Enterprise risk

Playing monopoly

China Aviation Oil is well placed to benefit from China’s economic boom – thanks to its powerful jet-fuel supply monopoly. Yet there are still opportunities for those willing to develop new markets, finds James Ockenden

Taking cover

US energy companies are increasingly taking out terrorism cover, even though none has yet made a claim. This is partly because the cost of policy premiums is falling. But this trend may be under threat. Joe Marsh reports

Missing links

For utility companies with income streams linked to inflation, using inflation derivatives to match assets with liabilities easily and relatively cheaply must be the easy option? If only it were that simple. By John Ferry

Kinder Morgan to buy more refined products terminals

US pipeline operator Kinder Morgan Energy Partners is to buy nine refined-products terminals from Georgia-based Charter Terminal Company and Charter-Triad Terminals for $75 million in cash and assumed liabilities. The deal is expected to close later this…

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Pressure on Puhca

The US General Accounting Office is to investigate whether the SEC has been lax in its oversight of the Public Utility Holding Company Act. How will this affect firms subject to Puhca requirements? By Paul Lyon

Earnings at risk

The structure of a typical energy portfolio often contains a different assetand contract mix from the simple derivatives instruments in a more standard portfolio.This requires a different approach to risk. Here, Les Clewlow and ChrisStrickland make the…

Shell completes sale of refined products pipelines

Shell Oil Products US has sold its major refined oil products pipeline systems to asset acquisition companies for $1 billion. Oklahoma-based Magellan Midstream Partners has paid $490 million for the mid-continent system, while Pennsylvania-based Buckeye…

Edison Mission Energy sells stake in NZ utility

California-based Edison Mission Energy has completed the sale of its 51.2% stake in New Zealand-based Contact Energy to Origin Energy New Zealand. Origin paid NZ$1.1 billion ($739 million) in cash and assumed NZ$535 million ($359 million) in debt to take…

Allegheny Energy makes $152m from share sale

Pennsylvania-based Allegheny Energy has sold 10 million shares for $151.5 million to four institutional investors. The company intends to use the proceeds to reduce debt as part of its plan to repay $1.5 billion in debt by the end of 2005.

El Paso makes $198m from further asset sales

Houston-based energy company El Paso Corp has sold four more power plants to Northern Star Generation for $147 million, continuing its mass sell-off of assets. El Paso’s merchant energy subsidiary has also received a final instalment of $51 million on…

Ameren on course to buy Illinois Power Company

US energy company Ameren Corp has received Illinois Commerce Commission approval to buy Illinois Power Company (IP) from Houston energy company Dynegy. The $2.3 billion deal – which is scheduled to be completed in the fourth quarter – still requires…

Oneok gets new $1bn financing and agrees to buy US gas co

Oklahoma-based energy company Oneok has obtained a five-year, $1 billion credit line from a group of banks to fund asset purchases. The company has also agreed to buy pipeline operator Northern Plains Natural Gas Company from asset acquisition company…

Atmos Energy gets go-ahead to buy TXU gas ops for $1.9bn

Texas-based natural gas company Atmos Energy is set to buy the gas distribution and pipeline operations of TXU Gas, the largest gas utility in Texas, on October 1. TXU Gas will still exist as part of TXU Corp, a non-regulated retail electricity provider …

Williams to retain energy trading business

Oklahoma-based energy company Williams said late last week it will continue operating its energy trading business, having failed to sell the rest of the wholesale power division. The company is focusing on long-term supply contracts and doing only a very…

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

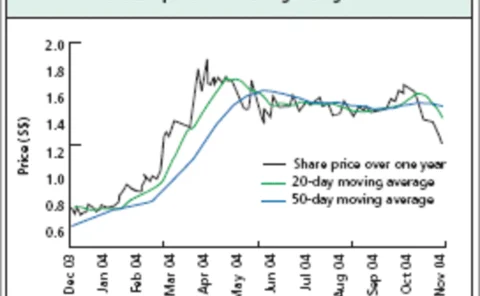

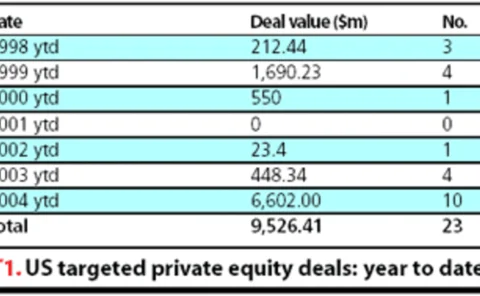

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

Worth 1,000 words

There’s little point in spending time and money on extensive risk analysisif your audience is likely to switch off when you show your results. BrettHumphreys shows that sometimes, risk managers need to be able to telltheir stories well

Constant reminders

Enron has received court approval to emerge from one of the most expensive bankruptciesin history. But pending litigations and trials mean that the Enron spectre willstill loom large. By Paul Lyon

SunGard acquires ASP pioneer Kiodex

SunGard has acquired New York based Kiodex, a supplier of web-based risk management, financial reporting, FAS 133 compliance and market data solutions for companies exposed to commodity price risk.

Alliant sells assets of gas marketing business

Wisconsin-based Alliant Energy Corp said yesterday that it has sold most of the assets of NG Energy Trading to BP Canada Energy Marketing Corp, but would not disclose the terms of the deal. The sale continues the trend for US energy companies to distance…

Southern Company promotes finance and risk execs

Atlanta-based energy company Southern Company has promoted Kim Greene to senior vice-president of finance and Mark Lantrip to vice-president of financial planning and enterprise risk management.

Mirant CFO Burns handed extra role of chief restructuring officer

Bankrupt Atlanta-based energy company Mirant has given chief financial officer Michele Burns the additional role of chief restructuring officer.

RWE Trading names Senior replacement

Brian Senior, Swindon-based managing director and head of UK energy at RWE Trading, will step down at the end of the year, and Peter Kreuzberg, head of risk management at parent company RWE, will replace him.