Risk management

The right charge

Savvy firms now accept risk is inevitable. Those that use their risk capitalefficiently outperform those that don’t. Brett Humphreys looks at alternativeinvestments to find out what the right risk-adjusted return on capital chargesmight be

Energia selects SunGard’s Entegrate ZaiNet

Energia, part of the Viridian Group, has selected SunGard’s Entegrate ZaiNet for the straight-through processing and risk management of its physical and financial power and gas contracts.

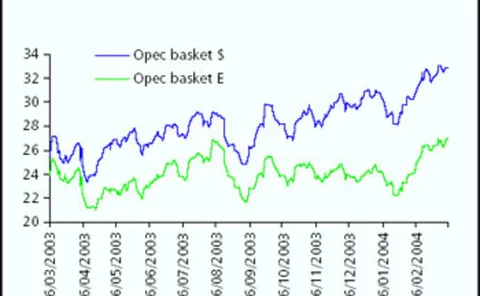

Dollar distress

Scottish Power has announced a £400 million cash windfall through its currencyhedging programme. Others have not been so lucky – but everyone is nowwaking up to currency trading. By James Ockenden

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

Crude protection

Oil producers are divided over the value of hedging oil prices. Are investorslooking for high returns and high risk, or more stable revenues? And how muchdoes hedging actually boost an oil producer’s value? By Joe Marsh

Using a square peg

Hedging load exposures is a complex issue, and plumping for hedging the expectedvolume is unlikely to be the best solution. Brett Humphreys and RahulGill showthat sometimes, the best hedge of a shaped position is an over-hedge

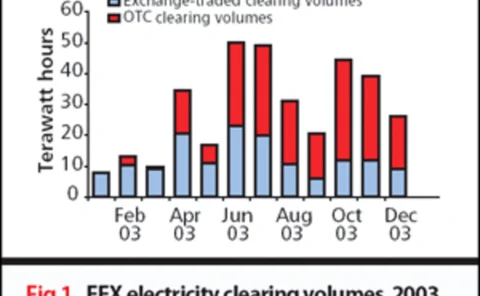

Skating on thin Ice

Profits at the Intercontinental Exchange fell by more than half last year thanksto a contraction in over-the-counter revenues. Yet the exchange reports recordvolumes for its IPE business. Paul Lyon analyses the results

A fertile future

The CME is hoping its introduction of fertiliser futures will protect the industryfrom fluctuations in the price of natural gas – a vital ingredient in mostnitrogen fertilisers. But is it a case of too little too late? By Paul Lyon

Unlimited liability

Potential liabilities for European nuclear operators are set to rise sharply.Financial guarantees for nuclear operators will have to be restructured. Aregovernments and the insurance industry up to the task? MariaKielmas reports

De Vitry elected to Isda board

Benoit de Vitry, London-based global head of commodities and emerging markets rates at Barclays Capital, has been elected to the board of the International Swaps and Derivatives Association (Isda).

Welcome to the Energy Risk awards 2004

The fourth annual Energy Risk awards recognise excellence and innovation in the field of risk management. And to mark the ever-changing face of the industry, Energy Risk has added three new awards this year.

RMS releases updated Climetrix weather trading system

Risk Management Solutions (RMS), a California-based provider of products and services for the management of natural hazard risk, today released version 4.0 of its Climetrix weather derivatives trading and risk management system.

String theory

Abstract: The complete understanding of forward price dynamics is a fundamentaltopic in commodity markets, and there have been many studies on the relationshipbetween spot and forward commodity prices. Here, GiorgioCabibbo and StefanoFiorenzani offer a…

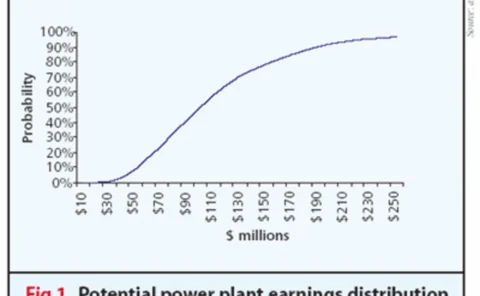

The big picture

Focusing only on measuring VAR and stress tests limits the role of the risk manager.And there are great benefits from a wider view of what risk management can achievefor a company. By Brett Humphreys

Nybot in Nymex sights, but IPE rumours are put on ice

Nymex is rumoured to be interested in acquiring Ice. Here, in an exclusive interviewwith Energy Risk, Nymex president Bo Collins suggests the exchange may also besetting its sights elsewhere. By James Ockenden

Bob Anderson

Former chief risk officer with El Paso, Bob Anderson now heads the Committeeof Chief Risk Officers full time. By James Ockenden

Energy risk manager of the year

Winner: BP

Risk manager of the year – retail

Winner: Reliant Energy Solutions

Risk manager of the year – consumer

Winner: Bayer

Taking the slow road

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh