Feature

Powering prices

The UK supplies the lowest priced power in Europe, and its Department of Trade and Industry wants to keep it that way. So it has published a report uncovering how the European Emissions Trading Scheme will affect power prices across Europe. By James…

The ETS law is an ass

Consultant Chris Cook offers a sceptical view of the development of European emissions trading, and suggests a new global energy solution based on an alternative to the financial market paradigm

Double exposure

Continuing our series on applications of Monte Carlo simulation to applied problems in energy risk management, Les Clewlow , Chris Strickland , Oleg Zakharov, and Scott Browne look at potential future exposure and the analogous measure of expected credit…

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

A hard nut to crack

This year has proved profitable for US oil refiners, but it could have been even better, had they not posted losses from forward product sales. Are refining companies learning from their trading mistakes? Joe Marsh reports

A new breed of bond

Issuance of rate reduction bonds by utilities may be down, but the market is preparing for a surge in new asset-backed securities derived from the stranded cost model. By Catherine Lacoursiere

Blending the rules

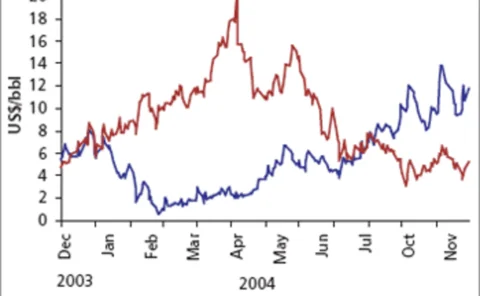

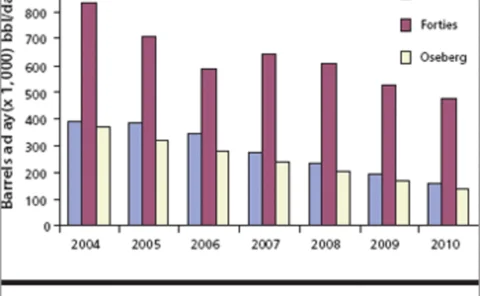

The speed of decline of North Sea crude raises fresh concerns over the suitability of the North Sea as a benchmark, and to worries over the value of long-dated derivatives contracts. By Stella Farrington

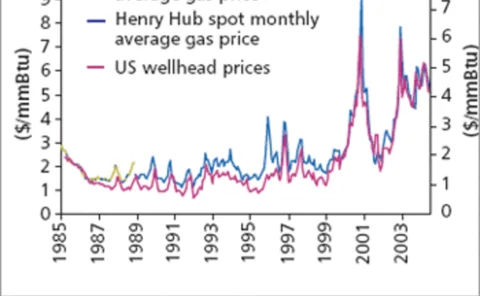

Bridging the gas gap

Volatility in the natural gas markets shows no sign of any let-up, which means that managing basis risk at Henry Hub continues to spur demand for increasingly innovative derivatives products. Catherine Lacoursiere reports

Pay as you go

It is going to be a hard day at the office for Joe Risk Manager. The risk management committee might welcome his new risk charge system, but how would the traders take it? By Brett Humphreys and David Shimko

Back in power

As George W. Bush settles back into the White House for his second term, experts analyse the influence his energy and foreign policies may have on the energy industry both domestically and abroad. By Stella Farrington

Ten years of trading

As an analyst and software designer who has spent the past ten years working closely with energy markets, Sandy Fielden had no problem identifying what had the most impact on his world in that time – technology. A regular Energy Risk contributor for some…

The famous fifty

To celebrate Energy Risk’s 10th birthday, we have created the Energy Risk Hall of Fame: a group of individuals whose commitment and contribution to energy markets makes them a foundation of this business. Introduced by James Ockenden

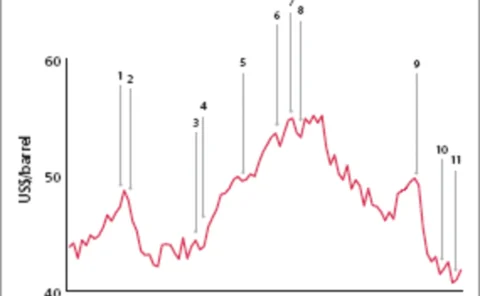

Merrill Lynch sees oil staying high in 2005

The oil price, which has roughly doubled since the start of 2000, and risen by over 60% this year, is likely to remain historically high in 2005 due to a structural shift in the market, said Robin Batchelor, co-fund manager of Merrill Lynch’s World…

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

Strengthen your portfolio performance

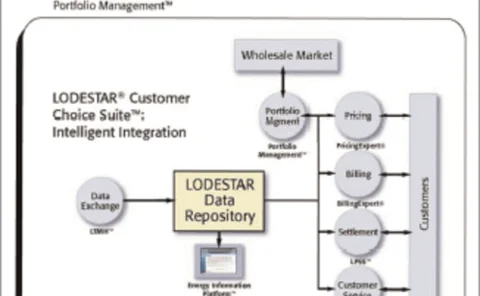

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

Balanced buying

Yijun Du and Xiaorui Hu present a general framework for applyingmodern portfolio theory to optimal natural gas procurements.They showthat successful natural gas procurement involves determining the optimalallocation between fixed-price and floating-price…

UK traded gas market: What with liquidity?

The last two months have been a difficult time for UK gas traders; but Philippe Vedrenne and Marc Lansonneur from Gaselys say conditions will improve, leaving a market that may be stronger than ever

Trading techniques

A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit dispatches can…

Ending the acrimony

Most utilities support hedging to mitigate price volatility, but are not sure how to communicate the benefits of hedging to their customers. Tim Simard of RiskAdvisory offers suggestions for improving the rate-hearing process

Changing of the guard

Changes to the European gas market may further attract financial players, and tighten the rules in case of physical supply disruptions. Meanwhile changes in the UK gas market may lead to clearing at the hub. By James Ockenden

Getting physical

Asset-backed trading strategies usually employ a combination of physicalpositions, which are subject to physical risk; and financial hedgingintruments, which are not. Here, Steve Leppard shows how value-at-risk,applied to this combined risk scenario, can…

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

Utility 2025: a vision

Power companies will face enormous political, societal, and technological change over the next 20 years. Douglas Houseman and Dennis Taylor of Capgemini look at how the utility of the future should embrace change