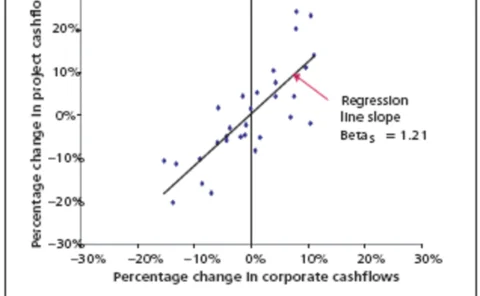

Market risk

The sum of its parts

One can view a corporation’s individual projects as a portfolio of options – useful risk management tools to be used if their risk/return ratios are better than that of the firm as a whole. But how to work out the equity cost of capital at this…

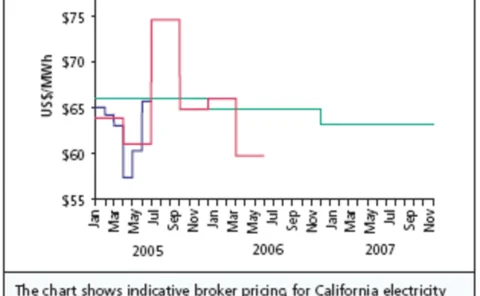

Shopping for curves

More regulation requires more accurate valuation of forward trades – and a need for more reliability in the forward curve tool. Sandy Fielden presents an informal survey of the data choices available to energy risk managers in the US natural gas and…

A solid foundation

MotherRock, the energy hedge fund set up by former Nymex president Bo Collins, recently chose Kiodex’s ASP-based risk management software. Joe Marsh explores the trade-off between web-based and installed systems

Calgary’s oil patch

Some Canadian oil and gas producers got their fingers burnt last year as oil prices soared and hedging programmes resulted in big losses. What will their strategies be in 2005? Catherine Lacoursiere reports

A complicated option

Why does the New York Mercantile Exchange not list average-price WTI crude options as a contract on its ClearPort electronic platform? Internal politics could be the main obstacle. Joe Marsh reports

Opec split over increasing oil production

Ministers of the Organisation of Petroleum Exporting Countries (Opec) arriving in the Iranian city of Esfahan Tuesday sent out mixed messages over the expected outcome of Wednesday’s meeting.

The swap terminator

Multilateral swap cancellations look set to become commonplace in the energy sector, thanks to a service from TriOptima, which has just terminated its first round of oil swaps for six firms. Joe Marsh reports

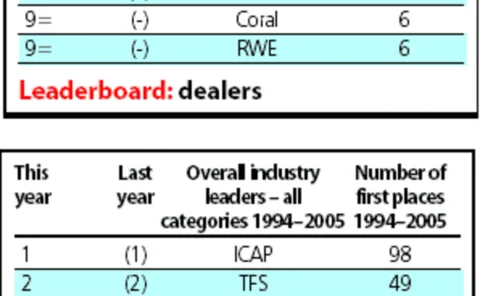

Rankings 2005

The energy markets gave corporates and funds plenty to think about in 2004 – and while the banks still dominate the rankings, some sectors have been taken over for the first time by energy companies. All is revealed in this year’s comprehensive round-up.

Merrill Lynch starts building coal desk

Matt Schicke, former director of coal trading at Michigan-based DTE Energy, has joined Merrill Lynch to build a US coal trading desk from its Houston office. As vice-president, he is initiating steps to trade coal, said Merrill spokeswoman Terez Hanhan.

The experts excel

The fast and furious energy markets gave corporates and funds plenty to think about in 2004 – and while the banks still dominate the energy rankings, some sectors have been taken over for the first time by energy companies. By James Ockenden and Joe Marsh

OpenLink may launch web-based version of Endur

OpenLink may launch a web-based version of Endur, its energy trading and risk management system, according to Matt Frye, Houston-based managing director of the software company.

Nymex confirms plans to launch in London

The New York Mercantile Exchange (Nymex) today announced plans to open an open-outcry Brent futures floor in London. "It's our intention to move to London as soon as possible," Nymex president James Newsome told reporters in London.

Real-time trading

In an efficient, real-time power market, low-cost generation units are dispatched ahead of those with higher operating costs, and the market price reflects balanced generation and load. Here Shulang Chen discusses the basic functions of a real-time…

Layers of intrigue

The Yukos saga – up to now largely confined to the political and legal arenas – recently took a step closer to the physical oil markets with a $6 billion oil deal between China and Russia. By Stella Farrington

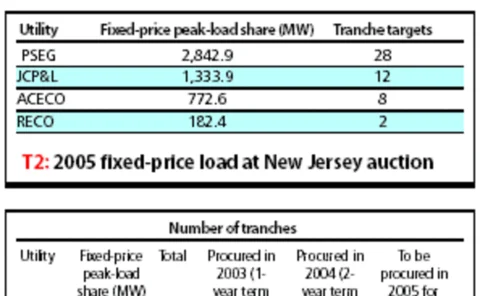

A bid for power

Clock auctions are a fairly recent method for utilities of procuring electricity from suppliers, but only New Jersey has an established process. Yet Ohio and Illinois are showing interest. Joe Marsh reports

Exceptions to the rule

With commodity markets set to fall within the scope of more EU regulation, trade associations are concerned that this extra burden on market participants could stifle trade. By Stella Farrington

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

Correlation: the horror!

The murky world of correlation, with its many pitfalls, represents a black hole in the minds of some energy market professionals. But, says Neil Palmer , you needn’t be afraid of the dark

Smoke without fire

The market for US financial coal swaps may be starting to show a little potential, but some major obstacles still remain before it catches alight – not least a widely accepted price index. By Joe Marsh

The basics of basis

Basis plays an important role for trading in the very complex US natural gas markets: spot will differ from the benchmark Henry Hub New York Mercantile Exchange price on the same day. Eric Fishhaut describes how the basis works and demonstrates the…

Crude imitation

Hedging Canadian heavy crude oil is difficult: unlike Canadian light crude, ithas no closely matching price benchmarks. Trading basis differentials is onesolution, but help may be at hand from another quarter. By JoeMarsh

Evolution expands gas and power desk

US broker Evolution Markets has hired two brokers for the North American natural gas and power desk it launched in October. Corey Geraghty and Trenton Davis now broker gas and electricity options from the company headquarters in White Plains, New York.

TriOptima trims six companies' oil swap portfolios

TriOptima, a Swedish company dedicated to reducing over-the-counter swap portfolios, has expanded its service into energy. The company has terminated its first group of multilateral OTC oil derivative swaps, with six companies eliminating unnecessary…

IPE launches UK electricity baseload index

The International Petroleum Exchange (IPE) has launched a UK electricity baseload index in response, it said, to industry demand for a viable index on which to base physical deals. The first pricing period will be for the March 2005 contract.