Enterprise risk

How much can you take?

Given recent events, energy firms need to fundamentally re-think how they estimate their risk tolerance. Maria Kielmas asks what has prompted this soul-searching

El Paso helps RiskMetrics adapt

RiskMetrics Group, a company more often associated with the financial sector, is implementing its risk solution software at energy firm El Paso Corp. How is it adapting the software to the specifics of the energy sector? Kevin Foster reports

FAS 133: increasing transparency

Standard & Poor’s Jack Kennedy and Neri Bukspan believe new Financial Accounting Standards Board rules for US energy traders will make it easier to measure a firm’s risk management ability, liquidity position and equity capital

Mark-to-market accounting revisited

New risk disclosure and valuation regulations are aiming to revive energy trading in the US, but cumbersome accounting rules may put companies off hedging altogether, finds Catherine Lacoursière

Getting protected

Insurance premiums may have rocketed for power companies over the past year but new ‘dual-trigger’ insurance products could still be an efficient way of transferring price risk. James Ockenden reports

Tripping around credit quality

Jack Kennedy of Standard & Poor’s looks at the effect of round-trip trades on a firm’s credit quality and how they should be treated

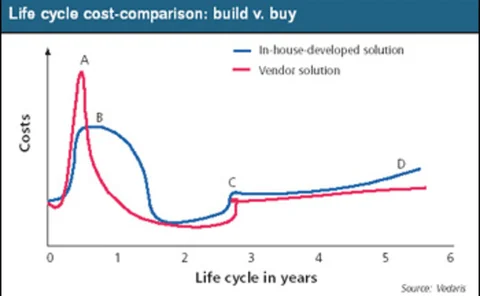

Build in or buy out?

Is it more cost-effective for companies to buy available systems from vendors or to develop and deploy their own energy trading and risk management solutions? Bob Bridger of Vedaris looks into the dilemma faced by many companies

A joint state-space model for spot and futures power

Portfolio-wide risk management requires a model that accounts correctly for correlations between the spot asset and various futures products. Kjetil Kåresen and Egil Husby discuss a joint multi-factor model for power spot and futures prices and show how…

Know your trade types

An accurate and clearly communicated classification of the types of trade a company carries out brings a better understanding of risk methodologies and where they are best used across the enterprise, says Greg Keers

The CRO road

A company-wide understanding of risk has never been more important for energy firms. Kevin Foster talks to three chief risk officers about their role and how it is changing

The three-way knock-on effect

Peter Nance and Lin Franks look at the interplay between market, credit, and operational risks and consider how firms might approach implementing an integrated company-wide system to tackle them

Untangling the web

Ruling out the need for a major software infrastructure project, web-based concepts make perfect sense for enterprise-wide risk management systems, says Martin Chavez

Keeping EAR simple

Brett Humphreys discusses how trading groups can be captured within earnings-at-risk and cashflow-at-risk models. He suggests taking a top-down approach instead of a bottom-up approach based on actual positions

Managing risk under SMD

Scott Greene, Mark Niehaus and Pankaj Sahay examine the impact of Ferc’s proposed standard market design on power risk management

Balancing the books

Regulators are taking advantage of a lull in power project development in the US to close loopholes in financing rules, reports Catherine Lacoursière

Clear in present danger

Energy companies are crying out for clearing solutions to reduce their counterparty credit risk. James Ockenden looks at new initiatives from London-based power exchange UKPX and German firm Clearing Bank Hannover

The rise of the money men

Wanted: company to trade power in the US. Strong credit, trading expertise and appetite for risk required. Only banks need apply? By Kevin Foster

Green risks for the black stuff

The impact of environmental risk on oil companies may be substantial, says a new report by the World Resources Institute. What will the effect be on the oil majors’ stock prices? James Ockenden reviews the report

The price of good information

The accounting scandals across the US – particularly at Enron – have led to demands for more independent market data in the energy sector. Who’s providing it, and is it meeting the industry’s needs? Kevin Foster reports

Keeping an eye on the long-term

Brett Humphreys discusses the problems with standard credit risk limits and proposes limits that may work better