Risk management

Risk-adjusted planning

An energy firm’s economic performance can be highly affected by incorrect valuation of implied economic risk. For this reason it is essential to provide management with the correct risk assessment tools. Here we propose a way of introducing risk…

The best of all worlds

Thanks to their varying scale, structure and diversity, European organisations often have very different solutions to risk management. But which system is the most effective? In an exclusive to Energy Risk, the European Energy Risk Forum offers a route…

Training the tiger

Derivatives are finally beginning to gain wider acceptance in Taiwan, but senior executives remain wary, associating them with the collapse of Barings and, more recently, China Aviation Oil’s huge trading losses, finds David Hayes

Evolution to open Calgary office in July

Energy broker Evolution Markets will open an office in Calgary, the centre of the Canadian energy-trading markets, in early July.

Editor

"The FFA market offers enough arbitrage opportunities to have a hedge-fund manager in clover"

Staying one step ahead

Picking the right investment opportunities will never be a precise science, but a combination of global forecasting and risk management has enabled US Global Investors to become one of the most successful US mutual funds in the energy space. Its chief…

The clearing challenge

Growing over-the-counter trade in the energy markets, much of it from hedge funds, coupled with exceptional price volatility, could test the current clearing system to the limit, warns independent consultant Chris Cook

The dragon’s revenge

In the second article on the pitfalls of hedging, Neil Palmer considers one of the risks of managing options: dynamic hedging. He shows there is an awful lot that can go wrong in the quest for perfect risk elimination

North AmericanEnergy Forum

Leading energy market players discuss market trends, credit risk management and the future of the energy sector market, with a special focus on Canada

Stateside summit

Adding to the success of Energy Risk Europe in March, last month’s Energy Risk USA conference raised some lively debate. ERM, credit risk and the problems facing quant analysts were among the hot topics. Oliver Holtaway reports

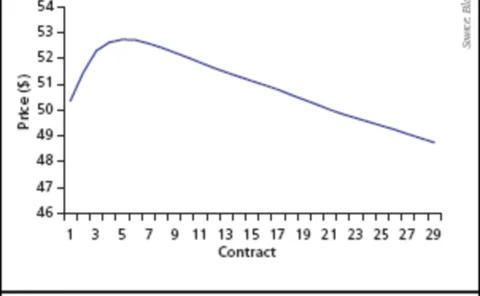

Freight looks forward

Freight derivatives are increasingly seen as a key risk management tool. Banks and hedge funds are also trading them. But will the growth in liquidity continue, or is this another false start for the market? Stella Farrington reports

The ABC of PCA

Often, the costs associated with implementing advanced statistical models can outweigh the potential benefits. Brett Humphreys shows how to smooth and speed up choppy simulations using principal components analysis

Commodity kickers

Retail investors are showing greater interest in commodity-linked products. but most of the structures launched in Europe so far have been based on small, tailor-made baskets. By Patrick Fletcher

UK business paying £1bn/year too much for energy

UK businesses are failing to manage energy buying efficiently and as a result are exposed to volatile prices, losing up to £1 billion ($1.81 billion) a year, a new survey has found.

GlobalView technology to support ConfirmHub

US-based GlobalView Software has been chosen as the exclusive technology provider to ConfirmHub, a joint venture by brokers Icap, Amerex Energy and Prebon Energy. ConfirmHub is a post-execution, straight-through processing (STP) trade-confirmation…

Awards

Welcome to the annual Energy Risk awards, celebratingthe talent,innovation and enthusiasm that forms thebackbone of this industry.

Contract killers

Hidden risks can lurk in unexpected areas – such as the contracting process. Brett Humphreys and Brett Friedman discuss how risk managers must look beyondsimple value-at-risk measures and find other potentially hidden exposures

Buyer beware

Risk-management software development is still struggling to recover from slashed budgets after the Enron debacle. So before choosing a new system, buyers should look closely at five critical areas, writes Salim Jabbour

Slaying the dragon

In the first of a two-part series on hedging risk, NeilPalmer looks at the effectsof imperfect correlation on basis risk, and finds that unless you have a perfecthedge, you may just have to learn to live with risk

Counterparty risk

Eduardo Canabarro, Evan Picoult and TomWilde present a new approach to derivativescounterparty credit risk that can affect utilities using a onefactor conditionalindependence framework, deriving a formula for theratio of ‘expected positive exposure’ to…

The vendors’view

Energy software vendors are the first to admit they suffered financially fromthedownturn in the markets, but most stress they’ve developed innovative solutionsdespite the slump. Energy Risk put Salim Jabbour’s concerns to vendors