Enterprise risk

CCRO and S&P form liquidity working group

The US Committee of Chief Risk Officers (CCRO) has established a working group along with rating agency Standard & Poor’s (S&P) to define the most effective metrics integral to assessing the liquidity demands of energy supply and wholesale marketing…

US puts trust in Canadian finance

Canadian income trusts have been trading at all-time highs. Now that the Canadiangovernment is allowing bigger players onto the market, interest from US energyfirms in such vehicles is growing. By Catherine Lacoursiere

Nymex president to quit

Bo Collins, president of The New York Mercantile Exchange (Nymex), will leave the exchange at the end of this month. Nymex said the decision not to renew his contract was by made by "mutual agreement."

Pressure group calls for debarment of Reliant’s US Dept of Defense contracts

Public Citizen, the Washington DC-based pressure group, has called for the debarment of Reliant Energy from its newly awarded $35.9 million electricity contract by the US Department of Defense while it is under federal indictment for its role in creating…

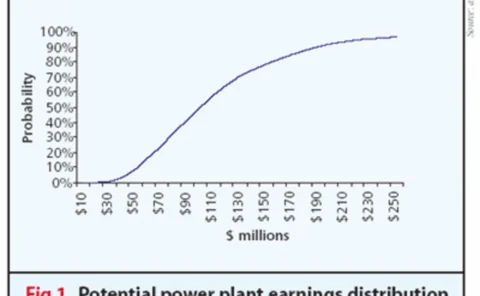

FEA unveils updated power exposure solution

Financial Engineering Associates (FEA), the Berkeley-based subsidiary of technology company Barra, today unveiled its @Energy/Power Generation 2.0 solution for power plant optimisation, risk exposure assessment and valuation

The cost of optimism

Petroleum engineers and financial regulators have never spoken the same language,as the recent Royal Dutch/Shell debacle has shown. And this has led to confusionover state oil reserves. By Maria Kielmas

Thomas Brooks

Thomas Brooks, president of Constellation Power Source, outlines his contributionto the Constellation Group’s success. By Joe Marsh

The right charge

Savvy firms now accept risk is inevitable. Those that use their risk capitalefficiently outperform those that don’t. Brett Humphreys looks at alternativeinvestments to find out what the right risk-adjusted return on capital chargesmight be

Crude protection

Oil producers are divided over the value of hedging oil prices. Are investorslooking for high returns and high risk, or more stable revenues? And how muchdoes hedging actually boost an oil producer’s value? By Joe Marsh

Icap will not pay Prebon’s £2m damage claim

Icap has no intention of recognising rival broker Prebon’s £2 million claim for damages after a dispute over the employment of three Icap coal brokers, according to its director of corporate affairs Mike Sheard.

Deutsche asks SEC to clarify guidelines

Deutsche Bank claims the SEC’s guidelines for estimating oil reserves are outdated. And Shell, unsurprisingly,also believes that the SEC should clarify its reserve rules. By Joe Marsh

Skating on thin Ice

Profits at the Intercontinental Exchange fell by more than half last year thanksto a contraction in over-the-counter revenues. Yet the exchange reports recordvolumes for its IPE business. Paul Lyon analyses the results

Unlimited liability

Potential liabilities for European nuclear operators are set to rise sharply.Financial guarantees for nuclear operators will have to be restructured. Aregovernments and the insurance industry up to the task? MariaKielmas reports

Duke gets all clear on accounting investigation

The US Department of Justice has closed its grand jury investigation into issues related to Duke Power’s regulatory reporting, concluding that no action is warranted against the company. Duke, the North Carolina-based energy company, was informed of the…

Welcome to the Energy Risk awards 2004

The fourth annual Energy Risk awards recognise excellence and innovation in the field of risk management. And to mark the ever-changing face of the industry, Energy Risk has added three new awards this year.

Statoil and Alex Kvaerner swap chief executives

Helge Lund has joined Norwegian energy company Statoil as chief executive, replacing acting CEO Inge Hansen. Hansen replaces Lund as CEO of one of three divisions of newly restructured Norwegian industrial group Aker Kvaerner.

Erasing Enron

Enron’s story may finally be drawing to a close. Jeffrey Skilling has finally been indicted and the company’s creditors have begun receiving ballots to vote on a plan of reorganisation. By Paul Lyon

The big picture

Focusing only on measuring VAR and stress tests limits the role of the risk manager.And there are great benefits from a wider view of what risk management can achievefor a company. By Brett Humphreys

Repeal repercussions

Opinions are divided over the possible repeal of the Public Utility Holding CompanyAct. All agree that the environment for investor-owned electric utilities woulddramatically change if the repeal were to go ahead. By Paul Lyon

Bob Anderson

Former chief risk officer with El Paso, Bob Anderson now heads the Committeeof Chief Risk Officers full time. By James Ockenden

Energy risk manager of the year

Winner: BP