Enterprise risk

How long will the shopping spree last?

China appears set on a programme of foreign energy asset acquisition. Maria Kielmas looks into the implications for the energy industry

The risks of E&P

After two years of soaring oil prices, oil majors are still building low oil-price forecasts into future investment plans. Is this sound risk management, or are they being too risk averse? By Stella Farrington

Nymex plans to sell 10% stake to private equity firm

The New York Mercantile Exchange (Nymex) has signalled its intention to sell a 10% equity stake to General Atlantic, a US-based private equity firm, for $135 million.

Pieces of a puzzle

To get enterprise-wide risk management to work, a firm needs to piece together the right models, processes and software – and the right attitude. US utility Allegheny Energy has done just that, finds Oliver Holtaway

● Accounting standards ● Nordic energy

This month’s Energy Risk debate covers the topical issues of accounting standards, followed by an expert question and answer panel on the influential Nordic energy region

Lufthansa continues to save through fuel hedging

German airline Lufthansa has reported a increase in operating expenses of only 1.3% despite a big surge in fuel prices, partly thanks to its fuel-hedging strategy.

Great expectations?

Risk and expectation are two sides of the same coin. But could you quantify your own risk appetite? explores some ways to put a price tag on those hazards you can’t avoid Neil Palmer

The energy equation

Quantitative analysis in the energy industry is undergoing a crucial transition as it moves out of the role of secondary support to sit at the heart of business decision-making. Stella Farrington looks at its advance

Regulation tops risk managers’ concerns

Regulatory risk is seen as the most significant threat to business and a greater source of concern than country risk, market and credit risk, terrorism and natural disasters, a recent survey reveals.

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

Checking outside the box

Companies often use checklists to evaluate their IT buying requirements. But these rarely address what the firm actually needs. Brett Humphreys discusses how over-reliance on checklists may lead to poor software buying decisions

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

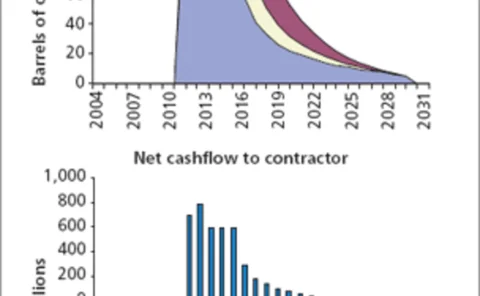

Risk-adjusted planning

An energy firm’s economic performance can be highly affected by incorrect valuation of implied economic risk. For this reason it is essential to provide management with the correct risk assessment tools. Here we propose a way of introducing risk…

A good time to build

US utilities may need to spend more than $100 billion in the next 25 years on new power plants and transmission capacity. Richard McMahon looks at how utilities are assessing long-term risks and attracting potential investors

The best of all worlds

Thanks to their varying scale, structure and diversity, European organisations often have very different solutions to risk management. But which system is the most effective? In an exclusive to Energy Risk, the European Energy Risk Forum offers a route…

Training the tiger

Derivatives are finally beginning to gain wider acceptance in Taiwan, but senior executives remain wary, associating them with the collapse of Barings and, more recently, China Aviation Oil’s huge trading losses, finds David Hayes

Staying one step ahead

Picking the right investment opportunities will never be a precise science, but a combination of global forecasting and risk management has enabled US Global Investors to become one of the most successful US mutual funds in the energy space. Its chief…

Stateside summit

Adding to the success of Energy Risk Europe in March, last month’s Energy Risk USA conference raised some lively debate. ERM, credit risk and the problems facing quant analysts were among the hot topics. Oliver Holtaway reports

Awards

Welcome to the annual Energy Risk awards, celebratingthe talent,innovation and enthusiasm that forms thebackbone of this industry.

Contract killers

Hidden risks can lurk in unexpected areas – such as the contracting process. Brett Humphreys and Brett Friedman discuss how risk managers must look beyondsimple value-at-risk measures and find other potentially hidden exposures

Buyer beware

Risk-management software development is still struggling to recover from slashed budgets after the Enron debacle. So before choosing a new system, buyers should look closely at five critical areas, writes Salim Jabbour

Finian O’Sullivan

If anyone knows how to keep an oil company showing healthy profit, it’s FINIANO’SULLIVAN , chief executive of Burren Energy. EithneTreanor meets him

The vendors’view

Energy software vendors are the first to admit they suffered financially fromthedownturn in the markets, but most stress they’ve developed innovative solutionsdespite the slump. Energy Risk put Salim Jabbour’s concerns to vendors