Market risk

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

Tentative steps

Algeria’s state-owned oil company Sonatrach is about to become the first oil and gas company within Opec to roll out an independent risk management programme to cover its crude oil and gas sales. Stella Farrington reports

Reuters launches order-routing system for commodities

Global information company Reuters has launched Reuters Order Routing for Commodities (RORC), a new trading solution for the European energy market.

CME weather trading volumes already past those of 2004

Weather derivatives trading volumes for 2005 on the Chicago Mercantile Exchange have already surpassed last year's volumes, said the exchange yesterday. The number of contracts traded this year hit 124,177 on April 12, compared with 122,987 for the whole…

Icap-Hyde hires Toyne to head tanker FFA broking

Icap-Hyde, a London-based joint forward freight and shipping derivatives-broking venture between broker Icap and shipping broker JE Hyde, has added to its team. Simon Toyne has joined as director of tanker forward freight agreements (FFAs), responsible…

Battle for Brent rages on as open outcry closes at IPE

Open outcry at London’s IPE had its last day on Thursday, yet the debate over whether the screen can adequately replicate an oil market rages on, with IPE and Nymex both taking a punt on opposing beliefs.

Nord Pool hires ex-Natsource brokers, eyes power spread contract

Nordic power exchange Nord Pool has hired brokers from the Oslo office of energy broker Natsource, which would fit with rumours that Natsource is closing its Scandinavian business. Natsource president Jack Cogen declined to comment.

Nymex to launch gas oil futures in Dublin

The New York Mercantile Exchange (Nymex) has said it will launch a northwest Europe gas oil futures contract in Dublin on Friday April 8.

Nymex launches gas oil futures in Dublin

The New York Mercantile Exchange (Nymex) has said it will launch a northwest Europe gas oil futures contract in Dublin on Friday April 8.

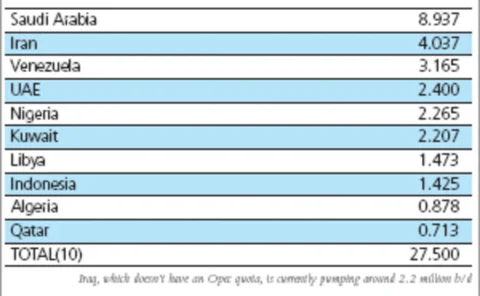

Has Opec lost control?

Minutes after Opec tried to cool scorching oil prices by announcing a hike in its output target, oil surged to record highs. Has Opec lost control, and is there anything it can do to bring prices down? Stella Farrington finds out

An energetic debate

Enterprise-wide risk measurement and management, regulatory issues and pricing and hedging strategies were the hot topics this year at Energy Risk Europe in Amsterdam. James Ockenden and Joe Marsh report

The battle for Brent

Open-outcry the IPE is over, but the debate over whether the screen can adequately replicate an oil market rages on, writes Stella Farrington

Enter the scrum

A surprise Opec headline can throw the market into a tailspin, but gathering the news can be even more frenetic. In March, one scrum even resulted in broken bones. Stella Farrington writes from Iran

A star rises in the east

Iran’s ministry of petroleum has given the green light to launch a new petroleum exchange in the country. Mohammad Asemipour, adviser to Iran’s oil ministry and a key architect of the project, talks to Stella Farrington

Petroleum price surges

Oil prices once again are on the rise, with some analysts predicting ‘super-spikes’ in the near future to match the price rises of the 1970s. Eric Fishhaut summarises some of the key changes, and looks at how traders can make use of the volatility in the…

Real option valuation

Many non-financial assets can be viewed as ‘real options’ linked to an underlying variable such as a commodity price. Here, Thomas Dawson and Jennifer Considine show that the stock price of an electricity generating company is significantly correlated…

Polish power exchange chooses OMX software for trading and clearing

In a move to develop its electricity spot and derivatives market, the Polish Power Exchange (PolPX) will use the Condico system from Stockholm-based OMX, the owner and operator of the Swedish stock exchange.

EEX set to compete with EXAA in Austrian spot power market

Austrian energy exchange EXAA will soon have competition for spot trading of physical power in its home market. From April 1, Austrian companies will be able to trade electricity for delivery to most of Austria directly on Germany's European Energy…

Both sides of the fence

Ernst Eberlein and Gerhard Stahl analyse price series of 25 energy spotrates simultaneously using Lévy models. This model class allows thecapture of stochastic behaviour of these financial instruments.Theimplications of this analysis will form the…

A solid foundation

MotherRock, the energy hedge fund set up by former Nymex president Bo Collins, recently chose Kiodex’s ASP-based risk management software. Joe Marsh explores the trade-off between web-based and installed systems

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Midwest power market to start on April 1

The US energy market regulator yesterday gave the Midwest Independent System Operator (Miso) the go-ahead to launch its wholesale energy market on April 1, after several delays.

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…