Feature

Viva lost vegas

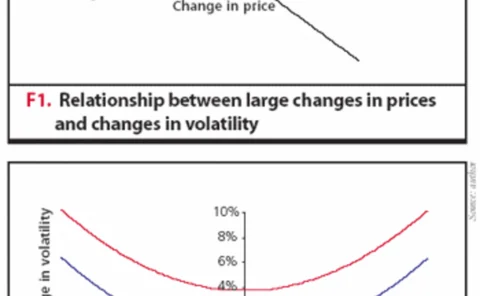

Brett Humphreys discusses the problems of calculating true value-at-risk on aconcentrated options portfolio – in particular, the various pitfalls thatcan befall a risk manager in ignoring vega risk – and considers ways ofhandling these issues

Vertical take-off

As UK supplier Centrica narrows its focus to fund an asset acquisition spree, James Ockenden finds the ‘asset-light’ utility model has finallybeen buried and a move towards ‘vertical integration’ is now thestrategy of choice

Building load links

In the third article in this series, Les Clewlow , ChrisStrickland and MichaelBooth show how the Monte Carlo techniques used in previous articles can accuratelyhighlight the crucial relationship between price and load – a complex correlationaffecting the…

Technology upload

There has been a recent upswing in the fortunes of energy risk software industry. And that is reflected in this year’s expanded technology vendor guide, making it the definitive guide to energy software and technology available

The troubleshooter

After struggling for a year with a difficult Triple Point installation, US energycompany Cinergy brought in energy IT veteran Joel McKnight. Nine months on, implementationand integration is complete. By Joe Marsh

Simulating Excellence

Of the numerous risk management problems that can be solved with a computer,there are few that cannot be solved using Microsoft Excel. BrettHumphreys discusseshow it can be used to construct Monte Carlo simulations

King of convenience

The need for Sarbanes-Oxley certification has boosted sales of internet servicerisk systems, says web pioneer Martin Chavez of Kiodex. By James Ockenden

Bucking the trend

Openlink’s founder Coleman Fung talks to James Ockenden about the decisionsthat have promoted his company to one of the leading risk management solutionproviders

Faith in the figures

There are signs that price reporting will remain voluntary, despite the drop-offin reporting levels, but proposals are still being made on all sides. EricFishhaut looks at the progress being made to achieve greater price transparency

Nordic volumes heading south

Nordic region electricity trading volumes are falling fast, which is damagingprofits at Oslo-based power exchange Nord Pool. The company may face postinga loss for 2004 if it cannot reverse this trend. Joe Marsh reports

Energising Houston

Bear Stearns created its Houston-based energy group to acquire and optimise powergeneration assets in North America. And the business is going from strength tostrength, says its managing director Pamela Baden. PaulLyon reports

The standard is set

Continuing last month’s focus on documentation under which commoditiesare traded on the UK’s National Balancing Point and Belgium’s ZeebruggeHub, using Isda’s European Gas Annex. By Agnes Bizet and Kevin Wulwik

Energising Houston

Bear Stearns created its Houston-based energy group to acquire and optimise powergeneration assets in North America. And the business is going from strength-to-strength,says its managing director Pamela Baden. Paul Lyon report

Weather patterns

OTC weather derivatives volumes are down around 20% on last year, but exchange-tradedweather futures are on the up. Paul Lyon looks at WRMA’s annual survey,and reviews the past year’s trends in the weather risk market

Banking on energy

Banks keen to establish an energy trading presence are finding that partneringwith energy companies, or even acquiring trading businesses outright, could bethe way forward. Paul Lyon reports

The liquidity makers

Hedge funds are bringing liquidity to the structured end of commodity markets,and some – such as Citadel – are even trading in physical energyproducts. This can only make energy markets more efficient, finds James Ockenden

Long wait to market

Plans to create a small natural gas exchange in Russia highlight the complicationsof gas sector reform – arriving at realistic tariffs, finding new reservesand organising transport to name a few. Maria Kielmas reports

Spring loading

Abstract: In May’s Expert Series, LesClewlow and Chris Strickland discussedthe use of Monte Carlo simulation in energy risk management and introduced aseries of models that they argued were suitable for the simulation of energy-and weather-dependent…

US puts trust in Canadian finance

Canadian income trusts have been trading at all-time highs. Now that the Canadiangovernment is allowing bigger players onto the market, interest from US energyfirms in such vehicles is growing. By Catherine Lacoursiere

Houston happenings

Regulatory pressures, asset valuation and price reporting were just a few of the topic areas covered at Energy Risk’s USA conference in Houstonlast month. Here Paul Lyon rounds up some of the conference highlights

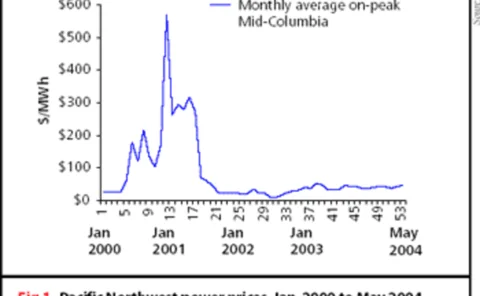

Northwest in excess

The Bonneville Power Administration’s power buyback scheme to tackle electricity shortages in the US Pacific Northwest in 2001 has worked rather too well. The region was left with bankrupt aluminium producers and a surplus of power that is not proving…

Hedging on the fly

In the first of a series of articles profiling energy users and their risk managementstrategies, we take a look at Texas-based Southwest Airlines, one of the mostactive hedgers in the aviation industry. By Joe Marsh

Where gas is keener

Fearing its competitiveness is slipping, the Canadian natural gas industry islobbying for pipeline rates of return and tax policies on a par with the US.By Catherine Lacoursière