Enterprise risk

Rothschild enters oil risk sector

Heading the senior team is Martin Fraenkel, previously managing director of JPMorgan Chase's global commodities group in London. Fraenkel has recruited hissenior team from outside Rothschild. KamalInvestment bank Rothschild has entered the oil risk…

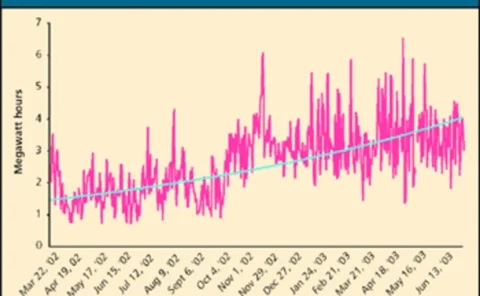

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals

Enron files complaint against six of its former banks

Houston-based Enron last month filed a court complaint against six of its former banks, claiming they gave bad financial advice that contributed to its demise in late 2001. As a bankrupt company, Enron is required to try to recover as much as it can for…

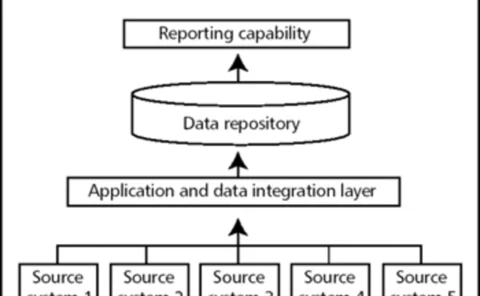

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Water faces rising costs

UK water utilities are expecting rising electricity and environmental costs as they and their regulator prepare for the next five-year price review. Maria Kielmas reports

A hard Act to follow

The final piece of the Sarbanes-Oxley Act – section 404 – falls into place this month, requiring internal control reports. While the Act may go some way to restoring investor confidence, it is costing energy companies dear, finds Kevin Foster

System-ready for Sarbanes-Oxley

Energy companies are not alone in having to review their operations to comply with the Sarbanes-Oxley Act. Energy software suppliers, too, are looking at their systems, although most are confident they are already well prepared, finds Clive Davidson

Deregulation versus re-regulation

While the US authorities are still ironing kinks out of a major electricity market redesign and looking to repeal the utility industry’s most influential Act, US regulators and self regulators are moving to fill the vacuum. Catherine Lacoursière reports

Utilities cut spending on IT

Energy utilities have cut spending on IT by 13% so far this year, according to the initial results of a study by Connecticut-based consultancy the Meta Group.

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

Correction – Allegro: The following text should have been included in the software vendor directory in last month’s (July) issue.

Allegro Development has provided energy firms with transaction and risk management software solutions for almost 20 years. Founded in 1984, Allegro provides an industry-leading set of customisable energy software components for companies including…

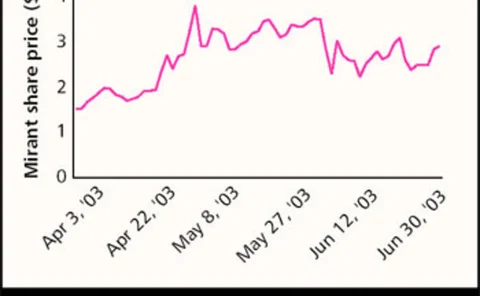

Mirant bankruptcy is not terminal

US energy firm Mirant’s July bankruptcy filing bucks the recent trend of last-minute restructuring deals that have saved many of its rivals from a similar fate. But analysts say the company is likely to emerge from its filing with at least some of its…

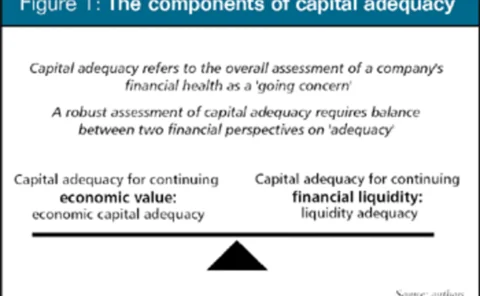

A capital adequacy primer

A summary of the Committee of Chief Risk Officers’ (CCRO) emerging guidelines on capital adequacy, by Cinergy’s Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith

Austrian rail firm on the risk management fast track

Austria’s largest electricity consumer, rail firm Österreichische Bundesbahnen, talks to EPRM about its energy risk management strategy. And, as Paul Lyon discovers, other end-users could learn from the innovative company

Management buys out SG’s weather and cat bond funds

Société Générale’s (SG) weather derivatives team completed an amicable management buyout of the weather division at the French bank. The buyout creates what is believed to be the largest range of dedicated weather derivative and catastrophe bond funds,…

Valuing exploration and production projects

Lukens Energy Group’s Hugh Li sets out an option method for valuing exploration and production projects, using a practical example

Emerging adequacy

The Committee of Chief Risk Officers’ capital adequacy ‘emerging practice’ guidelines will, says the capital adequacy committee chair, evolve into a new regulatory body within a year. James Ockenden reports

S&P to apply stress test to power firms

Standard & Poor’s (S&P) is to apply a stress test designed to measure how well power companies can stand price swings in volatile electricity markets. The move is part of the credit rating agency’s effort to combat criticism of rating agency failure to…

Backwardation and contango change indicators for seasonal commodities

In the first part of this two-part article, Svetlana Borovkova introduced two indicators for detecting changes between backwardation and contango market states. Here, in the second part, she applies the indicators to seasonal commodities and introduces a…

A secure base

Long praised as pioneers in the energy derivatives space, US energy firms are now looking to make their overall risk management practices more robust. And, as Paul Lyon discovers, these companies have several innovations up their sleeves, such as…

Mirant raises prospect of bankruptcy

Energy company Mirant asked its bank lenders to approve a pre-packaged bankruptcy plan in June, suggesting the Atlanta-based company could be forced to file for Chapter 11 bankruptcy.

Ferc executes already dead Enron

Enron became the first company to face the Federal Energy Regulatory Commission’s (Ferc) “death penalty” in June when the US energy regulator revoked the bankrupt firm’s authority to sell electricity at market-based rates.