Feature

Editor

"The good people buying and selling energy have once again been shafted by corporate greed"

BITs in pieces

Argentina is launching a direct attack on the validity of investment treaties, and other countries may be about to follow its lead. How are investors responding to the challenge? Maria Kielmas reports

The perfect balance

For most governments, hedging oil price risks on the financial markets is not impossible. But it is politically difficult. Most find instead opt for establishing ‘rainy day’ stabilisation funds. By Maria Kielmas

Volatility conspiracy

The concept of volatility is universally used by quantitative analysts. But is it a concrete idea or a false friend? And does it even exist? Energy quant Neil Palmer takes a look at its mysteries

Oiling the wheels

Bribery and corruption is a hot topic, not least in the energy sector. Energy Risk this month looks at recent high-profile cases and what governments are doing to combat the problem. By Daren Allen and Kelly Williams

European emissions trading on track

The EU emissions trading scheme is on track to start in January 2005, with the European Commission having approved 16 out of 25 of the EU member National Allocation Plans that lie at the heart of the scheme, said Peter Vis, acting head of the Industrial…

A slice of the IPE

The fate of the Nymex Brent contract launched this month in Ireland – an undisguised attempt to grab business from the IPE – will be determined by Christmas, say Dublin floor traders. By Stella Farrington

A slow squeeze

The oil price may have eased recently, but it remains high. What impact is this having on the global economy? Concerns remain for the long-term future of crude supply. Joe Marsh reports

A surprising future

High oil prices are not triggering as large an upturn in oil exploration as was first expected, with many questioning how long the current situation will last. But high prices are having some rather unexpected effects. By Maria Kielmas

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way

Clear intentions

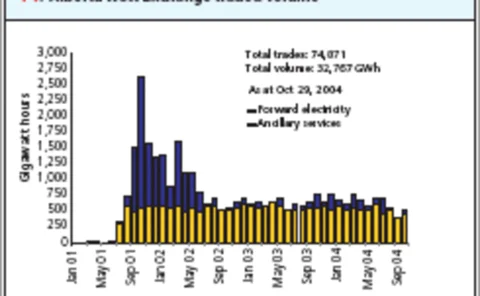

The Alberta Watt Exchange in Calgary is already clearing over-the-counter electricity contracts and from next year will be able to clear natural gas as well. But how much liquidity will it attract? Joe Marsh reports

Taking cover

US energy companies are increasingly taking out terrorism cover, even though none has yet made a claim. This is partly because the cost of policy premiums is falling. But this trend may be under threat. Joe Marsh reports

Agree to disagree

Volatility in the dry freight market has led to the use of derivatives such as forward freight agreements and the development of other innovative products. But will they have a lasting impact on the energy markets? By Hann Ho

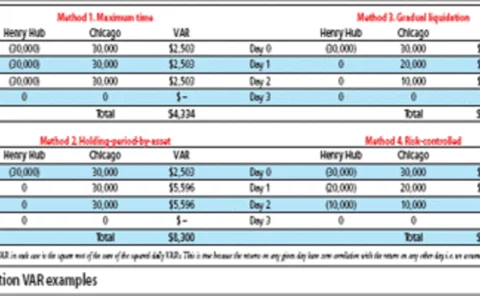

Risky liquidations

It is all too easy to go for the simplest solution when liquidating an energy portfolio of different positions. Brett Humphreys discusses some of the problems with appropriately calculating the VAR associated with liquidating a portfolio

A popular punt

Experts remain bullish about the flow of new money into catastrophe cover. But an influx of hedge funds backed increasingly by institutional capital has led to worries of a “domino effect”. By Maria Kielmas

Missing links

For utility companies with income streams linked to inflation, using inflation derivatives to match assets with liabilities easily and relatively cheaply must be the easy option? If only it were that simple. By John Ferry

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Pressure on Puhca

The US General Accounting Office is to investigate whether the SEC has been lax in its oversight of the Public Utility Holding Company Act. How will this affect firms subject to Puhca requirements? By Paul Lyon

Bilateral collateral

Until recently, there was little legal protection from foreign investment risk.But the past few years have seen the rise of the bilateral investment treaty(BIT). Matthew Saunders shows how BITs can benefit the energy sector

Found in translation

While risk managers have become focused on value-at-risk and similar risk metrics,these may not be the best way of communicating risk to stakeholders. BrettHumphreys discusses how to improve communications

Avoiding the gas work

Ferc is exploring whether gas storage inventory details should be posted on adaily basis. How will this affect the development of the embryonic natural gasstorage swaps market? Paul Lyon reports

The windy city rules

The Chicago Climate Exchange is going from strength to strength if its new initiatives,new members and volumes are anything to go by. Here PaulLyon talks to CCX founderRichard Sandor about the exchange’s future

Best laid plans

Growing interest in commodities on all sides mean energy products will be a good bet in 2005. And this has led to the increased popularity of new forms of structured correlation products. By James Ockenden and Joe Marsh

Energising the US

Democratic presidential nominee John Kerry has plans to require the US to generate20% of its electricity from renewable sources. But just how different are Kerry’sand President Bush’s stances on energy policy? By Paul Lyon