Enterprise risk

Running a smooth operation

Due to internal control scandals, process failures and the Sarbanes-Oxley Act, energy firms must keep an ever-closer eye on internal operations. Openlink’s Philip Wang and freelance author Jack King lay the basis for an operational risk framework

More power to the banks

Banks now have greater freedom to participate in derivatives markets based on physical commodities thanks to two recent ruling by US regulators. As a result, the balance of power looks set to shift from Houston to New York. By Paul Lyon

Lessons in loaning

Lenders and borrowers alike are becoming ever more innovative at a worrying time for energy company financing. But will the new ideas catch on? Paul Lyon reports

Enron will not centralise risk management

Failed energy trader Enron plans to package together the majority of its internationalassets into a company known as InternationalCo, the shares of which will be distributedto its creditors.

How to run a market

Former-derivatives-trader-turned-author Frank Partnoy wants to see tougher accounting standards and risk disclosures to deter corporate crooks. But are the regulators listening? Maria Kielmas reports

Energy firms find succour

US energy company debt has reached critical levels, with nervous investors and banks working hard to keep these companies afloat. But Paul Lyon finds the secretive hedge fund industry could also lend a helping hand

Ferc calls for risk manager vigilance

The director of the office of market oversight and investigations (OMOI) at theUS Federal Energy Regulatory Commission (Ferc), has urged energy risk managersto alert his office to any suspicious market practices.

CROs seen as vital for restoring confidence

Chief risk officers (CROs) have a vital role in helping shape the future of thetroubled energy sector and should report directly to their company’s boardif investor confidence is to be rebuilt in the industry. Vincent Kaminski, seniorvice-president of…

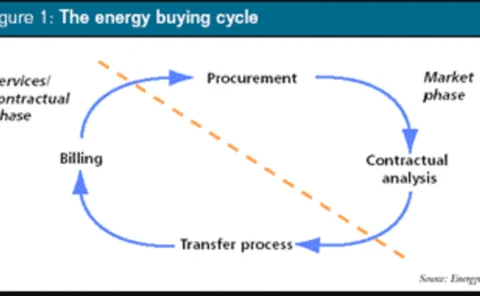

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes

Own, sell or restructure

UK and US utilities are presently saddled with a lot of debt, thanks to overcapacity and low power prices. But what’s the best way for these firms to deal with the power plants they don’t need? By Jessica McCallin

Delaying the inevitable?

As Reliant Resources celebrates a $6.2 billion refinancing deal, some in the industry say such deals are merely postponing problems that are bound to resurface. James Ockenden reports

Applying modern portfolio theory to optimal gas purchasing

Yijun Du and Xiaorui Hu present a general framework for applying modern portfolio theory to optimal natural gas procurements. They show that successful natural gas procurement involves determining the optimal allocation between fixed-price and floating…

Tough talk on derivatives

The Commodity Futures Trading Commission and Ferc are getting tough in throwing fines around. Is this a ploy to avoid being lumbered with further over-the-counter regulatory responsibilities? Some market participants certainly think so. By Paul Lyon

Wanted: cash for new lines

Can Ferc’s standard market design encourage much-needed investment in the US power grid and develop a merchant model for transmission assets? By Kevin Foster

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done

Trading with a small ‘t’

What made headlines before is now becoming everyday news: energy companies are scaling back or leaving energy trading. Some industry observers are emphasising the shift to ‘trading around assets’. Anne Ku investigates just what this means

Greening the markets

Environmental risks are increasingly being recognised as important financial issues, but the markets are still some way from rewarding companies for good environmental performance, as Kevin Foster discovers

Online clearing: the shape of energy markets to come

The energy trading market is moving towards a structure in which participants achieve market presence through a dedicated market network, rather than having to use local or regional exchanges, says strategic consultant Chris Cook

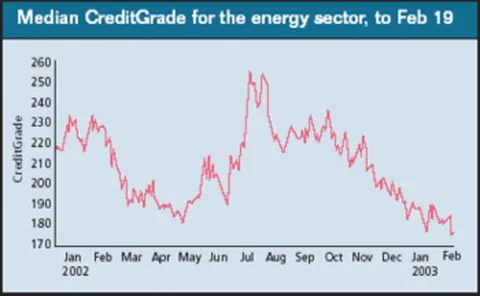

Credit watch

Risk management and analytics firm RiskMetrics gives this month’s analysis of energy companies’ credit quality using its CreditGrades tool