Enterprise risk

Var too far

The energy industry has shown tremendous commitment to value-at-risk (Var) methodologies. But use of Var has been misguided, as James Ockenden discovers

A new cop on the beat?

The Federal Energy Regulatory Commission has been severely criticised for its actions – or lack of them – during California’s disastrous attempt at deregulation. It is now hitting back at the energy industry. Kevin Foster reports

What’s the worst that could happen?

Brett Humphreys discusses how using a standard credit value-at-risk measure may be misleading for credit risk decisions

TXU finds the right combination

Kevin Foster looks at the reasons behind TXU Energy’s choice of Knowmadic’s Integration Suite data management software, and at the product’s features

EPRM’s list of software vendors and selected client firms

As we have done in previous years, EPRM asked all the companies in this directory to provide a list of their clients. While some have too many to provide an exhaustive list of them here, others have preferred to name a select few or just the types of…

Enel waits on liberalisation

While Italian energy major Enel Group has systems in place to manage its individual market risks, it is delaying any decision on enterprise-level risk management software until Italy decides how it will proceed with energy liberalisation, finds Clive…

Techno prisoners

IT disasters can bankrupt companies, so software vendors should be available 24-7. But often mergers and sales mean the software supplier no longer exists in its original form. What can the buyer do then? Joel Hanley reports

APB Energy’s winning formula

Kentucky-based APB Energy is one of the leading energy brokerage firms in North America. It has maintained its growth despite Enron fallout, perhaps due to its diverse range of services and locations. Kevin Foster reports

Building a bridge to Var

Value-at-risk (Var) is a technique often applied to the energy industry. But there are limitations to its use. Here, Leslie McNew aims to bring these limitations to light, and thereby give practitioners confidence in the use of Var

Rating agencies raise the bar

Confidence in energy traders has never been lower, and the metrics the rating agencies apply to their business are changing. James Ockenden assesses the damage

Mean-reverting smiles

Commodity markets such as crude oil exhibit mean reversion as well as option smiles. David Beaglehole and Alain Chebanier meet this challenge, constructing a model suitable for pricing exotic options in these markets

Utilities renegotiate to survive

For the past 10 years, Argentina’s privatised utilities have been icons of successful energy sector reform. But with the country’s deepening crisis, they face increased difficulties. What can investors do to mitigate such risks, asks Maria Kielmas

A cure for Enron flu

Brett Humphreys discusses recent events in the energy sector and the role risk managers can play in improving the industry

From academia to entertainment

Don Stowers reports on an internet platform for the oil and oil products market that is branching out into the entertainment business

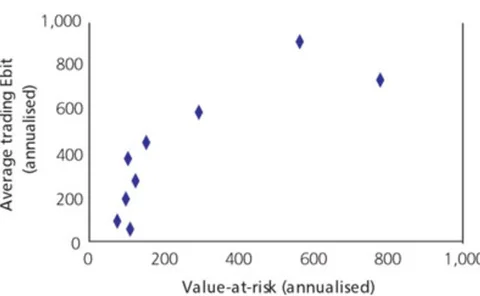

Keeping score

This month Brett Humphreys and Zach Jonasson show how energy trading firms can compare performance using publicly available corporate information

Quantifying technical analysis

In the last of our series of tutorials on risk management tools, Richard Weissman provides an overview of technical analysis for the energy business

Covering the threat

Since September 11, energy companies have had to re-assess the threat of terrorist attack. Despite the insurance industry introducing new terms and products, some companies remain unprotected, as Joel Hanley discovers