Market risk

Former Enron executive pleads guilty

John Forney, a former Enron executive, yesterday pleaded guilty toone count of conspiracy to commit wire fraud for the purpose of manipulatingCalifornia's electricity market during the 2000-2001 Westernenergy crisis, the US Attorney's Office for the…

Calpine sets up $250m credit facility

California power company Calpine has entered into a $250 million letter of credit facility with Deutsche Bank, which expires in October 2005. The San José-based company expects this new credit enhancement structure to widen its spark spreads and increase…

Looking to the east

Can power market operators in the new EU member states in eastern Europe gainthe liquidity they need to challenge either bilateral electricity contracts orthe established exchanges? Joe Marsh reports

Putin’s endgame

The geopolitical premium on oil prices is rising as Russia pursues its ‘oligarchs’. Catherine Lacoursiere reports on the wider effects of Russian oil giant Yukos’ collapse

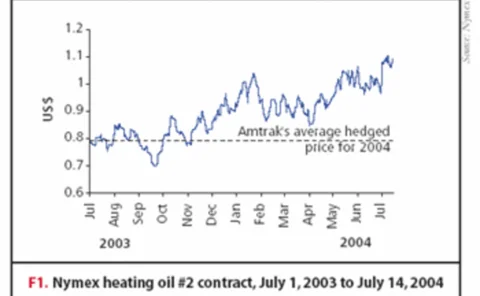

Dealings in diesel

In the latest in a series of articles in which Energy Risk profiles energy users’ risk management and hedging strategies, Joe Marsh talks to US rail company Amtrakabout how it deals with its fuel exposures

All systems go

More than 450 of you voted and voiced your concerns in Energy Risk’s inaugural User Choice Awards. Below we show which suppliers you voted for as top of their field in the energy business this year

Huberator’s hopes

APX and Fluxys subsidiary Huberator are planning to launch a gas exchange forthe Zeebrugge hub in early 2005. But is an exchange really needed by the tradingcommunity? Paul Lyon reports

APGA supports Ferc decision to fine three companies

The American Public Gas Association (APGA) has applauded the US Federal Energy Regulatory Commission (Ferc) for its decision to fine three energy companies $8.1 million for sharing natural gas storage inventory data with their customers and affiliates. …

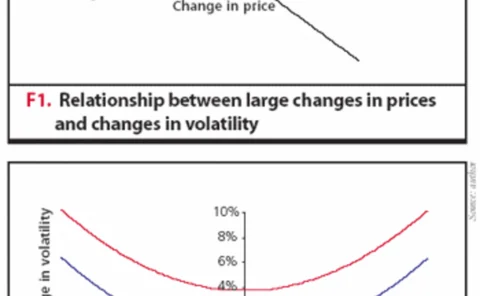

Viva lost vegas

Brett Humphreys discusses the problems of calculating true value-at-risk on aconcentrated options portfolio – in particular, the various pitfalls thatcan befall a risk manager in ignoring vega risk – and considers ways ofhandling these issues

A decent exposure

Most energy companies have a portfolio of over-the-counter energy derivativesthat could have significant credit exposures. In this paper, RafaelMendible examines the credit exposure of these derivatives, its relationto volatility,and its relation to…

Vertical take-off

As UK supplier Centrica narrows its focus to fund an asset acquisition spree, James Ockenden finds the ‘asset-light’ utility model has finallybeen buried and a move towards ‘vertical integration’ is now thestrategy of choice

Building load links

In the third article in this series, Les Clewlow , ChrisStrickland and MichaelBooth show how the Monte Carlo techniques used in previous articles can accuratelyhighlight the crucial relationship between price and load – a complex correlationaffecting the…

Edison Mission sells off foreign power assets, posts Q2 loss

California-based Edison Mission Energy is to sell its remaining foreign generation assets to London-based generator International Power and Japanese trader Mitsui & Co for $2.3 billion. International Power will take a 70% stake and Mitsui a 30% stake of…

DrKW forms energy trading business

Investment bank Dresdner Kleinwort Wasserstein (DrKW) has formed a London-based energy trading business, headed by Neil Rothwell.

BNZ enters energy trading

The Bank of New Zealand (BNZ) has launched an energy risk management desk. The plan is to target the bank’s corporate client base who need hedging solutions for their energy, base metals and agricultural commodities exposures, said Wayne Jolly, BNZ’s…

US regulator doles out Enron fines

The US Commodity Futures Trading Commission (CFTC) has hit Enron and its former trader Hunter Shively with $35 million and $300,000 in civil fines respectively for gas price manipulation.

Wolverine to be market maker for Japanese weather futures

Wolverine Trading, the Chicago-based energy trading company, will be the lead market maker for Japanese weather futures soon to be offered by the Chicago Mercantile Exchange (CME).

Trading master agreement updated for UK power

The London-based Futures and Options Association (FOA) has released new standardised power trading documentation for the UK.

Top energy software vendors to be revealed

Energy traders have just one day left to vote in the biggest ever poll of energy technology users, the Energy Risk User Choice Awards 2004.

CME appoints lead market maker for fertiliser futures

Chicago Mercantile Exchange (CME ) yesterday said that Agriliance will be the lead market maker for the exchange’s new fertiliser contracts traded on Globex, the exchange’s electronic trading platform. Minnesota-based Agriliance markets crop nutrients,…

Industrials lack price risk skills, says risk advisor

Outsourcing of price risk management will be a major growth area over the next few years, as industrial companies lack the skills required to manage their commodity risk, according to Chris Bowden, chief executive of price risk services firm Utilyx.

APX restructures and hires senior staff

APX Group, which provides exchanges for natural gas and power trading across northwest Europe, will move London-based power exchange UKPX’s forwards market onto its own system on August 18. The group has also made several senior appointments following…

Newsome leaves CFTC to head up Nymex

James Newsome has quit as chairman of the US Commodity Futures Trading Commission (CFTC) to head up the New York Mercantile Exchange (Nymex). Newsome’s resignation is effective from July 23, and he will be president of Nymex from August 2, replacing Bo…