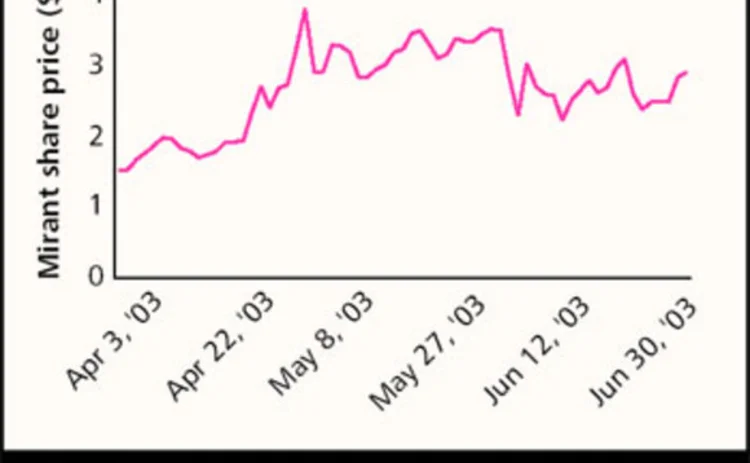

Mirant raises prospect of bankruptcy

Mirant, which is trying to refinance $5.3 billion of debt, had earlier asked its bondholders to approve the plan, which is a contingency measure should its refinancing plan fail. The company has a total of $8.9 billion of debt.

“ Our strong preference is to achieve a financial restructuring out of court, and we remain hopeful we can do so,” said Marce Fuller, president and chief executive of Mirant, in a statement on June 20.

But Mirant’s troubles worsened in mid-June, when bondholders

More on Financing

Why commodity finance is ripe for stablecoin

Digital currency brings cost efficiencies to financing, but its real benefit to commodity firms lies in making huge pools of new capital available, write Jean-Marc Bonnefous and Ronan Julien

Uncertainty causes rethink on clean energy investment

Waning enthusiasm for net-zero pledges, environmental policy shifts, funding cuts and US tariffs are causing clean energy investors to retreat

Deal of the year: Intersect Power

Energy Risk Awards 2025: Clean energy company secures significant BESS financing amid market volatility

Innovation of the year – Project: Tramontana

Energy Risk Awards 2025: Finance specialist develops transformational agroforestry project

Sustainable finance house of the year: Bank of America

Energy Risk Awards 2025: Bank furthers commitment to sustainability with large-scale transactions that showcase innovation, ingenuity and vision

Supply chain decoupling fires up alpha focus at BofA

Talking Heads: Stock dispersion sees funds gross up on long/short baskets, while US structured notes come of age

Sustainable bond markets miss an options trick

A derivatives mindset could boost lagging sustainability-linked market, argues climate think-tank

UBS precious metals team shines amid market turmoil

Global uncertainty always adds allure to precious metals, putting a premium on the long-standing relationships and cutting-edge technology of the UBS precious metals team