Feature

Answers in the wind

Project valuation means making calculated assumptions that aren’t always accurate. Brett Humphreys discusses the assumptions that may be embedded within a valuation and how these assumptions can affect the final value

Enter the scrum

A surprise Opec headline can throw the market into a tailspin, but gathering the news can be even more frenetic. In March, one scrum even resulted in broken bones. Stella Farrington writes from Iran

A star rises in the east

Iran’s ministry of petroleum has given the green light to launch a new petroleum exchange in the country. Mohammad Asemipour, adviser to Iran’s oil ministry and a key architect of the project, talks to Stella Farrington

Both sides of the fence

Ernst Eberlein and Gerhard Stahl analyse price series of 25 energy spotrates simultaneously using Lévy models. This model class allows thecapture of stochastic behaviour of these financial instruments.Theimplications of this analysis will form the…

Turbulent times

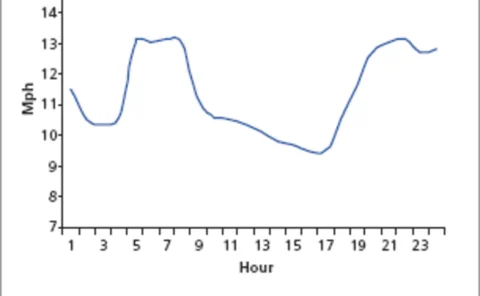

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

A shift in perspective

As far as the electricity market is concerned, the EU emissions trading scheme is aimed only at the generation side of the market. But end users also affect carbon emissions levels. This could represent a missed opportunity. Here, Oliver Rix, Phil Grant…

A solid foundation

MotherRock, the energy hedge fund set up by former Nymex president Bo Collins, recently chose Kiodex’s ASP-based risk management software. Joe Marsh explores the trade-off between web-based and installed systems

Calgary’s oil patch

Some Canadian oil and gas producers got their fingers burnt last year as oil prices soared and hedging programmes resulted in big losses. What will their strategies be in 2005? Catherine Lacoursiere reports

A complicated option

Why does the New York Mercantile Exchange not list average-price WTI crude options as a contract on its ClearPort electronic platform? Internal politics could be the main obstacle. Joe Marsh reports

Ethanol

The production of ethanol – a component of gasoline – is growing fast, which has led to the imminent launch of two ethanol futures contracts and a joint production venture involving Sempra Energy. By Joe Marsh

Opec split over increasing oil production

Ministers of the Organisation of Petroleum Exporting Countries (Opec) arriving in the Iranian city of Esfahan Tuesday sent out mixed messages over the expected outcome of Wednesday’s meeting.

The swap terminator

Multilateral swap cancellations look set to become commonplace in the energy sector, thanks to a service from TriOptima, which has just terminated its first round of oil swaps for six firms. Joe Marsh reports

Layers of intrigue

The Yukos saga – up to now largely confined to the political and legal arenas – recently took a step closer to the physical oil markets with a $6 billion oil deal between China and Russia. By Stella Farrington

A bid for power

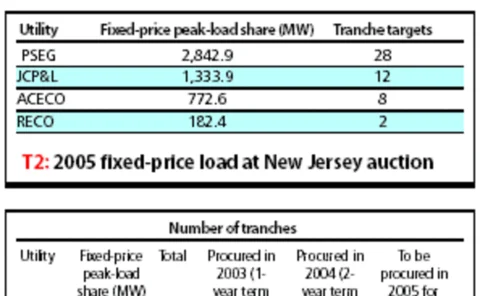

Clock auctions are a fairly recent method for utilities of procuring electricity from suppliers, but only New Jersey has an established process. Yet Ohio and Illinois are showing interest. Joe Marsh reports

Exceptions to the rule

With commodity markets set to fall within the scope of more EU regulation, trade associations are concerned that this extra burden on market participants could stifle trade. By Stella Farrington

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

Correlation: the horror!

The murky world of correlation, with its many pitfalls, represents a black hole in the minds of some energy market professionals. But, says Neil Palmer , you needn’t be afraid of the dark

Smoke without fire

The market for US financial coal swaps may be starting to show a little potential, but some major obstacles still remain before it catches alight – not least a widely accepted price index. By Joe Marsh

If the cap fits...

Legal compliance seems the only way to achieve cuts in carbon dioxide emissions. Europe is leading the way, but the US is some way from a similar approach, despite a regional initiative sparking some interest. Joe Marsh reports

Crude imitation

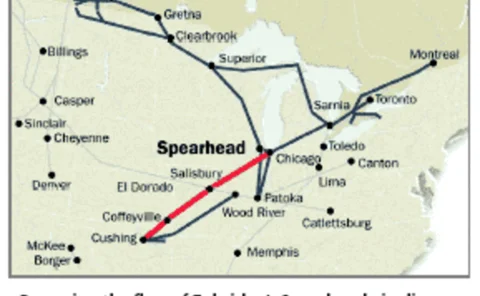

Hedging Canadian heavy crude oil is difficult: unlike Canadian light crude, ithas no closely matching price benchmarks. Trading basis differentials is onesolution, but help may be at hand from another quarter. By JoeMarsh

A Kyoto windfall

Heavy polluters needing to reduce emissions under new EU legislation may find a solution in the developing world under Kyoto’s Clean Development Mechanism. Stella Farrington reports

Open for business

The EU Emissions Trading Scheme began this month, but much of the success of the fledgling carbon market will hinge on the behaviour of the 5,000 small companies who make up the bulk of the market. By Stella Farrington