Enterprise risk

CCRO data hub update to follow Energy Risk USA conference

The US-based Committee of Chief Risk Officers (CCRO) will give a presentation in Houston next Wednesday, May 11, on the energy data hub it is developing. The session will follow the last presentation of the Energy Risk USA 2005 conference and will take…

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

Tentative steps

Algeria’s state-owned oil company Sonatrach is about to become the first oil and gas company within Opec to roll out an independent risk management programme to cover its crude oil and gas sales. Stella Farrington reports

An energetic debate

Enterprise-wide risk measurement and management, regulatory issues and pricing and hedging strategies were the hot topics this year at Energy Risk Europe in Amsterdam. James Ockenden and Joe Marsh report

Real option valuation

Many non-financial assets can be viewed as ‘real options’ linked to an underlying variable such as a commodity price. Here, Thomas Dawson and Jennifer Considine show that the stock price of an electricity generating company is significantly correlated…

The sum of its parts

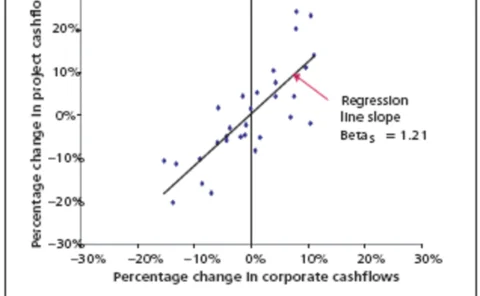

One can view a corporation’s individual projects as a portfolio of options – useful risk management tools to be used if their risk/return ratios are better than that of the firm as a whole. But how to work out the equity cost of capital at this…

A solid foundation

MotherRock, the energy hedge fund set up by former Nymex president Bo Collins, recently chose Kiodex’s ASP-based risk management software. Joe Marsh explores the trade-off between web-based and installed systems

Rankings 2005

The energy markets gave corporates and funds plenty to think about in 2004 – and while the banks still dominate the rankings, some sectors have been taken over for the first time by energy companies. All is revealed in this year’s comprehensive round-up.

OpenLink may launch web-based version of Endur

OpenLink may launch a web-based version of Endur, its energy trading and risk management system, according to Matt Frye, Houston-based managing director of the software company.

Mirant to pay $460m to settle California energy crisis claims

Bankrupt Atlanta-based energy marketer Mirant will pay $460 million to California power utilities and public agencies to resolve claims related to the state’s energy crisis in 2000 and 2001. The California utilities and agencies in the settlement were…

Fitch to buy Algorithmics

Fitch Group, parent of credit rating agency Fitch Ratings, is to acquire New York-based risk management software provider Algorithmics. The purchase, valued at $175 million, is expected to close in January, said Fitch today.

China Aviation gets six week breather

China Aviation Oil (CAOSCO) has been granted a six week extension by the High Court of Singapore to its deadline to submit its scheme of arrangement restructuring plan, due today. The new deadline is January 21, 2005.

Bankrupt Mirant seeks more time to file restructuring plan

Bankrupt US energy marketer Mirant has sought a further 90 days in which to file its plan of reorganisation for emerging from Chapter 11 protection from creditors. It filed the request with the US Bankruptcy Court on Monday, and this would be the third…

Satya Capital sues China Aviation Oil

Indonesian firm Satya Capital Limited is suing China Aviation Oil (Singapore) Corp and it parent company China Aviation Oil Holding Company for over $28 million for an alleged breach of a share purchase agreement, CAO (Singapore) Corp said late Wednesday.

Duke to settle California power crisis allegations

US power company Duke Energy and some of its subsidiaries will pay $207.5 million to settle allegations that it acted improperly during the California power crisis in 2000/2001. The US Federal Energy Regulatory Commission (Ferc) approved the settlement…

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

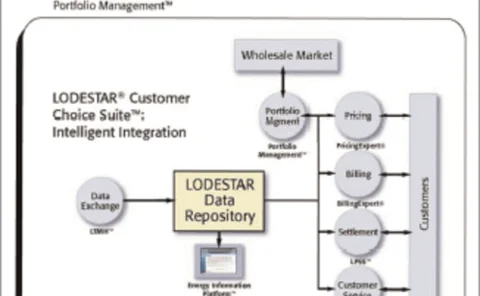

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

China Aviation Oil hid US$390m derivative loss in struggle to survive

China Aviation Oil’s trading unit, China Aviation Oil (Singapore) Corp (CAOSCO) hid an initial US$390 million loss while its directors sought “white knights” to save it from liquidation, it emerged yesterday as the company announced an estimated US$550…

Utility 2025: a vision

Power companies will face enormous political, societal, and technological change over the next 20 years. Douglas Houseman and Dennis Taylor of Capgemini look at how the utility of the future should embrace change

Oiling the wheels

Bribery and corruption is a hot topic, not least in the energy sector. Energy Risk this month looks at recent high-profile cases and what governments are doing to combat the problem. By Daren Allen and Kelly Williams

Dynegy to buy Sithe Energies from Exelon

Dynegy is set to reduce the effect of some of its loss-making tolling and financial swap contracts, buy power plants in the northeast US and acquire a supply agreement to increase stable cashflow and service debt.

Gazprom completes Rosneft merger, appoints head of new company

Sergei Bogdanchikov will retain his job as chief executive of Gazpromneft, the new company formed yesterday by the merger of Russian gas monopoly Gazprom and state oil company Rosneft. He was previously head of Rosneft.

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way