Enterprise risk

Counterparty concerns

Following the California crisis and the fall of Enron, energy firms are finally paying more attention to credit risk. Here Fred Cohen, Satyan Malhotra and Rafael Cavestany present some overarching issues senior management must address in implementing an…

Hedging ahead

Continuing our series of tutorials on risk management tools, Dan Rowe looks at how physical positions can be hedged with exchange-traded futures and options contracts

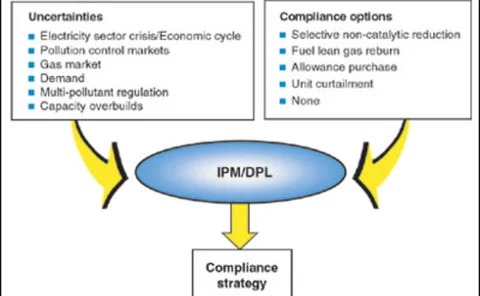

Controlling power

Maggi Shippy-Ksionsk and Stefan Ulreich explain how portfolio risk management gives a company control over its energy procurement

Not just a quick fix

Real options are an accepted risk management technique in the energy sector. Kevin Foster takes a look at how are they being used and what factors are affecting their development and implementation

Going OTC with forwards and swaps

Continuing our series of risk management tutorials, this month Dan Rowe look at swaps and forward contracts in the over-the-counter market

A hedge by any other name

It is one of the most commonly used phrases in risk management parlance, but what exactly is meant by the term ‘hedge’? Here we propose a new definition. By Brett Humphreys

Ripples from a big fish

What effect has the fall of Enron had on the energy sector? Energy market information specialist FAME Energy offers a brief analysis of the state of the industry

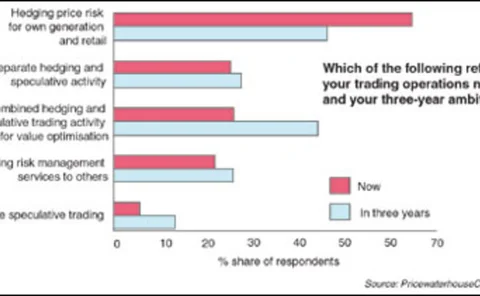

Trading software: tailored to maturity

It is critical that an energy company looking to acquire risk management and trading software be aware of its current as well as future needs. By Fred Cohen and Satyan Malhotra

Poor relations

Here EPRM outlines an approach for sorting out common problems relating to calculating correlation measures in value-at-risk. By Brett Humphreys

Deutsches data duel

Statistical analysis of competing meteorological data from two different sources in Germany might lead to disparate views of weather risk management. By Bob Dischel