Market risk

Trading techniques

Merchant generators make daily decisions on how to get the most from their assets.How much capacity should be sold in the day-ahead market and how much shouldbe set aside for the hourly market are seldom-studied but thorny questions. ShulangChen looks at…

Merrill Lynch sees oil staying high in 2005

The oil price, which has roughly doubled since the start of 2000, and risen by over 60% this year, is likely to remain historically high in 2005 due to a structural shift in the market, said Robin Batchelor, co-fund manager of Merrill Lynch’s World…

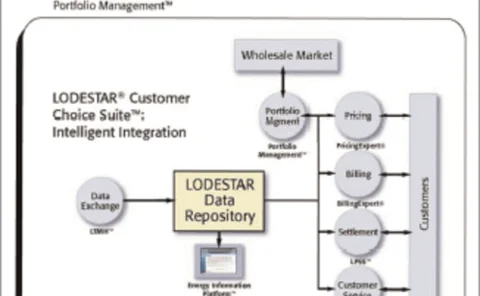

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

Balanced buying

Yijun Du and Xiaorui Hu present a general framework for applyingmodern portfolio theory to optimal natural gas procurements.They showthat successful natural gas procurement involves determining the optimalallocation between fixed-price and floating-price…

UK traded gas market: What with liquidity?

The last two months have been a difficult time for UK gas traders; but Philippe Vedrenne and Marc Lansonneur from Gaselys say conditions will improve, leaving a market that may be stronger than ever

Trading techniques

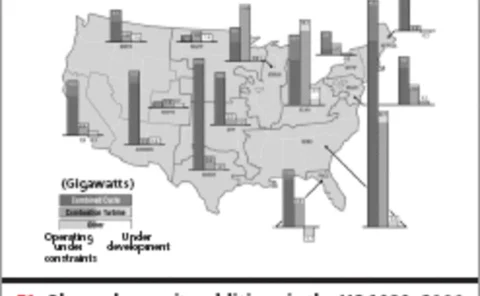

A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit dispatches can…

Ending the acrimony

Most utilities support hedging to mitigate price volatility, but are not sure how to communicate the benefits of hedging to their customers. Tim Simard of RiskAdvisory offers suggestions for improving the rate-hearing process

Changing of the guard

Changes to the European gas market may further attract financial players, and tighten the rules in case of physical supply disruptions. Meanwhile changes in the UK gas market may lead to clearing at the hub. By James Ockenden

Getting physical

Asset-backed trading strategies usually employ a combination of physicalpositions, which are subject to physical risk; and financial hedgingintruments, which are not. Here, Steve Leppard shows how value-at-risk,applied to this combined risk scenario, can…

China Aviation Oil hid US$390m derivative loss in struggle to survive

China Aviation Oil’s trading unit, China Aviation Oil (Singapore) Corp (CAOSCO) hid an initial US$390 million loss while its directors sought “white knights” to save it from liquidation, it emerged yesterday as the company announced an estimated US$550…

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

Caring competition

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…

Editor

"The good people buying and selling energy have once again been shafted by corporate greed"

The perfect balance

For most governments, hedging oil price risks on the financial markets is not impossible. But it is politically difficult. Most find instead opt for establishing ‘rainy day’ stabilisation funds. By Maria Kielmas

Volatility conspiracy

The concept of volatility is universally used by quantitative analysts. But is it a concrete idea or a false friend? And does it even exist? Energy quant Neil Palmer takes a look at its mysteries

Dominion buys 310MW plant from Dynegy and NRG

Dominion Virginia Power, the power utility subsidiary of Dominion, today completed the purchase of the 310-megawatt Commonwealth power plant in Chesapeake, Virginia. The move is consistent with its aim of reducing the cost of long-term power purchase…

Saudi to up oil output to 12.5 million b/d

Saudi Arabia’s total oil production capacity is now at 11 million barrels a day (b/d) and plans are in place to increase it to 12.5 million b/d, Saudi Arabia’s Minister of Petroleum and Mineral Resources, Mr Ali Al-Naimi, said Monday.

CFTC allows US firms to trade on EEX

The US Commodity Futures Trading Commission has permitted US companies to trade power derivatives on the European Energy Exchange with immediate effect, EEX said Thursday.

Energy users demand trading oversight

The debate continues over whether speculative traders are distorting energy prices, following a letter sent by the Industrial Energy Consumers of America (IECA) to Congress last week. “Energy markets have changed drastically, and regulatory oversight,…

Energy traders urged to pre-register for risk poll

Energy traders wishing to take part in Energy Risk/Risk’s 12th annual Commodity Rankings can now pre-register to vote to avoid missing important voter updates and deadlines in the magazines’ annual survey of the energy business.

BNP beefs up energy team

BNP Paribas has expanded its energy derivatives team in London with four significant hires.

IPE members approved to trade on Ice OTC markets

The International Petroleum Exchange’s (IPE) registered brokers and local traders can now trade on IntercontinentalExchange’s (Ice) over-the-counter markets for their own accounts.

California ISO gets tough on generators with new software

Power suppliers in California will face financial penalties if they deviate from pre-specified generation levels as of December 1. This is one of the main changes brought in by a new software system implemented by the California independent system…