Market risk

Nymex ends open-outcry trading of PJM monthly power futures

The New York Mercantile Exchange (Nymex) will move daytime trading of the PJM monthly electricity futures contract to ClearPort, its internet-based system, from the open-outcry trading floor on November 1.

Evolution starts brokering US natural gas and power

US coal and emissions broker Evolution Markets has expanded its services to include over-the-counter (OTC) brokerage services for North American natural gas and power. Jeff Rosenzweig has joined as managing director of the new gas and power desk, and…

Shell completes sale of refined products pipelines

Shell Oil Products US has sold its major refined oil products pipeline systems to asset acquisition companies for $1 billion. Oklahoma-based Magellan Midstream Partners has paid $490 million for the mid-continent system, while Pennsylvania-based Buckeye…

Pemex signs up to OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

El Paso makes $198m from further asset sales

Houston-based energy company El Paso Corp has sold four more power plants to Northern Star Generation for $147 million, continuing its mass sell-off of assets. El Paso’s merchant energy subsidiary has also received a final instalment of $51 million on…

Pemex signs for OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

Allegheny Energy to sell Illinois power plant

Pennsylvania-based Allegheny Energy is to sell a power plant in Manhattan, Illinois for $173 million to a private investment firm that specialises in energy assets. ArcLight Capital Partners has agreed to buy the 672-megawatt (MW) Lincoln Generating…

RBS offers freight derivatives

Royal Bank of Scotland (RBS) has started offering shipping derivatives, in the form of forward freight agreements (FFAs) linked to the transport costs of bulk commodities to its client base.

Williams to retain energy trading business

Oklahoma-based energy company Williams said late last week it will continue operating its energy trading business, having failed to sell the rest of the wholesale power division. The company is focusing on long-term supply contracts and doing only a very…

Refco hires OTC energy broking team

The European arm of New York-based financial services firm Refco has hired two brokers to form an over-the-counter (OTC) energy derivatives team. Glen Ward and Andrew Riddell join Refco Overseas in London from US broker Amerex’s London office.

Dominion forward-sells shares to obtain equity on demand

Virginia-based energy company Dominion has forward-sold 10 million shares of its common stock in a block trade to JP Morgan Securities. The deal was done in connection with a forward-sale agreement between Dominion and investment bank Merrill Lynch. It…

Shaping the curve

A shaped forward curve is important for both trading and risk management. Here, Giorgio Cabibbo and Stefano Fiorenzani provide a model for shaping electricityforward curves that is consistent with both financial theory and market practice.Here, they…

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

Good neighbours

Spanish and Portuguese energy market participants are hopeful that a joint Spanish-Portuguesepower market is imminent. But how competitive will the Portuguese side of themarket be? Joe Marsh reports

A history lesson

Abstract: The size of bid/ask spreads in electricity options has both valuationand credit implications. Here, Ted Kury of The Energy Authority shows how toderive theoretical spreads using historical option price data so they can beused as liquidity…

A fresh landscape

Prebon Energy’s Kevin McDermott says that much has changed in the electricitybroking world post-Enron. And it’s all for the better. By Paul Lyon

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

Covering all the bases

Abstract: Many articles have discussed constructing models for either spot orforward prices. Yet none cover the whole process of constructing a joint modelfor both. Here, Andreas Huber and MonikaKrca develop a multi-factor model thatcaptures both the…

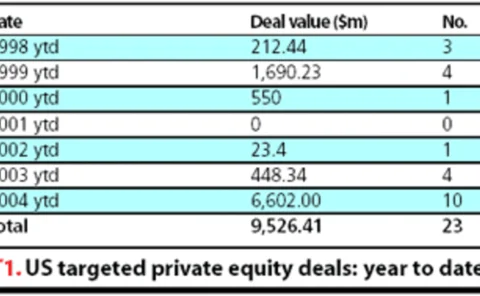

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

Grain versus cane

Since Nybot listed a new futures contract for ethanol in May, the product hasemerged as a critical ingredient in US refining. Gasoline traders may find themselvesworrying about crop reports as much as they monitor Opec meetings and Nymex crude. Sandy…

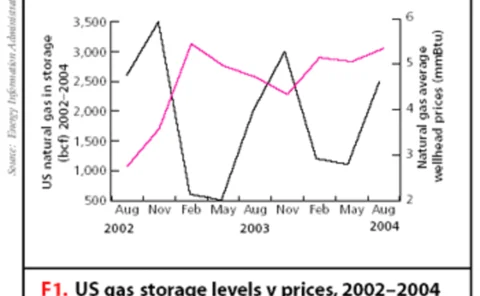

Storing up trouble

Utilities have become active hedgers against today’s high natural gas prices.In recent years, there has been a notable increase in both physical and financialhedging. Catherine Lacoursiere looks at whether storage is still a viable hedge

Constant reminders

Enron has received court approval to emerge from one of the most expensive bankruptciesin history. But pending litigations and trials mean that the Enron spectre willstill loom large. By Paul Lyon