, as Paul Lyon discovers, other end-users could learn from the innovative company

In search of power solutions

Blackouts across Italy in early July highlight the need for power plant investment – and the new market operator says promotion of derivatives trading is necessary to encourage such investment. But producers are yet to bite, finds James Ockenden

US coal trading picks up steam

While the coal market awaits pricing indexes to reinvigorate trading, emissions trading is getting a boost from increased coal burning. Catherine Lacoursière reports

Emerging adequacy

The Committee of Chief Risk Officers’ capital adequacy ‘emerging practice’ guidelines will, says the capital adequacy committee chair, evolve into a new regulatory body within a year. James Ockenden reports

The trouble with normalisation

Weather derivatives practitioners say normalisation agreements between regulators and utilities in the US are posing a threat to their industry. Kevin Foster investigates

A secure base

Long praised as pioneers in the energy derivatives space, US energy firms are now looking to make their overall risk management practices more robust. And, as Paul Lyon discovers, these companies have several innovations up their sleeves, such as…

Ferc’s California clean-up

Sixty energy firms and utilities will have to justify their activities during the California energy crisis, the Federal Energy Regulatory Commission (Ferc) said in its regular bi-weekly meeting on June 25.

Ferc executes already dead Enron

Enron became the first company to face the Federal Energy Regulatory Commission’s (Ferc) “death penalty” in June when the US energy regulator revoked the bankrupt firm’s authority to sell electricity at market-based rates.

Keeping up with the markets

The power trading sector has changed substantially in the past 12 months. Have trading and risk management software vendors kept pace? Kevin Foster reports

Avoiding STP failure

Entertaining as a Matrix-style spectre of a world governed by computers might be, for many involved in planning straight-through processing, seamless computing is the goal that every organisation should be trying to achieve, says Trayport’s Elliot Piggot

The software run-down

EPRM’s company-by-company listing of the leading energy software and information providers in the business, including a run-down of their clients

Running a smooth operation

Due to internal control scandals, process failures and the Sarbanes-Oxley Act, energy firms must keep an ever-closer eye on internal operations. Openlink’s Philip Wang and freelance author Jack King lay the basis for an operational risk framework

2003 system frontrunners

After the success of the 2002 systemfrontrunners section – where software companieshad the opportunity to highlight and showcasetheir technology and achievements – we arepleased to introduce the selection for 2003.

Teething problems in Texas

Advocates of retail electricity deregulation cite Texas as evidence that competitioncan succeed. But big risks remain for power marketers, finds Kevin Foster