Feature

Pemex signs for OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

Shaping the curve

A shaped forward curve is important for both trading and risk management. Here, Giorgio Cabibbo and Stefano Fiorenzani provide a model for shaping electricityforward curves that is consistent with both financial theory and market practice.Here, they…

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

Good neighbours

Spanish and Portuguese energy market participants are hopeful that a joint Spanish-Portuguesepower market is imminent. But how competitive will the Portuguese side of themarket be? Joe Marsh reports

Iberdrola’s inroads

Spanish utility Iberdrola supplied almost a third of its home country’selectricity in 2003. And with a joint Iberian energy market scheduled to startin March, the firm has plans for further expansion into Portugal. By Joe Marsh

A history lesson

Abstract: The size of bid/ask spreads in electricity options has both valuationand credit implications. Here, Ted Kury of The Energy Authority shows how toderive theoretical spreads using historical option price data so they can beused as liquidity…

A fresh landscape

Prebon Energy’s Kevin McDermott says that much has changed in the electricitybroking world post-Enron. And it’s all for the better. By Paul Lyon

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

Covering all the bases

Abstract: Many articles have discussed constructing models for either spot orforward prices. Yet none cover the whole process of constructing a joint modelfor both. Here, Andreas Huber and MonikaKrca develop a multi-factor model thatcaptures both the…

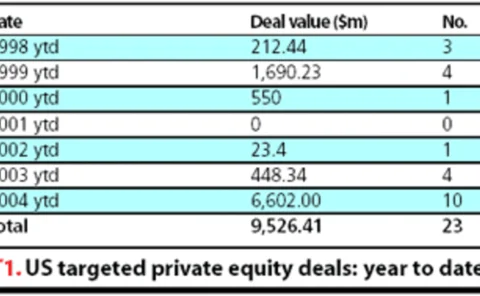

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

Worth 1,000 words

There’s little point in spending time and money on extensive risk analysisif your audience is likely to switch off when you show your results. BrettHumphreys shows that sometimes, risk managers need to be able to telltheir stories well

Auction advances

The Commonwealth of Virginia in the US has just completed an innovative auctionof nitrogen oxide emissions credits thanks to advice from Amerex and George MasonUniversity. Paul Lyon reports

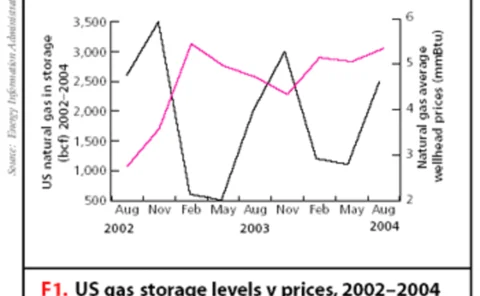

Storing up trouble

Utilities have become active hedgers against today’s high natural gas prices.In recent years, there has been a notable increase in both physical and financialhedging. Catherine Lacoursiere looks at whether storage is still a viable hedge

Pulp friction

In the latest of Energy Risk’s series of profiles featuring energy users’ riskmanagement and hedging strategies, Paul Lyon talks to Swedish pulp and papercompany SCA about how it deals with its sizeable energy exposures

Singing in the rain

Melbourne-based Southern Hydro Partnership signed its first precipitation hedgelast year – a landmark deal that paved the way for a number of other contractsto protect itself from the risk of low rainfall. Paul Lyon reports

Following the trend

The analysis of historical meterological data is vital for structuring weatherderivatives. But how should weather traders deal with the trends that may existsin the data? Steve Jewson and JeremyPenzer investigate

Weather wrap-up

Energy Risk’s inaugural weather derivatives survey shows that traders and end-users appearto be confident about the state of their business, despite high-profile exitsfrom the industry in recent years. Paul Lyon analyses the results

Accepting responsibility

Alex Schippers heads ABN Amro’s weather team – arguably one of the most innovative desks in Europe. Here he talks to Paul Lyon about the state of the global weather risk market

Raining information

Weather data is becoming increasingly accessible and more detailed, and – in Europe at least – publicly available data looks set to become less costly. Joe Marsh reports oncurrent developments in the weather risk market

Looking to the east

Can power market operators in the new EU member states in eastern Europe gainthe liquidity they need to challenge either bilateral electricity contracts orthe established exchanges? Joe Marsh reports

Putin’s endgame

The geopolitical premium on oil prices is rising as Russia pursues its ‘oligarchs’. Catherine Lacoursiere reports on the wider effects of Russian oil giant Yukos’ collapse

All systems go

More than 450 of you voted and voiced your concerns in Energy Risk’s inaugural User Choice Awards. Below we show which suppliers you voted for as top of their field in the energy business this year

Huberator’s hopes

APX and Fluxys subsidiary Huberator are planning to launch a gas exchange forthe Zeebrugge hub in early 2005. But is an exchange really needed by the tradingcommunity? Paul Lyon reports