Feature

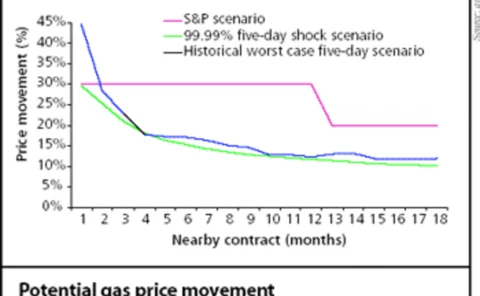

A poor standard

Rating agency Standard & Poor’s has recently released guidelines totest liquidity that could be an efficient probe into company finances. BrettHumphreys looks at how S&P has arrived at its calculations, asks if the liquiditymeasures are too conservative…

A natural standard

In the first part of a two-part series, Agnes Bizet and KevinWulwik highlightthe main issues to consider when trading under Isda’s European Gas Annex,including a close look at default events

Customerservice

Gas trading technology vendors are finding that continued market volatility is attracting clients keen to manage their exposures. But new entrants are forcing them to pick a model and stick with it. By Paul Lyon

Made in America

Bank of America has arguably built one of the most successful North American gas trading desks. Here Paul Lyon talks with Eric Nobileau, the bank’s global head of commodity sales

Prebon sets up coal desk

London-based broker Prebon may have failed in its bid to lure three coal traders from fellow broker Icap, but it is continuing to build a coal team. In mid-May, Sharon Millar, who previously traded paper and physical coal at UK utility RWE Innogy, joined…

Fair weather future

Judging from the success of the weather risk market in the Asia-Pacific region,the Chicago Mercantile Exchange couldn’t have picked a more opportune timeto launch Japanese weather futures. By Paul Lyon

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports

The cost of optimism

Petroleum engineers and financial regulators have never spoken the same language,as the recent Royal Dutch/Shell debacle has shown. And this has led to confusionover state oil reserves. By Maria Kielmas

Nord Pool’s back-up

Nord Pool Clearing is the first pure electricity clearing house to obtain capitalsupport through insurance to cover defaults by its trading counterparties. Areenergy companies set to follow suit? Joe Marsh reports

Simulating spots

Abstract: The use of Monte Carlo simulation is becoming increasingly importantin energy trading and risk management. Here, Les Clewlow and ChrisStrickland present the first in a series of articles looking at the implementation of simulationtechniques and…

Heroes or cowboys?

Banks and energy companies alike are sceptical about the role that hedge fundsplay in energy markets. Are they really an aid to market stability, or is theirpresence compounding market volatility? Paul Lyon reports

Price wars

Ferc is preparing to analyse the results of its survey on energy price reporting.But the American Public Gas Association is concerned that a voluntary reportingscheme cannot guarantee reliable indexes. By Paul Lyon

Heart broker

A bitter dispute involving an employment contract, three coal brokers and a claimfor £2 million in damages has highlighted the importance of observing contractuallaw when hiring and firing. By James Ockenden

The right charge

Savvy firms now accept risk is inevitable. Those that use their risk capitalefficiently outperform those that don’t. Brett Humphreys looks at alternativeinvestments to find out what the right risk-adjusted return on capital chargesmight be

Dollar distress

Scottish Power has announced a £400 million cash windfall through its currencyhedging programme. Others have not been so lucky – but everyone is nowwaking up to currency trading. By James Ockenden

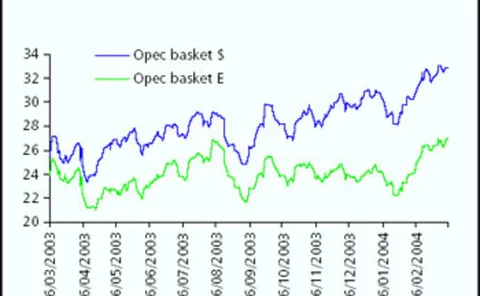

Crude protection

Oil producers are divided over the value of hedging oil prices. Are investorslooking for high returns and high risk, or more stable revenues? And how muchdoes hedging actually boost an oil producer’s value? By Joe Marsh

Using a square peg

Hedging load exposures is a complex issue, and plumping for hedging the expectedvolume is unlikely to be the best solution. Brett Humphreys and RahulGill showthat sometimes, the best hedge of a shaped position is an over-hedge

European companies outline concerns over emissions trading

Corporates are expressing concern at the ramifications of the European UnionEmissions Trading Scheme – just as EU member states finalise their nationalallocation plans. By Paul Lyon

Deutsche asks SEC to clarify guidelines

Deutsche Bank claims the SEC’s guidelines for estimating oil reserves are outdated. And Shell, unsurprisingly,also believes that the SEC should clarify its reserve rules. By Joe Marsh

Taking stock

Stock options are losing favour as a method of remuneration. Chicago-based PeoplesEnergy, for one, is to stop offering them altogether. And the onset of new USaccounting rules could well lead others to follow suit. By Paul Lyon

Skating on thin Ice

Profits at the Intercontinental Exchange fell by more than half last year thanksto a contraction in over-the-counter revenues. Yet the exchange reports recordvolumes for its IPE business. Paul Lyon analyses the results

US refinancings suggest recovery

Do several big debt refinancings at US utilities mean energy companies are finally starting to emerge from their post-Enron and post-California crisis problems? Joe Marsh reports