Market risk

BofA reports improved commodity-trading income

North Carolina-based Bank of America yesterday reported revenues of $45 million from commodity trading in its full-year 2004 results, up from a loss of $45 million for 2003. The investment bank's recovery came amid strong overall financial results for…

Risk Management Inc signs four utility clients

Risk Management Inc (RMI), a Chicago-based energy consultancy and brokerage, has signed up four new utility customers for its energy risk management and hedging services. The City of Glendale Water & Power and Pasadena Water & Power, both in California,…

Double exposure

Continuing our series on applications of Monte Carlo simulation to applied problems in energy risk management, Les Clewlow , Chris Strickland , Oleg Zakharov, and Scott Browne look at potential future exposure and the analogous measure of expected credit…

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

A hard nut to crack

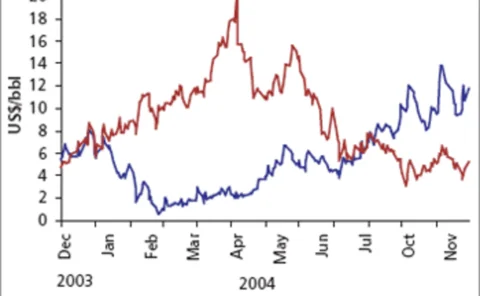

This year has proved profitable for US oil refiners, but it could have been even better, had they not posted losses from forward product sales. Are refining companies learning from their trading mistakes? Joe Marsh reports

Blending the rules

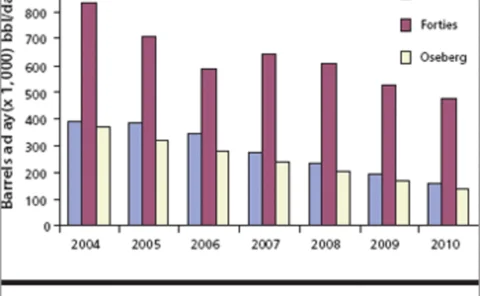

The speed of decline of North Sea crude raises fresh concerns over the suitability of the North Sea as a benchmark, and to worries over the value of long-dated derivatives contracts. By Stella Farrington

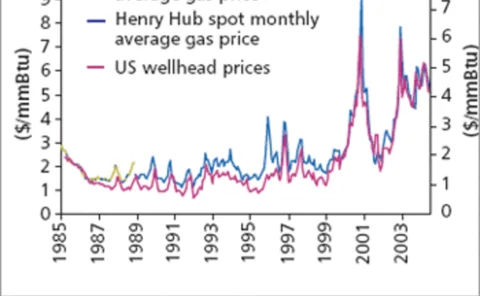

Bridging the gas gap

Volatility in the natural gas markets shows no sign of any let-up, which means that managing basis risk at Henry Hub continues to spur demand for increasingly innovative derivatives products. Catherine Lacoursiere reports

Pay as you go

It is going to be a hard day at the office for Joe Risk Manager. The risk management committee might welcome his new risk charge system, but how would the traders take it? By Brett Humphreys and David Shimko

Fitch to buy Algorithmics

Fitch Group, parent of credit rating agency Fitch Ratings, is to acquire New York-based risk management software provider Algorithmics. The purchase, valued at $175 million, is expected to close in January, said Fitch today.

Oil price falls despite Opec cut

Oil prices fell Friday afternoon despite a decision by the Organisation of Petroleum Exporting Countries (Opec) to rein in current oversupply, effectively taking 1 million barrels a day off the market.

European Commission blocks acquisition of Gás de Portugal

The European Commission has blocked the joint acquisition of Gás de Portugal (GDP), the country’s incumbent gas company, by Energias de Portugal (EDP) and Italian energy company Eni, because it would impede competition.

China Aviation Oil ceases oil derivatives trading

China Aviation Oil (Singapore) Corp has ceased all oil derivative trading activities after announcing a $550 million trading loss and seeking court protection from creditors last week, the company said late Wednesday.

Duke to settle California power crisis allegations

US power company Duke Energy and some of its subsidiaries will pay $207.5 million to settle allegations that it acted improperly during the California power crisis in 2000/2001. The US Federal Energy Regulatory Commission (Ferc) approved the settlement…

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

CMS Energy to sell $200m of convertible senior notes

CMS Energy intends to offer for sale $200 million of convertible senior notes due on December 1, 2024, but would not reveal the rate of interest they will pay.

BarCap launches commodity-linked credit product

Fixed-income investors can now make use of a credit instrument that provides access to commodities as an asset class, says Barclays Capital. The investment bank has launched Apollo, a collateralised commodity obligation (CCO), which uses derivatives…

Mirant settles price-reporting charges

A subsidiary of Atlanta-based energy company Mirant has settled charges with the US Commodity Futures Trading Commission (CFTC) of false reporting of natural gas prices. The commission found that Mirant Americas Energy Marketing (MAEM) traders made false…

Ten years of trading

As an analyst and software designer who has spent the past ten years working closely with energy markets, Sandy Fielden had no problem identifying what had the most impact on his world in that time – technology. A regular Energy Risk contributor for some…

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

The famous fifty

To celebrate Energy Risk’s 10th birthday, we have created the Energy Risk Hall of Fame: a group of individuals whose commitment and contribution to energy markets makes them a foundation of this business. Introduced by James Ockenden

The Energy Risk Team

The Energy Risk team of 2004 (above) wishes to thank its loyal readers, advertisers, sponsors and contributors for supporting the magazine through 10 years of tremendous market development. James Ockenden looks back over its history

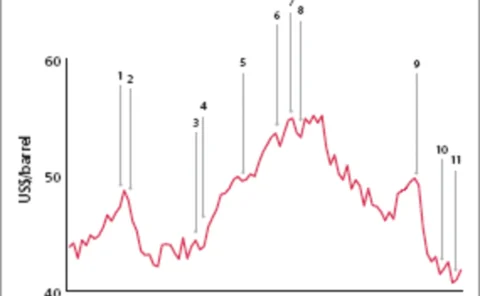

Evolution in energy

The price of oil has undoubtedly been the top story in the energy sector overthe past year or so, but examined over a period of 10 years, the picture looksmore stable. If there’s one trend that has changed the energy markets inthe past decade, it has to…

Benchmark in limbo

The development of a spot market for crude oil in the 1980s eventually led to oil futures trading and the need for benchmark pricing. With oil prices fluctuating wildly in the region in tandem with markets across the globe, theneed for price transparency…