Risk management

Getting physical

Abstract: Asset-backed trading strategies usually employ a combination of physicalpositions, which are subject to physical risk; and financial hedging intruments,which are not. Here, Steve Leppard shows how value-at-risk, applied to this combinedrisk…

Banking on energy

Banks keen to establish an energy trading presence are finding that partneringwith energy companies, or even acquiring trading businesses outright, could bethe way forward. Paul Lyon reports

The liquidity makers

Hedge funds are bringing liquidity to the structured end of commodity markets,and some – such as Citadel – are even trading in physical energyproducts. This can only make energy markets more efficient, finds James Ockenden

ABN to offer centralised power and gas clearing platform

Dutch bank ABN Amro today said it’s energy futures division is developing a platform to provide centralised over-the-counter (OTC) clearing for natural gas and power contracts at six European energy exchanges – UKPX, EEX, Endex, Powernext, IPE and…

KWI allies with Toshiba to tap Japanese market

KWI, the London-based risk technology company, has created the first Japanese-language energy trading and risk management (ETRM) application in conjunction with Toshiba Corporation, the Japanese developer and manufacturer of power generation systems.

BNP hires in commodity derivatives, following departures

French bank BNP Paribas has made four hires in its commodity derivatives business, following the departure of two senior members of its team last month. In early May Dutch bank ABN Amro hired Wayne Harburn, BNP’s former head of European energy trading,…

Fortis to enter energy trading with Xenon

Fortis Financial Services, the market trading affiliate of Fortis Bank, has selected Sakonnet Technology's Xenon trading and risk management application for its new energy trading activities in New York.

RWE signs up to Raft

RWE, the German utility company, has signed up to use Raft’s credit risk management technology, Raft Credit. Raft International, the London-based risk technology company, did not disclose the size of the contract.

NRG Energy creates chief risk officer role

NRG Energy has hired Philip Chesson to fill the newly created role of chief risk officer.

CCRO and S&P form liquidity working group

The US Committee of Chief Risk Officers (CCRO) has established a working group along with rating agency Standard & Poor’s (S&P) to define the most effective metrics integral to assessing the liquidity demands of energy supply and wholesale marketing…

Spring loading

Abstract: In May’s Expert Series, LesClewlow and Chris Strickland discussedthe use of Monte Carlo simulation in energy risk management and introduced aseries of models that they argued were suitable for the simulation of energy-and weather-dependent…

Houston happenings

Regulatory pressures, asset valuation and price reporting were just a few of the topic areas covered at Energy Risk’s USA conference in Houstonlast month. Here Paul Lyon rounds up some of the conference highlights

Hedging on the fly

In the first of a series of articles profiling energy users and their risk managementstrategies, we take a look at Texas-based Southwest Airlines, one of the mostactive hedgers in the aviation industry. By Joe Marsh

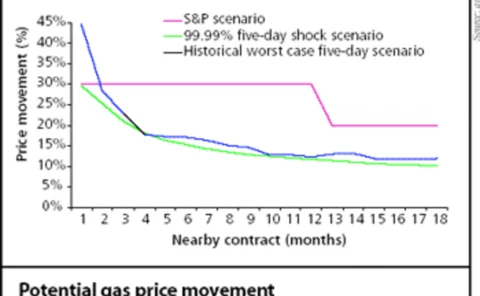

A poor standard

Rating agency Standard & Poor’s has recently released guidelines totest liquidity that could be an efficient probe into company finances. BrettHumphreys looks at how S&P has arrived at its calculations, asks if the liquiditymeasures are too conservative…

KWI hires SVP of operations

KWI, the London-based provider of trading and risk management software for the energy industry, today announced the appointment of Alan Somerville as senior vice president (SVP) of operations.

Liquidity, not regulation, is key to avoid manipulation, says CFTC

Regulators should avoid the temptation to implement over zealous regulation of the energy derivatives market, and instead encourage the development of liquidity, if market manipulation is to be avoided. That was the message delivered by Sharon Brown…

Price reporting is improving, says CCRO director

Confidence in the energy markets is returning partially thanks to an improvement in the price reporting practices of energy companies, according to Robert Anderson, executive director of the US-based Committee of Chief Risk Officers (CCRO).

Nymex to clear contracts on OTC oil and gas options

The New York Mercantile Exchange (Nymex) and broker Icap are set to launch an electronic market in options on oil and gas inventory statistics. The over-the-counter options will be offered through an auction process and cleared by Nymex.

Bayer signs up for SunGard Adaptiv

Bayer, the Leverkusen-based pharmaceuticals and chemicals company, has chosen Sungard’s Adaptiv trading and risk management product to support its commodity, foreign exchange and fixed-income trading operations.

S&P places focus on energy merchant liquidity risk

Rating agency Standard & Poor’s is to issue new liquidity adequacy guidelines for US energy merchants, which are particularly vulnerable to large and sudden liquidity demands related to collateral calls.

Nord Pool’s back-up

Nord Pool Clearing is the first pure electricity clearing house to obtain capitalsupport through insurance to cover defaults by its trading counterparties. Areenergy companies set to follow suit? Joe Marsh reports

Simulating spots

Abstract: The use of Monte Carlo simulation is becoming increasingly importantin energy trading and risk management. Here, Les Clewlow and ChrisStrickland present the first in a series of articles looking at the implementation of simulationtechniques and…

Heroes or cowboys?

Banks and energy companies alike are sceptical about the role that hedge fundsplay in energy markets. Are they really an aid to market stability, or is theirpresence compounding market volatility? Paul Lyon reports