Market risk

Dynegy to buy Sithe Energies from Exelon

Dynegy is set to reduce the effect of some of its loss-making tolling and financial swap contracts, buy power plants in the northeast US and acquire a supply agreement to increase stable cashflow and service debt.

A slice of the IPE

The fate of the Nymex Brent contract launched this month in Ireland – an undisguised attempt to grab business from the IPE – will be determined by Christmas, say Dublin floor traders. By Stella Farrington

A slow squeeze

The oil price may have eased recently, but it remains high. What impact is this having on the global economy? Concerns remain for the long-term future of crude supply. Joe Marsh reports

A surprising future

High oil prices are not triggering as large an upturn in oil exploration as was first expected, with many questioning how long the current situation will last. But high prices are having some rather unexpected effects. By Maria Kielmas

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way

Clear intentions

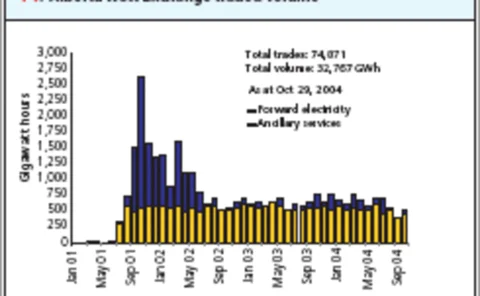

The Alberta Watt Exchange in Calgary is already clearing over-the-counter electricity contracts and from next year will be able to clear natural gas as well. But how much liquidity will it attract? Joe Marsh reports

Playing monopoly

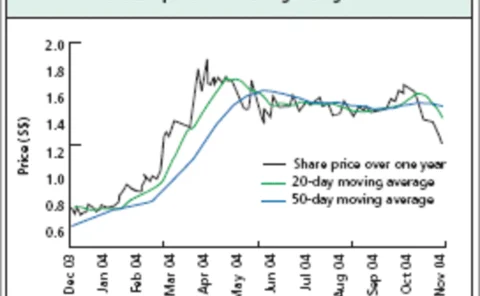

China Aviation Oil is well placed to benefit from China’s economic boom – thanks to its powerful jet-fuel supply monopoly. Yet there are still opportunities for those willing to develop new markets, finds James Ockenden

Agree to disagree

Volatility in the dry freight market has led to the use of derivatives such as forward freight agreements and the development of other innovative products. But will they have a lasting impact on the energy markets? By Hann Ho

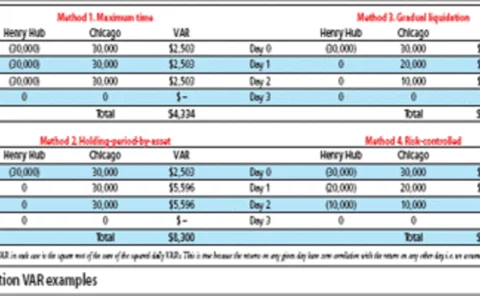

Risky liquidations

It is all too easy to go for the simplest solution when liquidating an energy portfolio of different positions. Brett Humphreys discusses some of the problems with appropriately calculating the VAR associated with liquidating a portfolio

A popular punt

Experts remain bullish about the flow of new money into catastrophe cover. But an influx of hedge funds backed increasingly by institutional capital has led to worries of a “domino effect”. By Maria Kielmas

Missing links

For utility companies with income streams linked to inflation, using inflation derivatives to match assets with liabilities easily and relatively cheaply must be the easy option? If only it were that simple. By John Ferry

Nymex to launch two new coal swap futures

The New York Mercantile Exchange (Nymex) will launch two new coal futures contracts – one for eastern coal and one for western coal – on its ClearPort trading platform on October 31.

Nymex to launch New England electricity futures contract

The New York Mercantile Exchange will introduce a New England swap futures contract on its ClearPort trading platform on October 31.

US Midwest a step closer to wholesale power market

After several delays, the Midwest wholesale power market might now be on course for launch next March. The Midwest independent transmission system operator (Miso) today announced the creation of three financial hubs for the wholesale trading of…

Nymex European launch imminent

Nymex aims to launch an open outcry exchange in Europe, most likely initially in Dublin using Nybot’s Finex facilities, according to president James Newsome.

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Fabio Leoncini

Fabio Leoncini, head of the Italian association of energy suppliers and traders,outlines his efforts to get Italy’s energy market fully competitive. By Joe Marsh

Found in translation

While risk managers have become focused on value-at-risk and similar risk metrics,these may not be the best way of communicating risk to stakeholders. BrettHumphreys discusses how to improve communications

Earnings at risk

The structure of a typical energy portfolio often contains a different assetand contract mix from the simple derivatives instruments in a more standard portfolio.This requires a different approach to risk. Here, Les Clewlow and ChrisStrickland make the…

Avoiding the gas work

Ferc is exploring whether gas storage inventory details should be posted on adaily basis. How will this affect the development of the embryonic natural gasstorage swaps market? Paul Lyon reports

Best laid plans

Growing interest in commodities on all sides mean energy products will be a good bet in 2005. And this has led to the increased popularity of new forms of structured correlation products. By James Ockenden and Joe Marsh

Driving up the price

Nowhere has the spiralling cost of petroleum been more acutely felt than in the US, where the car is king. The rise is, of course, directly related to high crude oil prices, pushed ever higher by threats to production arising from worldwide political…